Updated world travel outlook anticipates recovery will start in 2021

- The UNWTO projects that global travel will decline by 70% this year

- Most industry experts project that recovery will begin in the second half of 2021, with the global travel industry regaining 2019 booking volumes by 2023

The latest impact figures from the United Nations World Tourism Organisation (UNWTO) show that international tourist arrivals declined 70% in the first eight months of 2020 compared to the same period last year, amid continuing travel restrictions that have closed borders around the world during the pandemic.

The UNWTO reports that international arrivals fell by 81% in July and 79% in August, at the peak of the summer travel season in the Northern Hemisphere. That those numbers were not worse still – year-over-year declines earlier in the year reached 90% – is only because some borders had reopened over summer, notably in Europe. "The recovery was short-lived however, as travel restrictions and advisories were reintroduced amid an increase in contagions," adds UNWTO. "On the other side of the spectrum, Asia and the Pacific recorded the largest declines with -96% in both months, reflecting the closure of borders in China and other major destinations in the region."

All told, this amounts to 700 million fewer international arrivals year-to-date for 2020, and a loss of roughly US$730 billion in tourism revenues. UNWTO points out that this is more than eight times the industry losses in 2009 at the height of the global economic crisis. Analysts now expect that the overall decline in arrivals for 2020 will be close to 70%.

“This unprecedented decline is having dramatic social and economic consequences, and puts millions of jobs and businesses at risk,” warned UNWTO Secretary-General Zurab Pololikashvili. “This underlines the urgent need to safely restart tourism, in a timely and coordinated manner”.

Interestingly, there have been signs of tourism demand shifting to domestic travel in at least some major world markets over the last couple of months. In China, for example, the Ministry of Culture and Tourism reports 637 million domestic trips (representing about 80% of 2019 volumes) during the eight-day Golden Week holiday which began on 1 October. In Russia, domestic air bookings fully recovered to levels of 2019 and actually grew by 9% in August.

The big question

With a more complete picture of the true extent of COVID's impact on global travel, the question is increasingly when the industry can expect to begin to recover.

Based on projections by its Panel of Tourism Experts, UNWTO anticipates that the recovery in global tourism will begin in the third quarter of 2021. At least, that is the point at which a majority of the panel expects that recovery will be underway. Roughly one in five panelists (20%) believe the recovery won't start before 2022.

UNWTO adds that, "Most experts do not see a return to pre-pandemic 2019 levels happening before 2023. By regions, the largest share of experts pointing to a return to 2019 levels in 2023 or later are in Europe (74%) the Americas (71%) and Asia and the Pacific (66%). In Africa and the Middle East this share is 60% and 50% respectively."

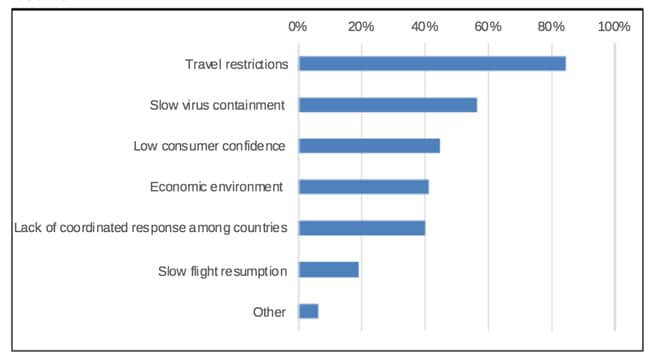

The main barrier to an earlier or more rapid recovery is the large-scale travel restrictions that remain in place in many destinations around the world. Alongside that, experts cite slow virus containment and declining consumer confidence as major factors that are hindering the recovery outlook.

For additional background, please see:

Most Recent

-

British Council says student recruitment to UK higher education will get a boost this year from South Asia and the “Trump effect” Read More

-

New Zealand expands post-study work opportunities for international students Read More

-

As Iran retaliates across the Middle East, schools close, students worry, and institutions reassess transnational education Read More