Mapping COVID-19’s impact on global student mobility

- New research shows that, while student flows have shifted, demand for study abroad remains strong

- Destinations with vaccine availability, open borders, and in-person instruction stand to gain competitive share of the global market going forward

A newly published joint paper from the Institute of International Education (IIE) and IC3,

“International Student Mobility Flows and COVID-19 Realities,” illustrates the great extent to which international student mobility flows shifted in the 20 years from 2000–2020 and suggests that the COVID-19 pandemic is altering the decision-making process of prospective students.

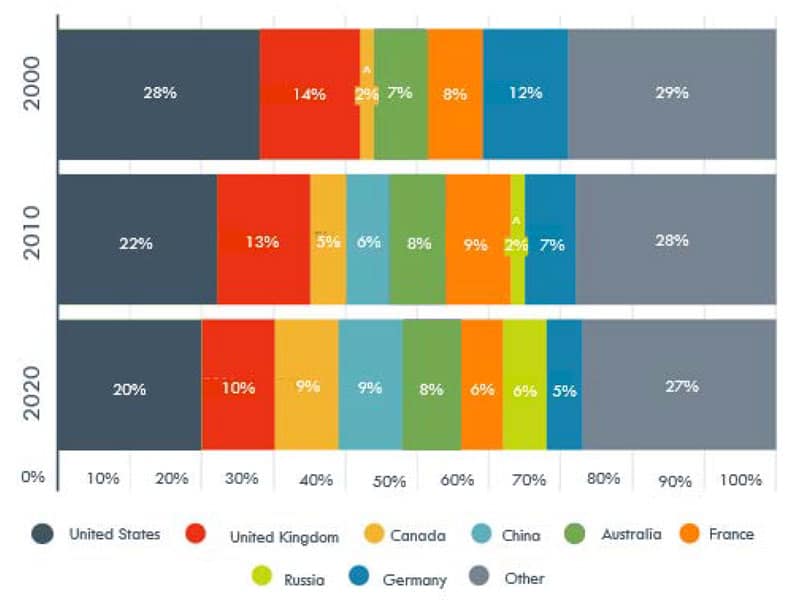

As you can see in the chart below, several major destinations claimed a substantial share of the world’s international higher education students in 2020 – and the mix of top destinations is quite different than in 2000. The US remains in first place in terms of numbers of students hosted but its share has been declining due largely to Canada and China becoming more competitive in recent years. The paper notes that Canada and China more than doubled their total international student numbers from 2010 to 2020.

Altogether in 2020, the top five destinations – the US, the UK, Canada, China, and Australia – hosted more than half the world’s international students.

Overreliance on China and India

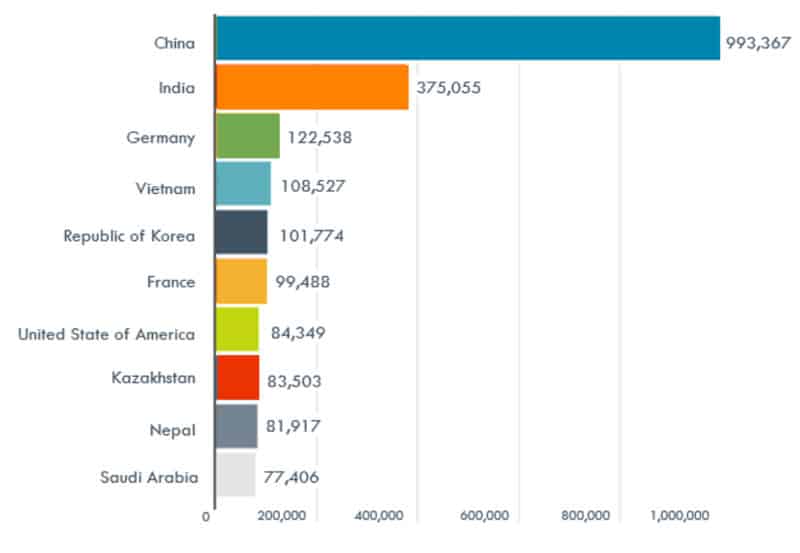

The paper also includes a chart (pictured below) that puts a fine point on how reliant most institutions with significant internationalisation mandates have become on Chinese and Indian students. The authors note,

“In 2020, Chinese and Indian students made up 53% of all international students in the United States (Open Doors, 2020). China and India also comprise more than 50% of international students in Australia and Canada and more than a quarter of international students in the United Kingdom (Project Atlas, 2020).”

It will come as no surprise to readers of ICEF Monitor that the IIE/IC3 paper finds evidence that “international student enrolment in most leading host countries for the 2020/2021 academic year declined.” We have written on the extent of these declines for all major destinations, and while our reporting generally jibes with the findings of the research paper – e.g., that “among the top five host countries for international students, [higher education] enrolment varied from declines of approximately 20% to a modest decrease” – we would note that the enrolment impact of COVID on Australia’s international education sector has been more serious than the paper suggests.

In Australia and elsewhere, notes the paper, the efforts of institutional staff and governments to move programmes online where needed and to support international students in whatever ways possible were instrumental to enrolment declines not being much steeper.

COVID’s impacts have been variable

The impact of the pandemic on enrolments have varied according to type of programme and institution. For example, IIE/IC3 notes that “short‐term exchange student enrolment numbers decreased markedly,” as opposed to a stable enrolment trend for degree-seeking students. This has certainly been true for the language learning sector in most major study destinations, where year-over-year declines due to COVID were often on the order of 70-80%.

While international student commencements (new enrolments) have generally fallen in many destinations, “continuing” enrolments have not fared so badly. The paper posits that,

“There may be several contributing factors to this trend. First, some countries noted declines in 2020 commencement data indicating that international students paused or slowed the pace of their academic study, thereby remaining enrolled for a longer period at their host institution. Additionally, many institutions provided support for continuing international students who were already in the country and continued their studies. As a result, continuing international student numbers held steady, and declines were reported primarily around new international student enrolment.”

In addition, large research institutions have tended to fare better than other types of institution.

The impact on students has been more universal

QS research has found that more than 70% of international students have suffered from stress and anxiety due to COVID, and as the months wore on, more and more institutions reported increasing their communications and efforts to help students. The triggers for students’ stress and anxiety appear to differ according to the circumstances under which they are studying and are particularly acute for students locked out of their chosen destination country (e.g., those who had planned to study in-person in Australia, China, or Japan – countries whose borders remain effectively closed to international students.)

Being able to have at least some in-person learning experience, even in the pandemic, is increasingly correlated with better mental health and the IIE/IC3 paper quotes a Nuffic survey that found that students who had received at least one-quarter of their classes in-person in fall 2020 were more likely to be satisfied with their study experience.

This fall, international students in the US, the UK, and Canada can expect to receive at least part of their education experience in-person – a fact that will not be lost on prospective international students whose first choice of destination might once have been Australia, New Zealand, or China and who might now be changing their minds. The most recent IDP Connect Crossroads survey found that more than a third of prospective international students were open to changing their minds about where they would go, depending on whether face-to-face instruction was available.

The pandemic will accelerate a disruptive trend that was already underway before the crisis – that of students increasingly considering a wider range of destinations than in the past, often for practical reasons (e.g., affordability, the ability to work/immigrate after graduating). Border policies, the availability of in-person instruction, and the opportunity to access vaccines are the newest factors in the mix, and they have the potential to fundamentally alter a destination’s popularity in the next couple of years at least.

Demand for study abroad is strong

At this point in the pandemic, the psychology of international students is somewhat different than it was in the early days of the crisis. Perhaps most importantly, we have now been living with COVID-19 for months, and students are losing patience with the crisis’s disruptive effect on their studies and career goals. Luckily for many, vaccines are now more available (either in students’ home country or in the destination country they have chosen), diminishing the risk of travelling abroad and attending in-person classes. For all these reasons, it is not surprising that recent research is showing that students are growing more eager to travel abroad. The paper cites QS 2021 findings including that:

- 42% of international students would feel comfortable travelling overseas for study once campuses are open and in‐person instruction has resumed.

- 38% felt comfortable once a coronavirus vaccine is widely available.

And, as the paper notes,

“Student interest is further evident in the increased application numbers from international students for study in the 2021/22 academic year reported by leading host destinations. Approximately 43% of responding US institutions indicated an increase in their application numbers from 2020 (Martel & Baer, 2021). UK institutions reported a similar proportion of increased application numbers for fall 2021 (BUTEX, personal communication, June 17, 2021).”

For additional background, please see: