Agent perceptions of study abroad destinations changing as the pandemic continues

- A recent survey shows that practical considerations have become more important to agents since the spring – specifically whether a country’s borders are open and whether a country has helpful visa policies enabling international students to study there

- The UK improved the most in terms of how agents perceived it in September versus May

- Australia, Canada, and New Zealand have lost some ground, while the US continues to be the least well perceived on a number of measures

- ICEF research also suggests that a country’s border policies affecting international students will be a top determinant of agents’ recommendations to students in 2021

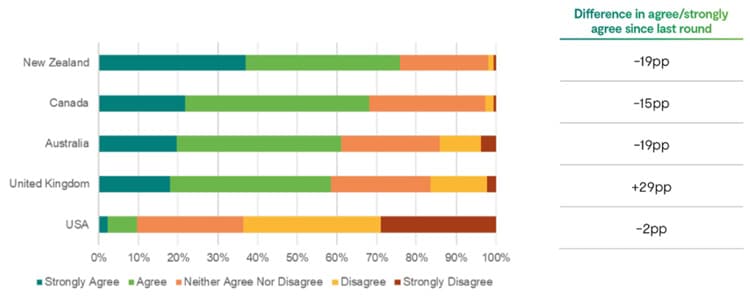

Navitas has conducted two studies in 2020 – one in May and one in September – gauging the degree to which the attractiveness of a study abroad destination is affected by agents’ perceptions of how well that country’s government is handling the pandemic. The September survey shows that agent perceptions have changed significantly over the course of the year towards the following destinations: Australia, Canada, New Zealand, the UK, and the US.

Of the five destinations, the UK has become much more attractive in agents’ eyes. It also appears that agents are now less influenced by a government’s perceived handling of the pandemic when they think of the attractiveness of a destination than they were in May, and more influenced by other factors.

The May survey included responses from nearly 400 agents in 63 countries, while the September survey was conducted among almost 300 education agents in 54 countries.

The UK has become more attractive over the year

Among leading destinations, the UK has gained the most ground since May in terms of agent perceptions. The percentage of agents saying that the UK government has handled the pandemic well went up by 29 percentage points in September – making the UK the only country whose reviews improved on this measure. As Navitas notes, however, “the agent survey was in the field in September prior to the more recent escalation in COVID-19 cases in the UK and on university campuses in particular.”

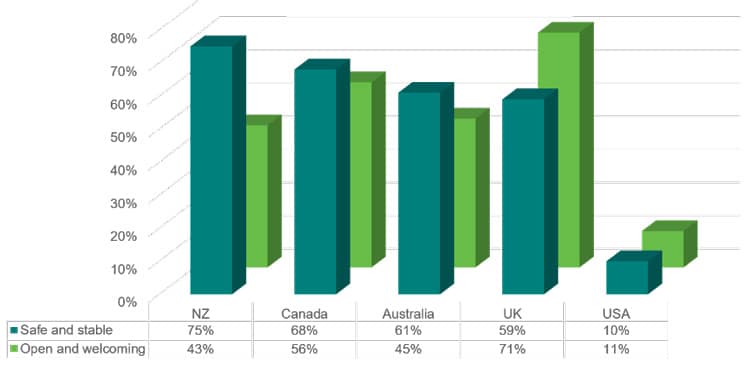

Navitas believes that the UK fared relatively well in the September survey largely due to agents’ belief that it has become much more “open and welcoming” than the rest of the destinations. Interestingly, as you can see from the graph below, the UK comes second to last in terms of its reputation as “safe and stable” but is much ahead of the other destinations when it comes to perceptions that it is “open and welcoming.”

The UK government’s significant efforts to ease travel restrictions over the summer and to jumpstart visa processing may be the main determinants of the UK’s better image in September than in May. The government also introduced new flexibility for short-term visas earlier this year.

For agents who’ve weathered an exceedingly difficult year because of stalled student mobility, such measures are most appreciated, to say the least. When they see a country working hard to welcome international students and improve visa handling, agents are not surprisingly impressed in a global context where several destinations’ borders are closed (e.g., Australia, New Zealand, and China).

Navitas says,

“For agents, a country’s reputation as being ‘open and welcoming’ is currently more important than its reputation as being ‘safe and stable’ when it comes to its attractiveness as a study destination.”

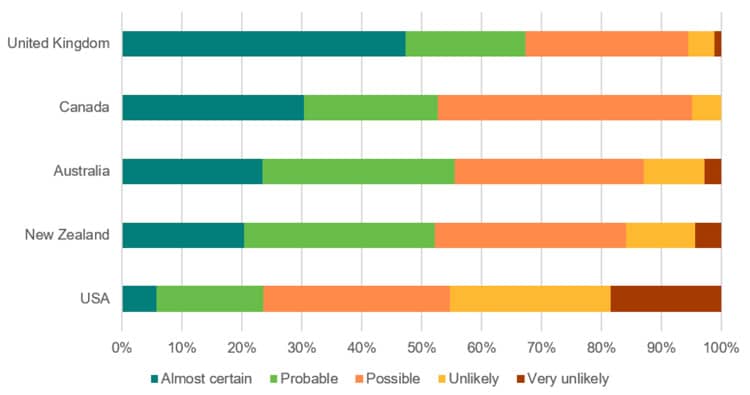

Navitas adds that agents’ sense of how able they will be to send students to a given destination in 2021 will influence their advice to students:

“Agent expectations around this will inform their advice to students looking to commence/re-commence studies, and as such, have the potential to significantly influence the flow of students in the short to medium term.”

Currently, agents view the UK as the most accessible education destination of the five. Nearly half of agents said in September that they are almost certain that they will be able to send students to the UK in 2021.

Explaining changing perceptions

Like it or not, we’re all becoming used to the pandemic. It’s been going on for months and it will continue to affect us for some time. As a result, the Navitas findings suggest that outbreaks in a given country and/or how a government is responding to the COVID crisis are becoming less important – as influencers of agent perceptions – than (1) typical pre-pandemic determinants (e.g., quality of education, programme reputation) and 2) sheer need to be able to get students from their country to a destination country. Specifically, Navitas believes the following four reasons are at the core of why agents are less influenced by governments’ response to the pandemic:

- Differences in performance between countries has moderated, especially as each country faces the challenges of sporadic outbreaks and second or third waves.

- Strong performers have become less distinctive as more and more countries find mixed results (be it health, social or political) in attempts to get the virus under control.

- Pre-COVID fundamentals that drive destination attractiveness start to reassert and influence destination decisions.

- Openness and ability to access the study destination becomes an over-riding short term concern.

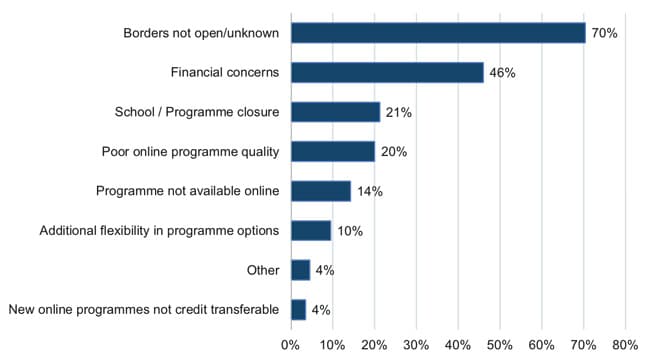

Closed borders are the main concern for agents

Findings from an ICEF Agent Voice survey conducted in August through October among 721 respondents reinforced the Navitas research on the importance of a country’s perceived openness. Borders not being open was cited by 70% of agents as the top challenge for students, with 46% saying financial concerns are the most challenging.

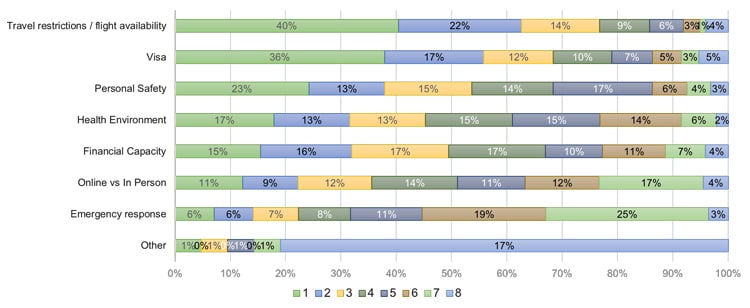

Similarly, agents say that travel restrictions and flight ability will be the main factors influencing where students will study abroad going forward.

Vaccines and the road ahead in 2021

It would be interesting to see a future survey question assessing the relationship between a country’s having a vaccination programme underway and that country’s attractiveness. The fact that the UK is the first to begin inoculations could conceivably help its image among agents desperate – like all of us – for COVID to be over. As Benjamin Mueller writes in the New York Times about the psychological response of those being vaccinated,

“For the first recipients, among them older Britons and hundreds of doctors and nurses who pulled the National Health Service through the pandemic, the shots offered a glimpse at life after Covid-19, replete with plans for rescheduled wedding anniversaries and bus trips to the seaside.”

On top of wedding anniversaries and seaside excursions, vaccines have the potential to be a catalyst for renewed international student mobility – a fact that will certainly not be lost on agents and students. Whether the US having similar access to significant quantities of vaccines will help its image among agents remains to be seen; currently the US is viewed as the least safe and stable and the least open and welcoming of the five destinations.

At the end of the day, it will not be how many doses of a vaccine are available, but rather how well a vaccination programme rolled out and how much it protected a population that will matter.

Until then, agents are apparently becoming more pragmatic in the advice they give to students wanting to study abroad. With the understanding that COVID will remain a risk for months to come and that despite this, students still want to study abroad and carry on with their lives, agents will be looking closely at border policies, visa and immigration policies, and the quality and availability of desired programmes when deciding what to recommend to students.

For additional background, please see: