Survey finds university leaders maintaining a strong focus on international student recruitment

- Senior university executives surveyed by Navitas/Nous Group who work at universities in Australia, Canada, and the UK say that recruiting international students is a top focus at their institution

- This goal is especially driven by a need for tuition revenues from international students

- More than half of those surveyed said that their university is under-resourced in terms of internationalisation activities

- More universities are relying on third-party recruitment specialists to help them meet their goals

Navitas and Nous Group have released an excellent report based on an inaugural online survey of 100 senior operational and strategic university leaders responsible for internationalisation initiatives in Australia, Canada, and the UK. The online survey was active between August and November 2022, and it explored areas such as:

- Commitment to internationalisation

- Internationalisation priorities

- Recruitment channels

- Institutional resourcing for internationalisation

- Entry requirements for international students

- Perceived threats to the ability to recruit international students

- Optimism about the sector

International student recruitment is the top priority

The report, entitled Thriving in a Hyper Competitive World, underlines that internationalisation remains a priority for university leaders in the three countries. This priority is mostly centred on international student recruitment (compared with international partnerships, study abroad, or TNE initiatives).

The study links the focus on recruitment to institutions’ need to generate revenue from international student tuition, especially coming out of the financial shock entailed by restricted student mobility during the pandemic. Further, the report authors note that the emphasis on recruitment stems from one or all the following pressures:

- A need to recover quickly from pandemic losses;

- Insufficient public funding of the university sector and/or rising operational costs;

- A weaker flow of Chinese students and thus Chinese students’ tuition fees.

Support for internationalisation is not always adequate

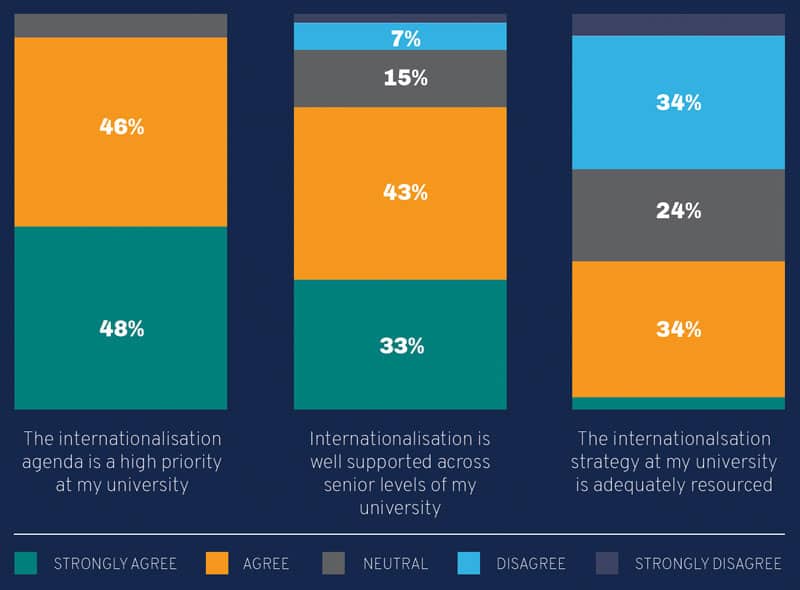

Despite leaders’ contention that internationalisation is central to their university’s agenda, fewer agreed that the mission is well supported at senior levels of administration and fewer still agreed that there is adequate resourcing for internationalisation, as shown in the chart below.

More reliance on third parties to assist in recruitment

University leaders indicated that they are relying more on “private partners” (e.g., outside firms that stream students into universities such as agencies, in-country representatives, pathway providers, etc.) to achieve international enrolment targets. This trend is driven by:

- A more challenging recruitment environment in China;

- An increase in the number of students applying through various means;

- A need to complement the capacity of institutional staff;

- A desire to be more environmentally friendly (e.g., by travelling less).

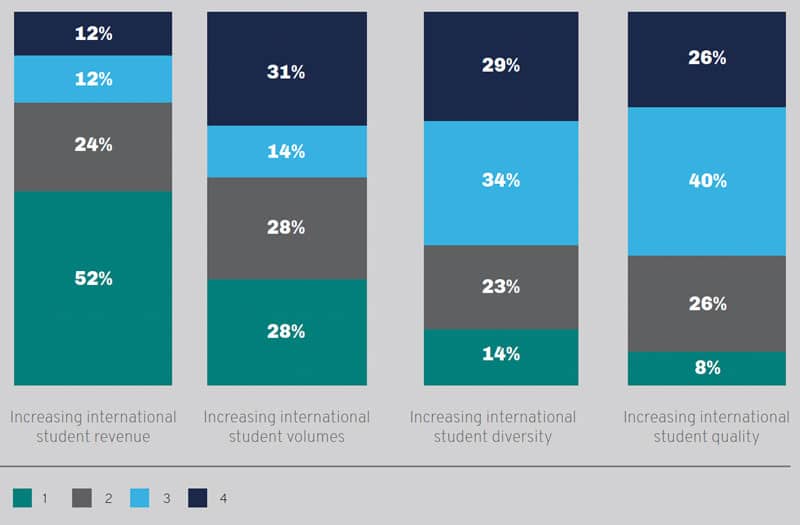

Increasing revenue is the dominant goal

Presented with a set of recruitment outcomes including increasing international student revenues, volumes, diversity, and quality, leaders were most likely to say increasing revenue was the most important (52% for revenue, versus 28% for volume and less than 15% for diversity or quality).

This finding underlines the financial challenges that many universities are facing, and the report notes:

“There are very few universities that are planning to achieve quality and diversity by turning students away or substantially raising acquisition costs per student.”

Relatedly, many respondents anticipated their university to raise international student fees over the next one to two years, following “a period of suppressed or negligible fee increases between 2020 and 2022.”

In terms of country variation, Canadian university leaders were most likely to say that increasing volume was the main goal, while UK leaders were more likely to cite revenue considerations. The report speculates: “This may reflect the increasing sophistication in international recruitment in the UK as compared to Canada, where demand has been driven largely by immigration policies rather than by strategic recruitment activity.”

What have been key priorities in 2023?

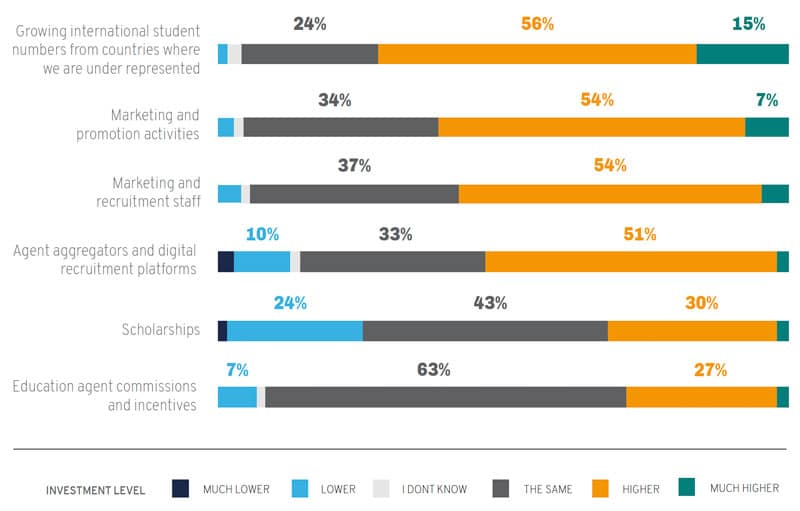

As the next chart depicts, recruiting in new target markets is a growing priority for university leaders, and more than half of respondents indicated that they will pursue this goal through an increased focus on marketing and promotion activities and staff. About a quarter of leaders – especially those in universities that are not in the highest tiers of world university rankings – said that scholarships are a lower priority

Student outcomes on the mind

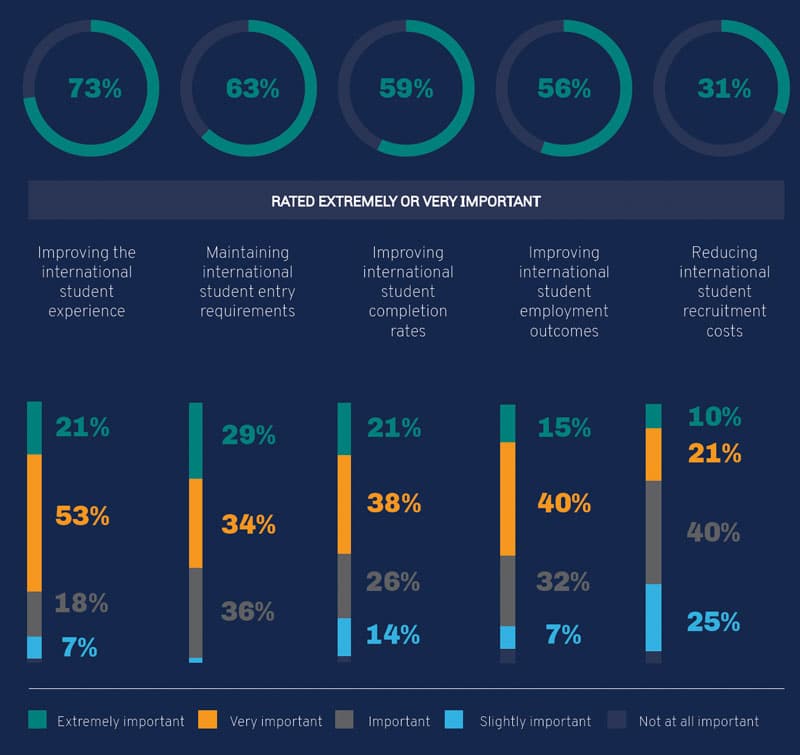

While increasing revenue is a preoccupation among the leaders surveyed, they also indicated a need to increase the in-study experience and graduation outcomes of international students, as depicted in the following chart. Especially high on the list of priorities is a goal of improving the international student experience and post-graduation outcomes (53% and 40% “very” or “extremely” important, respectively).

Key insights

The report makes two excellent points worth considering when sitting with the findings of the survey. The first relates to institutional operations, and the second is about the need to balance revenue targets with the quality of experience provided to students.

- “Universities must find the right balance of volume versus revenue: In a hyper- competitive environment, there is a risk that the cost of recruiting students rises substantially, leading to increased volume without the revenue returns.”

- “Universities must ensure appropriate focus across volume, revenue, quality and diversity. There are real risks to retention, student experience and student outcomes when volume and revenue come at the expense of student quality and diversity.”