New survey updates ELT industry expectations for pandemic recovery

- A new global survey of schools, agencies, service providers, and associations in the English-language training sector finds little hope for a significant recovery for the industry before summer 2021

- Only half of survey respondents say that they have sufficient cash to keep their business running for the next six months without government support or other adjustments

- Opinion was split as to whether a vaccine would be ready in 2021

The Association of Language Travel Organisations (ALTO) has released the results of its Q4 2020 Pulse Survey, which provides new insights on when agents and schools think their industry will recover from pandemic-related losses. The survey also sheds light on the financial stability of survey participants at this point in the crisis. One hundred and thirty agents, 92 language schools, nine associations, and six service providers across five global regions participated in the Q4 survey.

Recovery not expected for months

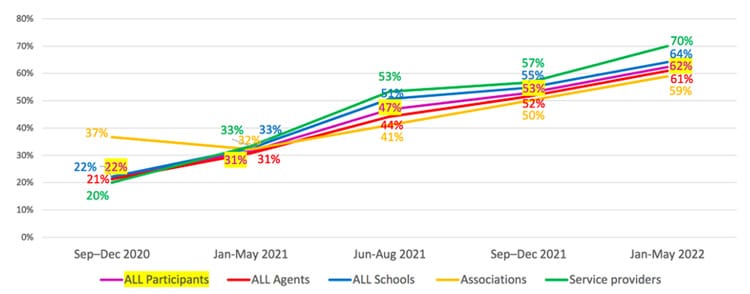

As the following chart indicates, respondents expect to recover to roughly half of 2019 volumes only in June-August 2021. A more fulsome but still incomplete recovery, where bookings and revenue would return to 60–70% of 2019 levels, is not expected to happen until early 2022. This finding represents a less optimistic outlook than what ALTO found in a previous survey, when respondents expected, on average, that business would reach 62% of 2019 levels by the end of 2021. That survey did not have the same sample as the Q4 2020 pulse survey but we can still observe that the industry is now bracing for a longer recovery than previously expected.

Cash reserves vary

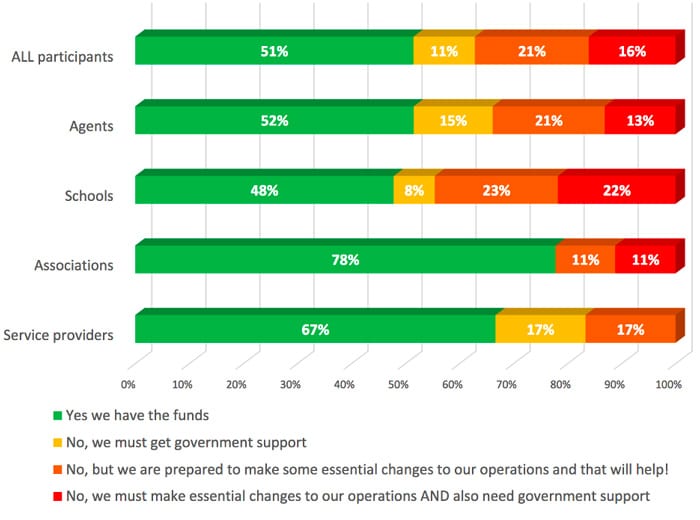

All respondents believe that it will take many months for their industry to recover, but not all say they have sufficient access to cash to sustain operations for the next six months. Across the global sample, half (51%) of respondents said they have enough cash for that time frame, with schools the least likely (48%) to say they can rely on their own reserves and associations the most likely (78%). The chart below shows also that there is significant willingness to alter operations to be able to survive the pandemic’s effects.

Schools are much more likely to have sufficient funds in Germany (75%), Ireland (67%), and to a lesser extent, the US (54%). By contrast, only 33% of ELT schools in Canada and 38% in Malta say they have sufficient cash to self-finance for the next six months; in South Africa, only 14% do. Canadian schools are also notable for the high proportion saying they need to make essential changes to their operations and also need government support (50%); by contrast, only 13% of schools in Germany said the same.

Among agents, those in Asia were far more likely to have enough reserves to last the next six months (73%, compared with a global average of 52%). The next most likely to have sufficient funds were agents in Latin America (55%), followed by agents in Turkey and MENA (44%) and then those in Europe and Russia (41%).

Casualties within the sector

ALTO reports that 5% of the survey sample said that there had been COVID-19-related deaths in their organisation or among their students. ALTO’s statement on this finding reads as follows,

“We are very sorry for your loss. It highlights the fact that behind the restrictions, the economic setback and many privileges of life we lost in the last 8 months, there are casualties and grieving families in the background.”

Waiting for a vaccine

Not surprisingly, only 5% of surveyed schools, agencies, associations, and service providers expressed hope that a vaccine for COVID-19 would be available this year. Almost half expect it to be available in the first half of 2021 and the remainder think that we’ll have to wait until the second half of 2021 or even into 2022.

For additional background, please see: