How big is the Internet, and how are we using it now?

- The global population of Internet users continues to grow, but average time online declined slightly this year

- Even so, social media use continues to go up as those key networking and messaging channels are also growing to play a larger part in search and brand discovery, including for study abroad

The annual report on global digital trends from marketing agency We Are Social is always a must-read around here. This year's edition, produced in collaboration with tech tool provider Meltwater and sector intelligence specialists DataReportal, is no exception.

"Digital 2023: Global Overview Report" provides an insightful, high-level view of many of the important trends that inform how we find and share information, communicate, entertain ourselves, and otherwise connect online.

The report points out that the world's population passed the 8 billion-person mark as of November 2022 and was roughly 8.01 billion at the start of this year. Nearly two in three of that total (or about 5.16 billion people in total) are now using the Internet. That represents about 3% year-over-year growth in the global user base between 2022 and 2023.

While that total number of users continues to grow, the data also shows that average time online per user actually declined year-over-year (down about -5% from 2022). "It is important to stress that this decline doesn't indicate that the Internet is becoming less important in our lives, however," writes DataReportal Chief Analyst Simon Kemp. "Rather, it suggests that people are becoming more purposeful in their use of digital technologies, and are prioritising the quality of their connected experiences over the quantity."

The gradual winding up of pandemic restrictions throughout 2022 has also played a part in that decline. "Tellingly, this latest figure is very close to the daily average for Q3 2019 – shortly before the COVID-19 pandemic delivered its profound impact on the world’s digital behaviours," adds Mr Kemp.

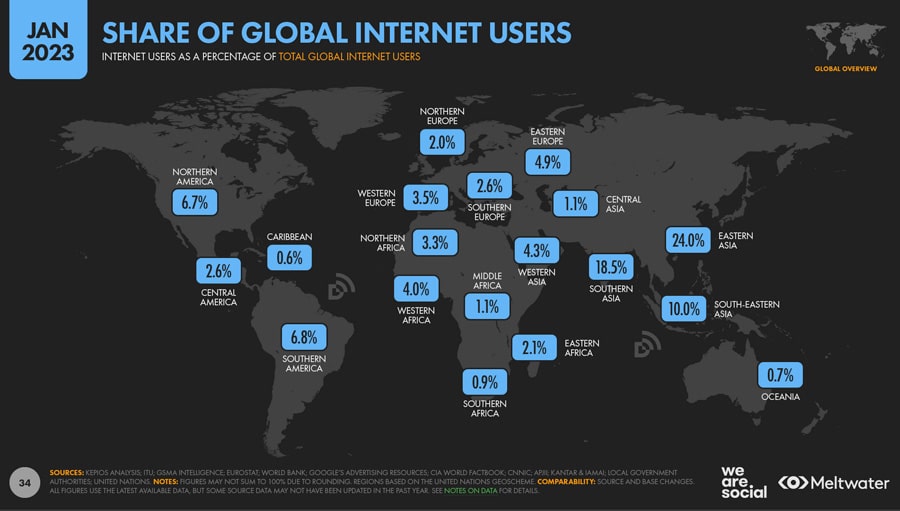

The report reminds us that a relatively small share of the world's Internet users are found in North America or Europe, with much larger user populations found throughout Asia. Asian users therefore have a correspondingly greater impact on global trends.

Internet use is increasingly fluid across desktop and mobile devices. Just over nine in ten (91%) users now access the Internet via their smartphones (roughly equivalent to those that access via desktop machines at home or at work).

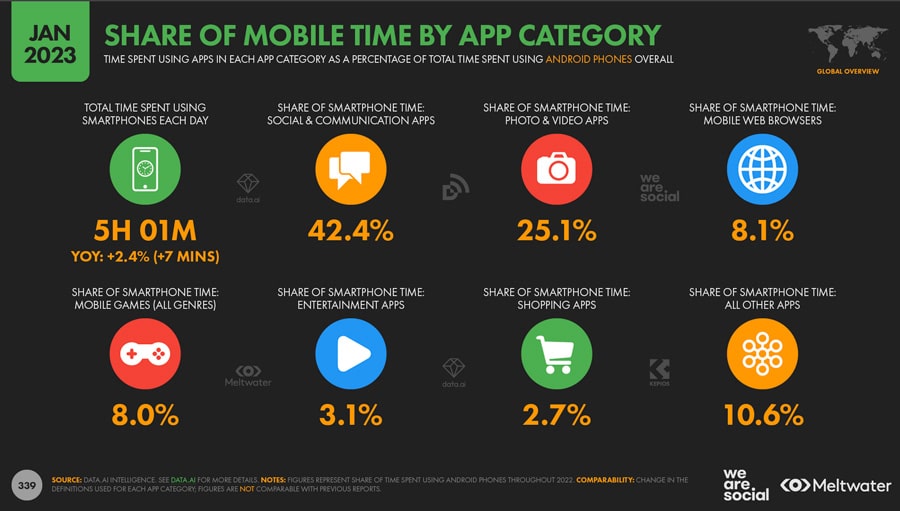

As we see in the summary below, however, mobile use accounts for just over five hours of the global daily average time of six hours, 37 minutes that users spent online each day as of January 2023.

Why are we here?

Most users (58%) say that "finding information" is their main reason for using the Internet, following by "staying in touch with friends and family" (54%), and "keeping up to date with news and events" (51%). "Research products and brands" is the main reason cited by 43% of users whereas "education and study-related purposes" comes in 10th overall at 38%.

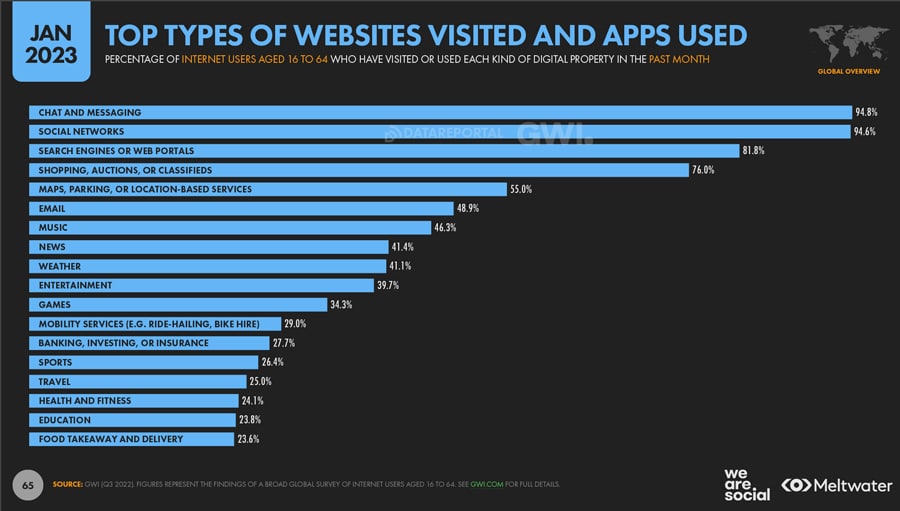

Those priorities are reflected in the following breakdown of the main types of websites that users visit as of January 2023.

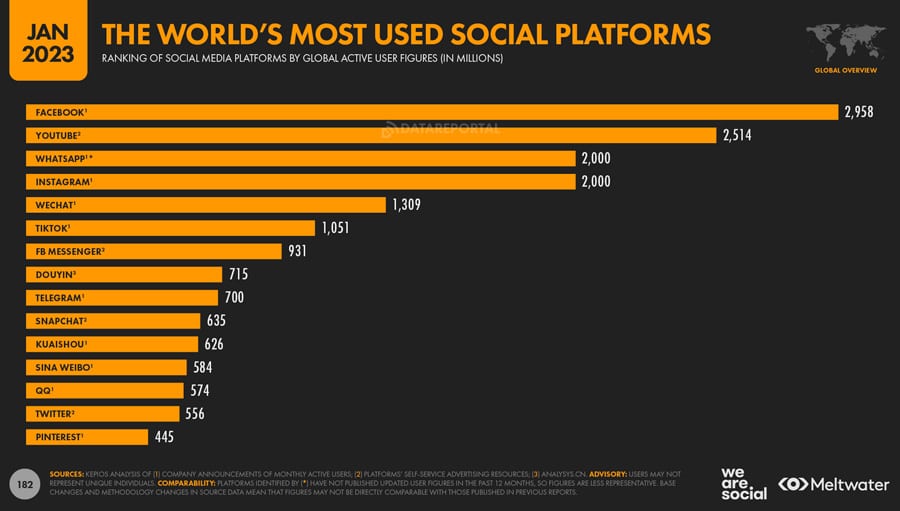

As that summary might suggest, this year's analysis also finds that – even with the global decline in average time online – users are spending more time than ever on social media. "The global social media user total has increased by close to 30% since the start of the pandemic, equating to more than 1 billion new users over the past three years," says Mr Kemp.

We can also distinguish, however, between user counts on those various social channels and actual usage, as measured by average time per user. TikTok, for example, is the sixth-largest platform by user population but leads all social channels in terms of average time used per month at 23 hours and 28 minutes (this compares to 19 hours, 43 minutes for Facebook and 12 hours for Instagram).

How do we find all of that information?

If, as noted above, "finding information" remains the number one reason that people use the Internet, what are the most important channels for doing so?

The data says that about 31% of users (aged 16 to 64) still say that they rely on search to find new products and services. Social channels clearly play an important role as well, especially for users between 16 and 24 years old.

As a related report notes, “Finding information doesn’t quite mean the same thing it used to. Social media algorithms can surface it before we even know what we’re looking for.”

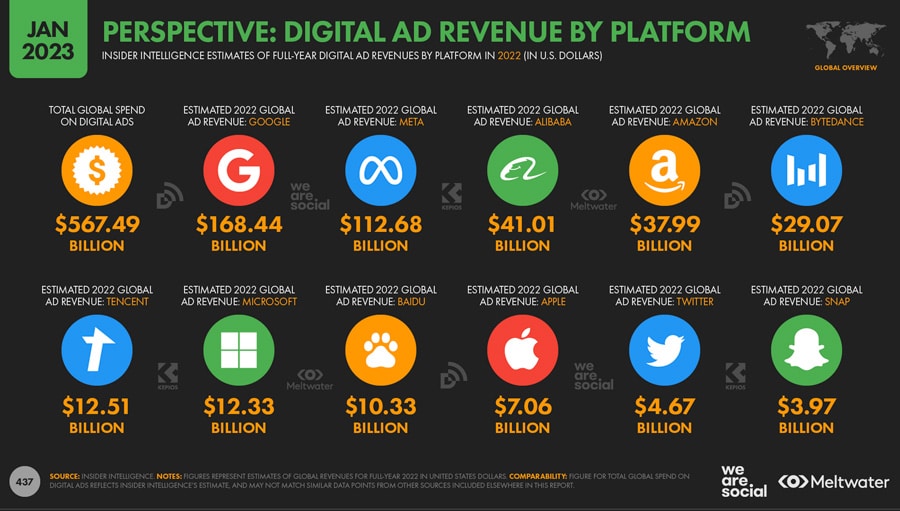

We can see this reflected as well in how digital advertising spend is distributed across search and social channels, as illustrated in the following summary for 2022.

Mr Kemp adds that, "[As of 2022], only internet users aged 16 to 24 were more likely to turn to social networks than search engines when researching products and services.

But [the latest data] confirms that this is now also true of younger Millennials, with 25 to 34 year-olds also more likely to prefer social networks when researching brands online."

The overall picture provided by those data points is that the balance is shifting over time, with a greater and greater emphasis on discovery-via-social media as opposed to discovery-via-search.

Mr Kemp expands: "This suggests that younger internet users are looking for more serendipitous discovery, in addition to looking for more 'conventional' answers to predefined questions.

One way for marketers to approach these shifting expectations is to rethink the somewhat didactic paradigm of conventional online search.

Rather than trying to deliver a single, all-encompassing answer, brands may have greater success if they help people to learn and discover answers for themselves.

For example, in contrast to the hierarchical ranking of search engine results pages (SERPs), search results on social media tend to be a lot more 'messy', offering searchers a variety of different kinds of answers and perspectives.

Moreover, on platforms like TikTok, users can quickly and easily identify whether a search result reflects – or is at least relevant to – 'people like me'.

That’s in quite stark contrast to the relatively anonymous nature of the results we see in SERPs, where searchers need to open various different links before they can identify whether the results are really what they’re looking for."

For additional background, please see: