Kenya’s demographic boom will have profound impacts on economy and education

- Problems in Kenya’s higher education sector may lead to greater demand for study abroad among Kenyan students

- Australia, Canada, the US, and the UK welcomed more Kenyan students in 2022 than in 2019

- Kenyans are known for their digital sophistication and strong digital recruitment strategies are a must in this market

For several years now, universities and colleges in the West and elsewhere have considered Nigeria a fertile recruiting ground for talented international students, not the least because of Nigeria’s massive population and youth demographic (about 7 in 10 Nigerians are under the age of 30). But several other African countries offer strong potential for student recruiters, and one of these is Kenya.

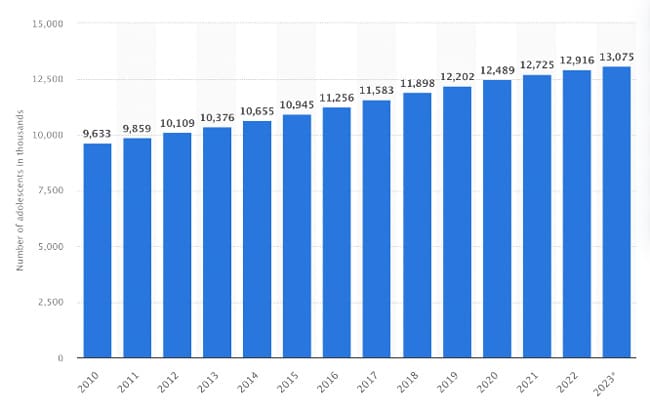

As in Nigeria, a youth bulge – a term used to describe a population in which the proportion of youth exceeds the proportion of those aged 35 or above – is a significant feature of Kenyan society. Kenya is the 7th most populous country in Africa (over 57 million), and one quarter of Kenyans are between the ages of 18 and 34. Even more strikingly, those under the age of 15 make up 43% of the population.

Kenya is a predominantly Christian country with two official languages: English and Swahili. Nairobi is the largest city and is often ranked the top “business” city in Africa; it is home to a large number of multinationals and is considered a gateway to the larger East African market. Nairobi is also the 74th wealthiest city in the world (4th in Africa), a standing allowed by a solid presence of high-net worth individuals.

Massive number of Kenyans about to enter labour force

Though fertility rates are now declining in Kenya, the reality is that the next couple of decades will see an unprecedented number of young people enter the country’s labour force. A World Bank report, Kenya Economic Update: Rising above the waves (2021), states that: “Over the decade from 2020 to 2029 the working age population will increase by an average of 1 million per year.”

The key to unlocking the potential of that influx of youth into the economy will be (1) equipping millions of young Kenyans with a solid education and in-demand skills and (2) creating enough jobs to absorb the soaring number of people who need them. This will be a difficult task, as it would be for any government no matter where in the world.

Youth bulge is challenging to accommodate

Youth bulges – caused by a milestone in a country’s development where the infant mortality rate falls but the maternal fertility rate does not – create both opportunities and challenges.

Theoretically, a youth bulge presents opportunities because those under the age of 35 have the potential to contribute so greatly to a country’s economy and development. But in practice, a heavy and accelerating proportion of youth creates stress on human infrastructure such as healthcare, education, and job training. Especially in developing countries, it is difficult for governments to expand social services and jobs at the same rate as the youth demographic is expanding.

What we tend to see in many cases where a youth bulge occurs is that a government quickly builds new educational capacity without being able to also ensure quality across the board. Uneven systems of higher education result, with some schools being excellent but incredibly difficult to get into and many other schools being available but expensive or of subpar quality.

In such systems, a large number of students emerge with diplomas and degrees but many lack the skills needed by employers. This is the case in Kenya, where youth unemployment has been a major problem for years. In 2018, the Kenya National Bureau of Statistics found that 9 out of every 10 unemployed Kenyans were under the age of 35 years. In 2020, a survey by market research firm CPS International found that half of Kenyan employers were dissatisfied with the level of skills graduates were emerging with.

Work experience and overseas study valued by Kenyan employers

The CPS International study found that the top asset valued by Kenyan employers assessing new graduates is work experience (85%) “followed by skills, hobbies and talents, volunteerism, internships and having studied overseas.” This suggests that study abroad programmes with an internship component are especially attractive to Kenyan students, and indeed, a recent global survey by Keystone Education Group – for which half of student respondents were African – found that internships were the top factor determining students’ choice of study abroad programme.

Pushing for vocational

The mismatch between graduates’ competencies and the skills needed by Kenyan employers has prompted the Kenyan government to invest in the country’s vocational education system (TVET) and to launch campaigns positioning TVET as “the preferable option” for Kenyan students. However, as in many developing countries, there is still a sense among families that vocational education lacks the prestige of an academic, university route.

Some foreign institutions are partnering with private and public stakeholders in Kenya to improve the quality of TVET in the country and to establish a presence in the market. For example, Vancouver Island University reports that is partnering with North Island College (NIC), and the British Columbia Institute of Technology (BCIT) to “work with four Kenyan institutions (Kisii National Polytechnic, Keroka Technical Training Institute, Sigalagala National Polytechnic and Bondo Technical Training Institute) to develop new programmes in electrical, welding and mechanical trades, while at the same time providing new opportunities for VIU staff and faculty to apply their skills and knowledge internationally.”

Soaring enrolments have overwhelmed the higher education system

In Kenya, the number of public and private universities has doubled in the past ten years and enrolments have surged. Between 2014 and 2022, tertiary enrolments increased by 28% and now stand at 562,000, positioning Kenya as the fourth largest enroller of university students in Africa after Nigeria, South Africa, and Ethiopia.

Though there are some very good universities and programmes, the World Bank concludes that overall:

“Soaring student-teacher ratios have undermined the quality of existing programmes, as teaching and other learning practices continue to be traditional in most higher education institutions, with over-reliance on rote learning and outdated curricula.”

Not only that, but most Kenyan universities are in financial distress – together, the debt of all public universities and associated colleges reached US$456 million in 2023, creating an insolvency crisis. Government structures for sponsoring students as well as university fees have not kept pace with rising enrolments, and the result is an overwhelmed, underfunded system.

The University of Nairobi, in particular, has been at the centre of controversy for its decision to address its financial woes by more than doubling tuition fees for postgraduate courses in 2021. The university (ranked 1001-1200 in the QS World Rankings 2023) has also just raised fees for medical programmes.

Overall, the Universities Funding Board – which determines tuition fees in Kenya – says that tuition fees in most Kenyan universities range between US$1,380 USD–US$5,000 USD per year.

Wealthier students now have more reason to study abroad

The financial crisis across Kenya’s higher education institutions threatens to have a massive impact on high-school graduates. After months of debate, the government has announced a new funding model that will govern which students get financial assistance – or full scholarships – for a place in a public university. Under this model, the poorest students will receive the most funding, while the most financially “able” will receive less than in the past. Previously, all students who scored C+ and above on the KCSE leaving exam were automatically given a government sponsorship. This is no longer the case.

The government has defended the reforms by noting that is simply impossible to maintain the previous level of financial support for all students given the rising number of enrolments – and that wealthier students have a responsibility to pay more.

Faced with a fee hike, more affluent students could find study abroad even more attractive than in the past. Not only do they have the traditional Western options of the US, UK, Canada, and Australia, but they also have more affordable options in other countries. Scholarships for Kenyan students are on the rise as a result of more intense competition among foreign educators.

Outbound mobility trends

ApplyBoard considers Kenya to be a “high-growth-potential” student source market (based on its internal modelling and industry data), along with Nigeria, Pakistan, Bangladesh, Egypt, and Indonesia.

Kenya was the top East African market for US educators in 2022, sending 5,790 students, up 45% compared with 2019.

Over 4,700 Kenyans are currently studying with Australian providers, 27% more than in 2019. Kenya is the top African source market and sends the 20th largest volume of students to Australia overall.

UNESCO data shows that UAE is also a top destination for Kenyan students, enrolling over 2,000 in 2020.

Canadian institutions enrolled 2,310 Kenyans in 2022, up 12% compared with 2019. Kenya sent a similar number of students to the UK in 2021/22, with 2,800 students enrolled, up 24% from 2019.

Kenyan economy

Kenya’s economy is the largest in East Africa, and the third largest in Sub-Saharan Africa after Nigeria and South Africa. The economy is guided by the “Vision 2030” strategy document, which charts a path towards Kenya attaining middle-income status as a nation by 2030. The country’s vibrant tech sector has earned Kenya the moniker of “Silicon Valley of Africa.”

The growth rate slowed in 2022 to 4.8%, lower than the IMF’s projection for the year. The slowdown was linked to “a drought, tighter financial conditions, and government spending cuts.” However, before the pandemic, Kenya was one of the top performing economies in Africa, averaging 5.9% annual growth between 2010 and 2018.

Top sectors are agriculture, forestry, fishing, mining, manufacturing, energy, tourism, and financial services. A major push is underway to have digital skills and technologies power the economy to new heights, detailed in the Digital Economy Blueprint.

The currency, the Kenyan shilling, has been depreciating for some time and has lost 7.8% of its value against the US dollar so far this year. Inflation is also rising on the back of escalating sugar prices. As a result, Kenyan families will be more price sensitive than usual this year.

Internet and social media

Well-executed digital campaigns are essential in Kenya. Internet penetration is very high, and young Kenyans are glued to social media, behind only Nigerians and Ghanaians in the amount of time they spend on social media. In order, Facebook, Twitter, YouTube, and Instagram are the most popular channels for Kenyan social media users.

The US International Trade Administration considers Kenya an excellent opportunity for US university recruiters and advises:

“US education institutions should take advantage of the thriving digital space in Kenya by investing in content creation to attract Kenyan students. Virtual school tours, student life, and educational benefits are some of the aspects that they should focus on. Facebook should be the primary platform of use, along with Google to target the specific demographic and to target parents who fund their children’s educational dreams. YouTube and Instagram should also be utilized to appeal to students looking to study in the US.”

Further, the Administration notes: “Kenyan students have high interest in studying technology and computer sciences and are especially interested in courses not offered by local universities.”

High school and university recruitment

As is typical in many countries, international schools offer great potential for foreign recruiters and many can be found here. Tuition fees average USD$5,000– $20,000 per year. More private schools can be found here.

A list of universities can be found here. At the top public universities in Kenya, including Egerton University, Kenyatta University, the University of Nairobi, Moi University, Maseno University College, and Jomo Kenyatta University of Agriculture and Technology, competition for admission is especially fierce.

The University of Nairobi is particularly well ranked in QS’s World University Rankings by Subject in three programmes: development studies (51-100) agriculture and forestry programme (301-350), medicine (451-500).

If students do not get into public universities, they can go to private universities but in this case, they do not receive government financial assistance. They can apply for loans from the Higher Education Loans Board (HELB), however. Private universities in Kenya include Africa Nazarene University, University of Eastern Africa-Baraton, Catholic University of Eastern Africa, Daystar University, United States International University-Africa, and Kenya Methodist University.

For additional background, please see: