Indian outbound student market poised to bounce back in 2021

- The Indian market has been a major driver of global student mobility over the past decade and is poised for further growth after the pandemic

- The market is very quick to adapt to changing contexts and policies in study destinations

- Institutions and schools recruiting in India are encouraged to place an emphasis on return on investment and employment outcomes for graduates and to ensure strong support services and communications for prospective and incoming students

In many respects, India has been one of the big stories in international student mobility over the past decade. Second only to China in terms of total outbound numbers, India has now become an important driver of overall growth in international education.

In fact, somewhere around 2014 India began to actually outpace China in terms of year-over-year growth. Over the five years from 2015 to 2019, India became not only the world’s second-largest sending market but also one of the fastest-growing sources of outbound students.

The burgeoning Indian market was in focus earlier this month at a special webinar convened by ISEM Canada, a professional practice group of international enrolment specialists.

In his opening presentation, panelist Vinay Chaudhry, the CEO of market-entry firm Worldwide EduConnect, provided some important context for this famously large and complex market.

"The student recruitment market is still maturing," he explained, "and I think we can expect a lot more from India." With its current population of 1.4 billion, India had been one of the fastest-growing economies worldwide before the pandemic. "We expect a very strong bounceback after COVID as well, " he adds.

The numbers from India are always dizzyingly large but to pick just a few from Mr Chaudhry's highlights: the population skews young, with roughly 500 million people below the age of 25. A Bain & Company analysis projects that nearly half (48%) of India's population will belong to the upper-middle and high-income classes as of 2030. Even now, 1.4 million students graduate each year from schools where English is the medium of instruction.

Mr Chaudhry pointed out as well that the Indian education system is now on the cusp of significant change, arising from the introduction of a new National Education Policy earlier this year. The NEP sets out goals to substantially increase participation in higher education, boost research outputs, and expand undergraduate programmes to four-year degrees. The NEP also aspires to have more Indian universities breaking into the upper tiers of global rankings.

Reflecting on current recruitment channels, Mr Chaudhry added that US universities tend to rely heavily on direct contact with high schools in India, and so are more invested in engagement with school counsellors. "Australia on the other hand, relies mainly on agents for probably more than 90% [of its enrolments from India]. And Canada is somewhere in the middle."

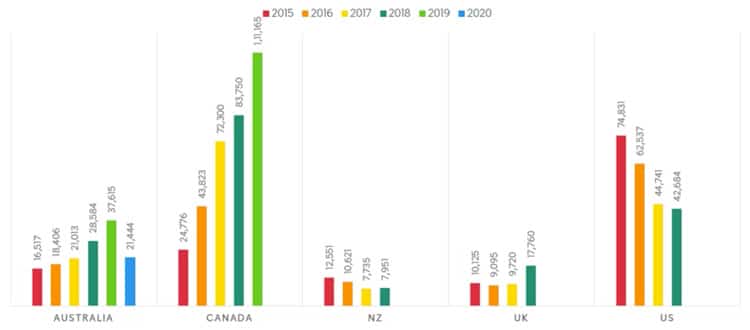

Reflecting further on those top destinations, the following chart shows 2019 enrolments from India for the top six destinations worldwide, with those top destinations accounting for the lion's share of the more than 750,000 Indian students abroad that year.

Mr Chaudhry added, however, that the competitive field is expanding quickly. "There are new countries that are emerging…Malaysia has emerged very strongly in the last couple of years. Ireland has been growing very fast. I would say the marketing spend by other countries is far more than [traditional leaders] at this point."

It is well understood as well that the market can be very volatile, with the capacity for very rapid growth but also for abrupt changes in destination preferences, especially in relation to changing policies around post-study work or settlement options. This pattern is revealed in the following chart which shows recent year-over-year trends for some of the top study destinations for Indian students.

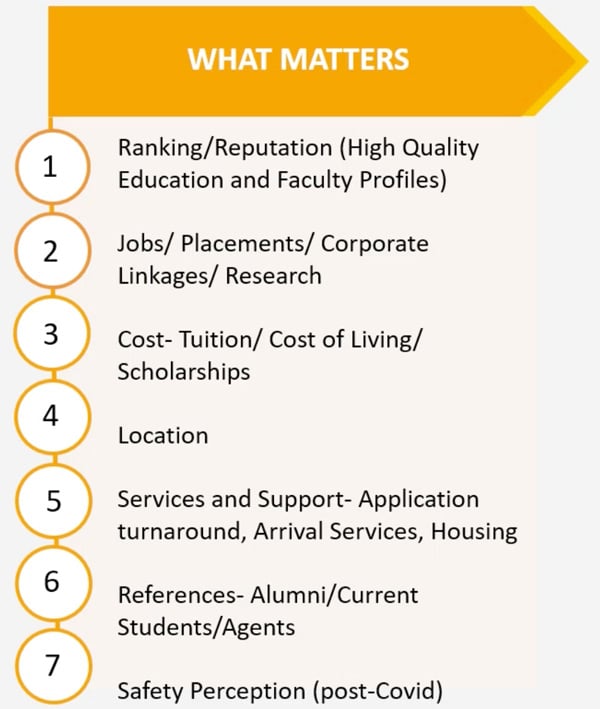

Expanding further on the very agile nature of the market, Mr Chaudhry also sets out some important points on key decision factors for Indian students, and suggested that some familiar marketing talking points, including features of campus life or the local area of a college or university, were given much less weight when compared to the points in the chart below.

"What does not matter in a country like India, [for example], is the kind of infrastructure the campus has or how many clubs there are on campus. The most important thing for a parent or student is the return on investment on their education. How many students are [employed after graduation] and what is their starting salary? You have to be able to answer those questions."

He pointed out as well that services and supports for students, including admissions processing and arrival services, are also an important aspect of competitive advantage for institutions and schools, as are referrals from alumni or current students.

The outlook for 2021

India is currently going through its second wave of COVID-19. IDP Connect Client Director Luna Das explained, however, that the economy is beginning to come back, schools are operating – albeit online – and exams have been completed on schedule. Major higher education entrance exams are expected to go ahead as scheduled in September.

Drawing on IDP Connect query and survey data, Ms Das highlighted a growing acceptance among Indian students for blended delivery models – that is, for programmes that begin online and then transition to face-to-face study. But she stressed as well the importance of ensuring that students are well supported by their institutions both before and during their studies, whether online or otherwise. "It is important to have strong support systems in place," she explained, "because students need a lot of support at this point in time." The overarching finding in the IDP research is that students are increasingly prepared to begin their studies abroad despite continuing uncertainty around online versus in-person study, quarantine provisions, etc.

Given all that, Ms Das strongly recommends that recruiting institutions "step up your communications strategies with an omnichannel presence" that can reach students, parents, and other stakeholders frequently and reliably. She added as well that, as part of that effort, transparency and support around arrival procedures and quarantine requirements are also key.

Her recommendations strongly echo other expert advice and survey findings this year which all point to the reality that prospective and incoming students need a great deal more support and communication during COVID. Those institutions and schools that execute well on those points can clearly establish an advantage in an increasingly competitive market.

For additional background, please see: