The push for diversification in foreign enrolment

- Educators have been talking about diversifying international enrolments for years. That elusive goal is now coming into sharper focus for many

The following feature is excerpted from the 2022 edition of ICEF Insights magazine and is reprinted here with permission. The entire issue of the magazine is available to download for free at icef.com/insights.

The Australian Strategy for International Education (2020–2030) report succinctly articulates the issue facing educators everywhere: “The covid-19 pandemic demonstrated that dependence on a small number of [student] markets is not sustainable.”

This reality has fundamentally changed the international education landscape. The past couple of years have been chock-full of webinars and conferences devoted to questions like these:

- How do we reduce our reliance on two or three key sending markets?

- How can we capitalise on our recent investments in online, remote, and hybrid course delivery so we can depend less on in-person enrolments and gain new revenue streams?

- How can we enrol students across a wider range of programmes, especially programmes that tie into the specific jobs and skills our economy needs to thrive?

Those themes reflect a new understanding of what a diversification strategy looks like today. For many educators, diversity is becoming more multi-layered and is no longer just about expanding the mix of nationalities in a student body.

A flattening Chinese outbound market

For years, experts have predicted that the flow of Chinese students would weaken through the 2020s because of many factors, including increased capacity and quality in China’s own higher education system. Somehow, this diminished flow still feels like a shock now that it has really taken shape.

Rising geopolitical tensions between China and the West may have accelerated the trend. The Chinese government has become increasingly intent on carving out a sphere of influence to rival North American–European ties. Its policies have shifted towards a goal of keeping more students at home, rather than having them leave for the West, to study and work.

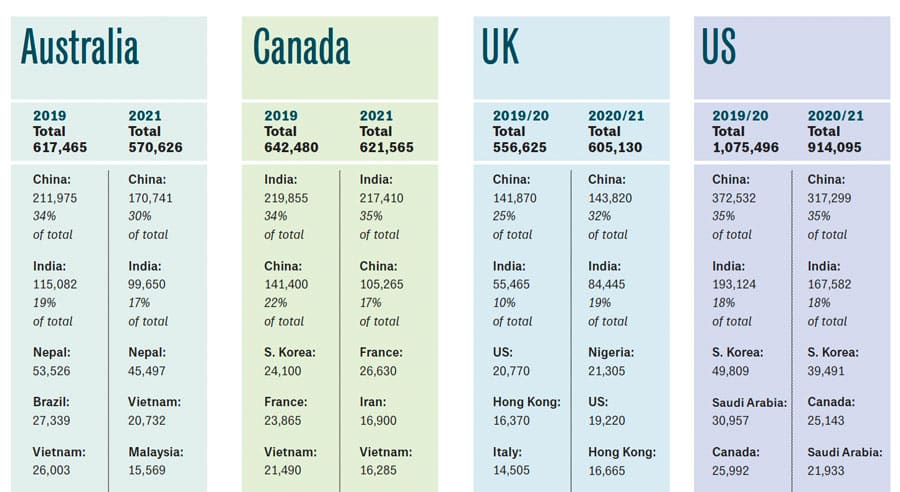

The four major English-speaking destinations are feeling the impact:

- The UK saw 5% fewer Chinese commencements in 2020/21;

- Also in 2020/21, Chinese enrolments in the US declined by 15%;

- From 2019 to 2021, the proportion of Chinese students in Canada’s international student population fell to 17% from 22%;

- The proportion of visas given to Chinese students for programmes in Australia in 2021 was 30% of the total, down from 35% in 2019.

It’s quite apparent that while China will continue to be a top sending market and a priority for recruiters the world over, it will no longer be the major driver of global mobility.

India is the new growth driver

Like China, India will remain a major (and growing) student market for the long term. Strong current demand from students in India is certainly helping to mitigate the trend of flattening or declining Chinese enrolments. Indian students composed 35% of Canada’s total international student population in 2021, stable since 2019, while in the UK, Indian enrolments made up a far greater share in 2021 (19%) than in 2019 (10%). Indian students remain the second-most dominant international segment in Australia and the US as well.

But educators are also aware that destabilising events can affect any outbound market. In 2012, the Indian rupee lost one-fifth of its value, depressing Indian student mobility for some time. In 2020, the US dollar hit a 20-year high, which is making it more costly for students in many countries – including India – to study there.

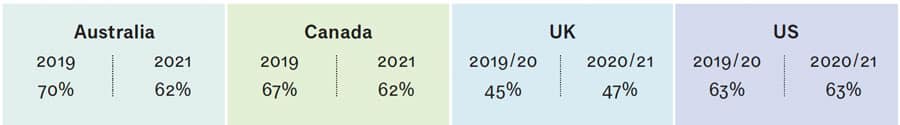

How diversified are leading destinations?

The table above shows that the UK is the least reliant of the four destinations on its top markets – i.e., its foreign student population is more dispersed across nationalities. However, Australia and Canada have made more progress lately in diversifying beyond their top five source markets.

Further, in the tables below, we see that the UK is becoming much more reliant on Chinese and Indian enrolments. Chinese and Indian students represented 51% of the total international student population in 2021 – a big jump from 36% in 2019.

Which new markets are on the radar?

In part because of where they are geographically, educators – sometimes with government partners – in each of the four destinations are prioritising different new student markets.

Australia

Target markets: Austrade market development activities in 2022 indicate that the following markets are priorities: Argentina, Brazil, Chile, Colombia, India, Malaysia, Mexico, Nepal, Peru, the Philippines, and Thailand.

How is it going? So far in 2022, there has been a year-over-year uptick in commencements from India, Nepal, Pakistan, the Philippines, and Thailand.

Canada

Target markets: Brazil, Colombia, France, Indonesia, Mexico, Morocco, Philippines, Thailand, Turkey, Ukraine, Vietnam

How is it going? Canadian immigration data shows that all of these markets except Vietnam sent more students in 2021 than in 2020. Growth is particularly strong from France, Mexico, Morocco, and Philippines. Outside of the government’s stated priorities for market development, Hong Kong, Nepal, and Sri Lanka are also growing fast.

UK

Target markets: Brazil, China, Europe, Hong Kong, India, Indonesia, Mexico, Nigeria, Pakistan, Saudi Arabia, Vietnam

How is it going? Unlike the other destination countries, the UK held onto its Chinese enrolments in 2021. India, Nigeria, and Pakistan are also sending many more students. Universities and Colleges Admissions Service cautions, however, that 2021 applications data shows that “just over half of all international applications for 2021 came from only seven countries…the UK remains heavily dependent on Chinese applicants.”

US

Target markets: Mexico, Nigeria, Europe*

How is it going? In 2021, the number of Nigerian and Mexican students on M-1 or F-1 visas increased by 12% and 13%, respectively, over 2020, and numbers from France, Germany, Italy, Spain, and the UK all increased as well. *The US does not have an international education strategy or other government-based indications of which markets are priorities, but SEVIS visa numbers for 2021 show that the above regions sent significantly more students last year, helping to spur US educators’ recovery from pandemic enrolment losses.

Reaching beyond national borders

During the pandemic, the notion of diversification for schools and universities expanded a great deal beyond its previous parameters. Diversity used to be thought of mainly in terms of broadening the number of nationalities on campus. Now, it also includes approaches to deliver programmes to international students at least partially off-campus.

This expansion of the definition of diversification is due to a couple of related factors that became clear at the height of covid-19 travel restrictions:

- Schools and universities that could deliver quality online learning to international students abroad – or already had branch campuses or joint programmes in other countries – were better able to withstand the shock of closed borders than those without these capabilities.

- New international student segments emerged. One example is students willing to begin studies online if they can eventually travel to a campus. Another is students willing to enrol in a totally online programme if they receive incentives to do so, such as lower tuition or post-study work rights in a destination country.

Both these developments highlighted the limitations – for enrolments and potential revenue – of the traditional model in which international students fly to overseas destinations to receive in-person instruction at a foreign institution.

The international perspective on these trends came through in a 2021 Canadian Bureau of International Education webinar that made it clear that institutions are thinking beyond traditional capacity limits such as available in-person classroom space or housing.

As George Brown College’s Rick Huijbregts explained during the webinar session, “We are bigger than just the physical space we have…we are thinking about how we can deliver the George Brown experience beyond [the campus], even outside of Canada.”

Quite simply, the pandemic massively expanded the potential market of international students around the world. It revealed just how many students would opt for quality online or hybrid (aka blended) learning if it delivered a credential awarded by a foreign institution and if it were offered at the right price with attractive incentives, such as lower tuition.

Life after STEM

International enrolments have always been heavily concentrated in a few key subject areas, especially business, technology, engineering, and other applied sciences. For some institutions, this focus can lead to capacity constraints in those programmes while spaces remain available in other fields of study. Aside from addressing these capacity imbalances, there is great value in getting international students and partners interested in a less concentrated, less limited way than is sometimes done.

With all that in mind, educators are now giving more attention to boosting international enrolments outside of business and STEM programmes. A mid-2022 survey conducted by ICEF suggests agents have a role to play in this process.

Agent respondents from 11 key sending markets said at least half of the students they counsel are interested in advice and recommendations about programme options. Agents emphasised the need for institutions to work closely with them to explain which programmes have extra capacity for international students, why students should be interested, and what jobs the programmes can lead to. If a programme is less expensive, for example, or has internships attached to it, strong industry links, or scholarships available, agents need to be able to communicate these increasingly compelling features.

This all suggests that additional targeting of students by programme area may be a strategy that is readily available to most educators. Diversifying enrolments across programmes is another aspect of risk management.