Scholarships, modernisation, and student mobility: Recruiting in Saudi Arabia now

- Saudi Arabia’s massive Vision 2030 endeavour is fully underway, and the Kingdom is rapidly becoming a more sophisticated, modernised economy and destination

- Vision 2030 creates significant opportunities for foreign educators and there is ample scholarship funding attached to it

- The shape of Saudi mobility will mirror the priorities of Vision 2030, and recruiters must be prepared to research the programme intensively and create strategies in accordance

- This is an in-depth market snapshot that includes a must-watch presentation by Middle Eastern recruitment experts

Geography: Southwest Asia. The Kingdom of Saudi Arabia (KSA) shares eastern borders with the Arabian Gulf, United Arab Emirates, and Qatar, while its western border flanks the Red Sea. Kuwait, Iraq, and Jordan share the northern border, and to the south are Yemen and Oman.

Main cities: Riyadh, Makkah, Madinah, Jeddah, and Dhahran. The Riyadh, Makkah, Madinah, and Eastern provinces hold almost three-quarters of the Kingdom’s student population.

Official language: Arabic. English is widely spoken as well.

Population: 36.2 million, of whom 37% are foreign-born. Population growth is predicted to decrease to 1% by 2030, and will start declining by 2060. About one-sixth of the population is aged 15–24. In mid-2022, almost 18% of Saudi youth were unemployed, and a significant proportion of those who could not find jobs were degree-holders. Increasing youth employment is a top priority for the Saudi government.

Language of instruction: Arabic in Saudi public schools – but English is becoming much more common in universities, especially for STEM subjects. Some English is taught in high school, but students do not generally graduate with high levels of English proficiency. Most Saudi universities have a preparatory year programme (PYP) to transition students from Arabic studies to English-language studies. Students must pass the PYP to be admitted to undergraduate programmes. There is a significant market opportunity for language schools to help Saudi students prepare for degree programmes in foreign destinations.

Religion: Islam. The government runs the country according to Wahhabism (a strict and literal Sunni interpretation of the Quran), and Saudis’ lives are greatly influenced by the rules of this version of Islam.

There has been some relaxation in the society in recent years, as summarised by France 24:

“The kingdom's religious police have been de-fanged, cinemas have reopened, foreign tourists have been welcomed, and Saudi Arabia has staged a film festival, operas, Formula One Grand Prix, heavyweight boxing, professional wrestling and a huge rave festival.”

Economy: In 2016, Saudi Arabia launched its Vision 2030 strategy, the goals of which include: diversifying the economy beyond oil industries, empowering women and youth, harnessing the power of digital technologies, and advancing the country’s tourism and healthcare sectors. According to the Strategy:

“Saudi Arabia is using its investment power to create a more diverse and sustainable economy … and its strategic location to build its role as an integral driver of international trade and to connect three continents: Africa, Asia and Europe.”

A crucial point for educators: It would be unwise to attempt to recruit in Saudi Arabia without fully researching Vision 2030 – what its goals are, impressive progress to date, which sectors are priorities – and how these priorities are creating demand for specific education programmes and degrees. Student mobility from Saudi Arabia over the next few years will be largely determined by the planning and government bodies attached to Vision 2030.

According to the IMF, Saudi Arabia is likely to be one of the world’s fastest-growing economies this year “as sweeping pro-business reforms and a sharp rise in oil prices and production power recovery from a pandemic-induced recession in 2020.” In Q3 2022, Saudi Arabia’s GDP grew 8.8% year-on-year.

Millions of foreign workers – who have always dominated private sector employment – have left the country over the past few years amid a government-led “Saudization” drive that has created barriers for many foreigners to work in the country. For example, businesses in the Kingdom must pay an “expat fee” of over USD$200 a month per foreign employee, foreigners must pay fees for dependents, and the sectors foreigners can work in are now limited.

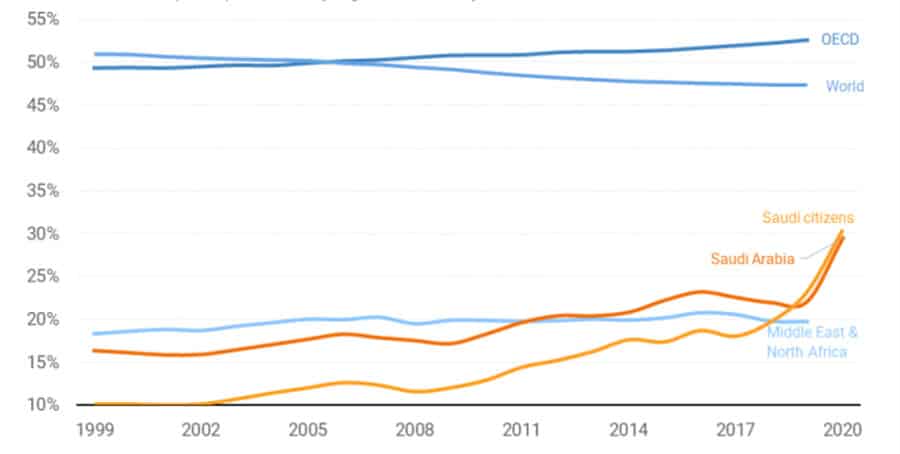

Not coincidentally, labour force participation by Saudis is increasing, particularly among women in the private sector. Brookings notes, “Saudi Arabia’s Vision 2030 reform program has an explicit objective to increase the female labor force participation rate to over 30%. For now, it looks like this objective was achieved 10 years early.”

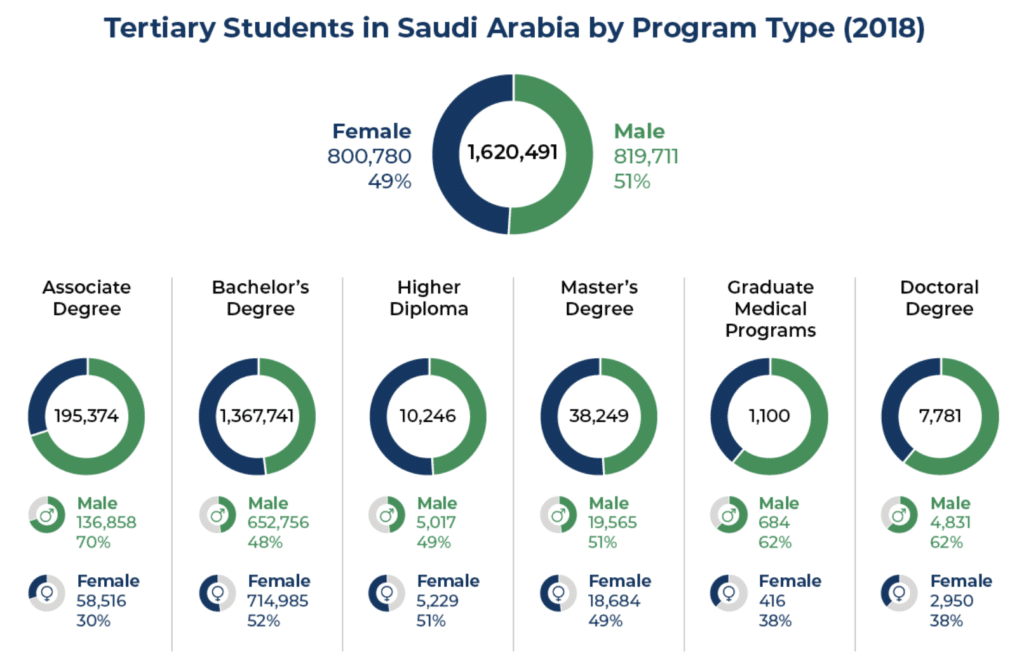

While Saudi women’s rights remain more restricted than in many parts of the world, they have expanded under the rule of Prince Mohammed bin Salman. Saudi women now have as much access to education as their male counterparts and they are eager to pursue university studies. There are more female than male undergraduates, for example, and women make up more than half of university students in the Kingdom. Top female Saudi students are eligible for the Kingdom's study abroad scholarships and encouraged to apply.

The number of Saudi households in high-income brackets is 3.4 million, the highest in the region. UAE follows next with 1.5 million households in that bracket.

Education system

The number of students aged 6–24 in primary, intermediate, and tertiary schools is projected to reach 11.2 million by 2025, up from 10 million in 2018. This is the largest student population in Gulf region (GCC), and most of it is concentrated at the secondary level.

Almost 9 in 10 Saudi students attend one of over 26,000 public schools in the Kingdom. The rest attend one of roughly 4,500 private schools. Enrolment in private schools is increasing faster than in public schools and 15% all K-12 enrolments in KSA are now in private schools. A Vision 2030 goal is to see this share grow to 25% by 2030.

Zawya.com reports that “63% of private schools adopt the Saudi curriculum, 33% of schools adopt the American curriculum, and 17% follow the British curriculum.” In addition, given KSA’s large expat population, there are many international schools that serve families from all over the world – from Pakistan and India to Japan and the Philippines to France and Germany.

Major players in KSA private education include:

- British International School of Jedda

- GEMS Education (which, in partnership with Saudi-government-funded Hassana Investment, acquired Saudi Arabia’s largest private school operator, Ma’arif, in 2019)

- International Schools Group (ISG)

- Kingdom Schools

- SABIS Education Services

- American International School

- Aata Educational Company

At the primary level, after kindergarten, students attend six years of primary school, and then undertake three years of intermediate school. For high school, students can choose an academic orientation or a vocational one. They sit for comprehensive exams twice a year that are supervised by the Ministry of Education.

Primary/secondary education is under transformation in the country. WENR reports that: “The Future Gate initiative, implemented by the company Tatweer Educational Technologies (TETCO) on the behest of the Saudi government, is ushering in smart classrooms and digital education management systems across Saudi Arabia: ‘Textbooks are being swapped out for mobile devices that provide up-to-date content in real time. Printed exams are transitioning to online assessments.'”

Tertiary: About 2.1 million students were enrolled in Saudi universities in 2022. The Council of Higher Education oversees the entire university sector, while the Ministry of Higher Education (MHE) administers the system.

EY estimates that unmet demand for a place at university within KSA was 150,000 seats this year, setting up high demand for study abroad. Most Saudi students enrol in tuition-free undergraduate programmes in public tertiary institutions. There are about 50 public and private universities in KSA, as well as many community colleges, women’s colleges, and vocational schools.

Colliers International predicts that the total demand for higher education among Saudis “will reach 2.8 million seats in 2030, compared to an estimated 1.97 million seats in 2022."

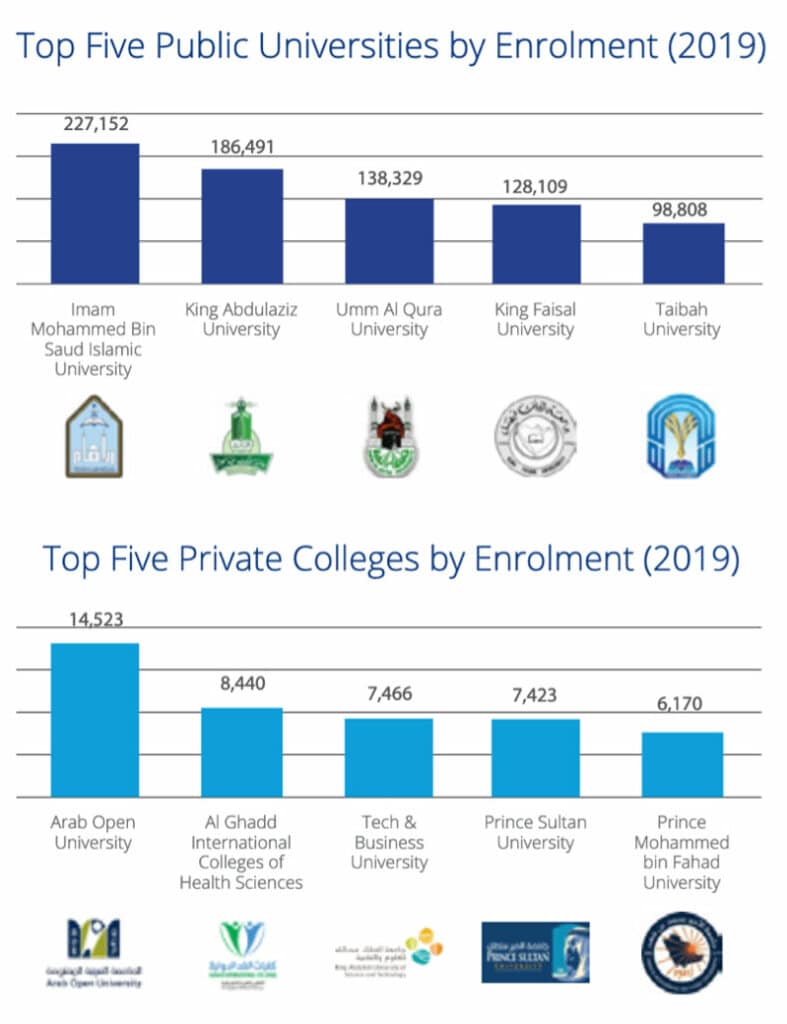

Five public institutions are responsible for nearly half of all public university enrolments, and five private colleges account for nearly half of all enrolments in the private sector.

Universities in major cities deliver roughly 200 bachelor’s, master’s, and PhD programs in English. Please see the 2023 QS rankings for the Arab region for a sense of the country’s top universities.

Colliers expects demand to rise among Saudi students for the following subjects and fields:

- Artificial Intelligence (AI)

- Robotic sciences

- Energy (e.g., Nuclear, Sustainable, Renewable, Solar)

- Health (including certificates and micro-credentials to boost the skillsets of medical professionals)

- Hospitality/Tourism

- Business studies to support investments in the SME sector

WENR offers this helpful graphic detailing the enrolments pattern (in 2019) across the Saudi higher education system.

Study abroad

The number of Saudi Arabian students studying overseas has declined from a high point in 2016, at which time there were more than 100,000 students abroad. Along with lower outbound mobility in the pandemic, the decline stems from the winding down of the King Abdullah Scholarship Program (KASP). At its peak, KASP sent tens of thousands of students to the US and significant numbers to Canada, the United Kingdom, and other leading destinations.

The programme has now been replaced with smaller, more targeted scholarships for Saudi students. A focus on sending students to major English-language destinations in the KASP era has been replaced with a determination to place students in top universities in any region and to programmes aligned with the Vision 2030 agenda.

In 2019, there were roughly 70,000 Saudi students abroad. Western destinations’ share of Saudi students has been declining in recent years. The US remains the top enroller of Saudi students, but enrolments were just 18,206 in 2020/21, down 17% from the previous year. In 2018/19 the number was nearly 40,000, and that was still a decline from the over 60,000 Saudi students enrolled in US programmes in 2015/16.

A diplomatic spat between Canada and Saudi Arabia in 2018 led to the Saudi government abruptly cutting scholarship funding for its students in Canada and requiring many to immediately leave the country. Thousands of Saudi students left Canada and thousands more abandoned plans to begin studies in Canada. Canada had risen to be a top destination for Saudi students prior to that dispute, but there are now only around 1,500-2,000 Saudi students in Canada.

Australia has yet to recapture the Saudi market after opening its borders again in late-2021. There are roughly 3,500 Saudi students in Australia now (2022), down from 7,000 in 2019.

The UK, however, has held on to its Saudi enrolments. There were about 8,800 Saudis in UK universities in 2020/21, up slightly from the number the year before and similar to enrolments in 2016.

Outside of Western destinations, Malaysia is the most popular choice for Saudi students choosing to study abroad. About 2,000 Saudi students chose Malaysia according to 2019 UNESCO data.

Scholarships

Custodian of the Two Holy Mosques Scholarship Program

The foremost scholarship programme that replaces previous iterations of KASP is the Custodian of the Two Holy Mosques Scholarship Program, run by the Ministry of Education. Under this scheme, the Saudi government plans to send 70,000 students to 200 approved foreign institutions/programmes by 2030.

Eligible students are streamed into one of four paths under the new strategy – the Pioneers Path, the Research & Development Path, the Providers Path, and the Promising Path:

- The Pioneers Path is designed to send students to bachelor and master’s programmes in all fields at the world’s top 30 education institutions.

- The Providers Path is designed to send students into bachelor, master’s, and “training” programmes with a clear relationship with specific labour market needs. Target fields include information technology, natural sciences, mathematics and statistics engineering, manufacturing and construction, business management, and tourism.

- The Research & Development Path is oriented to producing scientists and is intended for PhD-level students. Target fields include cybersecurity, digital currencies, artificial intelligence, sustainability and environmental management, aviation and defense, nuclear energy, intelligent energy management systems, and smart and sustainable cities.

- The Promising Path streams students into bachelor, master’s, and “training” programmes oriented to specific fields including sports, digital economy, public administration, business administration, marketing, and institutional behaviour.

The Ministry of Education is now accepting applications for the Custodian of the Two Holy Mosques Scholarship Program for the academic year 2023/2024 until 5 May 2023.

Important to know: Students who go to destinations such as the US, UK, Canada and Australia will not receive support for any English-language training required for their degree programmes, but students going to non-English-speaking destinations will receive support for language studies.

Other scholarships

There are many other government-funded scholarships in place with discrete goals, run by specific ministries such as the Ministry of Tourism, the Ministry of Culture, the Ministry of Defence, etc. New programmes are announced regularly and there are many opportunities for foreign universities and colleges that:

- Do their research (e.g., what Vision 2030 requires in terms of skills, which Saudi universities specialise in which programmes, and which government ministries are responsible for various sectors of the economy);

- Invest in creating a foundation of contacts and goodwill, beginning with the Saudi cultural bureau in their country and extending to meetings and arrangements with in-country representatives and agents who have an understanding of how the system works;

- Invest in in-person visits, regional events, and industry networking conferences;

- Are prepared to be patient and build up trust among Saudi decision-makers;

- Understand the sophistication of the scholarship environment in Saudi Arabia and of Vision 2030 in general;

- Are prepared to be flexible and very responsive to RFPs and other queries;

- Can make a clear case for how a particular programme is aligned with a scholarship's goals;

- Can articulate their brand well and explain why it is relevant in the Saudi context;

- Take the time to understand Saudi culture in general.

Please enjoy this excellent panel discussion about scholarships in the Middle East hosted recently by ICEF. On the panel were guests with immense experience in Middle Eastern markets:

- Marie-Claude Svaldi, VP of government relations and recruitment EMEA, ELS Education Services

- Craig Hastings, Division Adviser, Abu Dhabi Scholarships, Department of Education and Knowledge (ADEK)

- Sarah Crowther, President, Collective Study

For more information, please see: