UK: Online learning expected to drive further significant growth for TNE programmes

- UK institutions are now delivering some form of transnational education (TNE) for nearly 450,000 students in 225 countries

- Most TNE enrolments are in Asia, but activity has increased significantly in Europe as well

- In terms of enrolments across various TNE models, online delivery of programmes to students in their home countries is fast catching up with collaborative delivery with foreign partners and is the area where the greatest growth is projected this year

The UK has always been a leader in the provision of transnational education (TNE) – such as articulation agreements and joint programmes delivered in part or whole in a foreign country – and its institutions have been ramping up TNE activity still further in the past couple of years. Not surprisingly, the challenges of COVID travel restrictions are a driver of this expansion. For both UK institutions and those in other destinations, the pandemic has underlined how urgent it is to find ways of delivering education to a massive audience of students who are unable or unwilling to study abroad but still interested in credentials from a foreign institution.

The UK has an advantage in this regard as its TNE activity was already significant before the pandemic and there is considerable experience and infrastructure already in place. More UK educators are involved in TNE initiatives than ever, according to Universities UK, which defines TNE as,

“The delivery of degrees in a country other than where the awarding provider is based. It can include, but is not limited to, branch campuses, distance learning, online provision, joint and dual degree programmes, double awards, 'fly-in' faculty, and mixed models, traditionally referred to as blended learning.”

More UK institutions engaged, especially in Asia

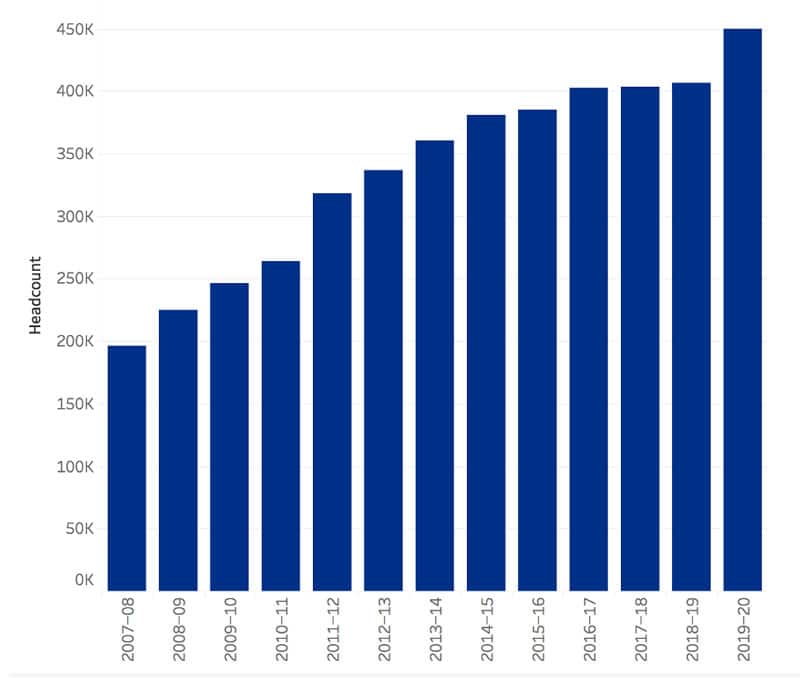

Universities UK publishes detailed analysis of HESA's Aggregate Offshore Record (AOR) data annually through their Scale of Transnational Education (TNE) report. They note that the number of providers in the UK engaged in TNE activity hit a record high of 156 in 2019/20, with data reporting changes leading to the inclusion of 14 new institutions. Total enrolment across all modes of TNE delivery reached just under 450,000 students in that year.

Overall, UK TNE provision is now happening in 225 countries, and Asia is the top region for this education export, accounting for around half of all enrolments. The top five countries for UK TNE programmes are all in Asia and enrolments in these countries represent 40% of the total (up from 36% in 2018/19). HESA data show increasing interest for TNE collaboration in South, Central and South East Asia, especially in China and Malaysia but also in Sri Lanka, Nepal, India, and Uzbekistan.

TNE enrolments in the top five countries in 2019/20 were:

- China: 49,800

- Malaysia: 49,375

- Sri Lanka: 30,825

- Singapore: 27,885

- Hong Kong: 22,400

The chart below shows the big jump in TNE enrolments for UK institutions from 2018/19 to 2019/20 following a few years of stable enrolments. Not since 2011 has there been such a significant increase.

In 2019/20, roughly two-thirds of students enrolled in UK TNE were undergraduates and about one-third were in postgraduate studies.

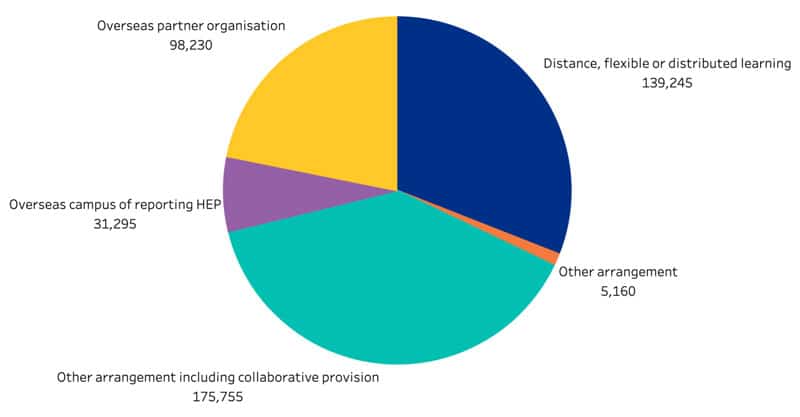

The largest percentage (39%) were enrolled in programmes delivered collaboratively with a partner (such as joint and dual degrees and franchised provision), but almost as many (31%) were studying courses delivered online by a UK provider. Another 27% were registered with an overseas institution, and 7% were enrolled at overseas branch campuses of UK institutions.

Expansion in Europe as well

UK universities are also setting up new partnerships in Europe, with many doing so to mitigate the potential of Brexit to dampen EU students’ interest in travelling to the UK for their studies. The number of students in Europe taking UK TNE programmes has increased by 60% in the four years since the referendum, outside the three main providers of distance learning. At the same time, Universities UK notes,

“There remain many challenges on the horizon, including the protracted effects of a UK-EU Trade and Co-operation agreement that creates a more uncertain regulatory environment for providers.”

Market for TNE is much larger now

Next year’s HESA data may reflect still more TNE enrolments for UK universities, Universities UK predicts. They estimate that there “could be in excess of 400,000 students studying at least partly online across borders in 2020–21.” Already there is evidence of many more students pursuing programmes this way: in 2019/20, 20,000 more students were enrolled in UK programmes delivered at least partly online in their home countries (as compared to the year before).

Shift online presents regulatory and recognition challenges

The pandemic has greatly accelerated the growth of hybrid and online learning – and as we have reported elsewhere, the international education landscape is already vastly different than it was at the start of 2020. During a webinar hosted by HolonIQ, a market intelligence platform for global educators, co-CEO Maria Spies said,

“COVID-19 is expected to have a lasting impact on patterns of consumption. Not just in terms of the learners themselves but also in the way that [international educators] respond and also in the actions of governments.”

The pace of change is not yet fully reflected in the regulatory environment for cross-border online learning, and national/international accreditation schemes are also in need of revision to accommodate the ever-more common alternative credentials that students are enrolling in. Universities UK adds,

“We are continuing to work with sector bodies and government to identify and address barriers to digital cross border provision that affect a growing number of providers, from taxation of digital transactions to recognition of online learning.”

Increasing online provision will expand international student markets

HolonIQ estimates that for every student who goes abroad, there are another four – and an estimated global total of 20 million higher education students – who would like to study outside their home countries but are unable to do so. This may be because of family or career commitments or because they lack the qualifications or funds to support studies abroad.

Whatever the case, the point is that, seen through this lens, the “addressable market” for international education is clearly much larger than just those students who can travel overseas.

One striking indication of increasing investment in online delivery models is the acquisition earlier this month of major MOOC platform edX by publicly traded online programme management company 2U for USD$800 million. The rush is clearly on to find partners and models with the potential to reach students in as many markets as possible in as many ways as possible – without students needing to travel overseas for their studies.

For additional background, please see: