British ELT numbers down 82% due to COVID

- A new survey of English UK members finds that, on average, centres are reporting an 82% decline in student weeks booked through Q3 of 2020

- This projects out to a direct revenue loss of more than £510 million for the country’s ELT sector

- Most survey respondents do not anticipate a full recovery to pre-pandemic enrolment levels before 2022

A new study from English UK highlights the severe impact that the pandemic has had on the country’s ELT sector this year. The study, which was prepared by industry research specialists BONARD, relies on survey responses from 145 reporting centres (representing 43% of all ELT enrolments in the UK) which were then extrapolated to the entire English UK membership.

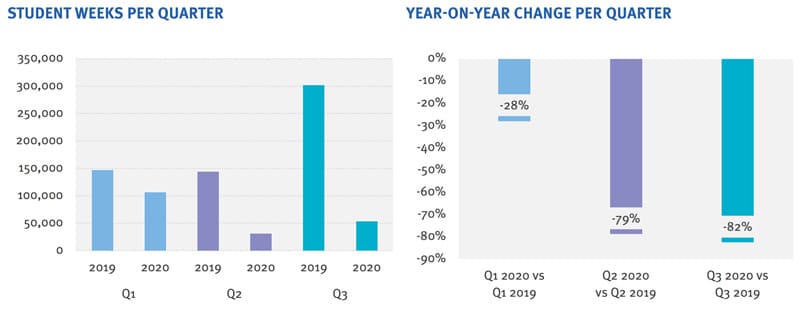

On average, responding centres reported enrolment declines of 82% for the first three quarters of 2020 as compared to the same period in 2019. The following charts highlight the quarter-by-quarter decreases reported by English UK members.

The Q3 indicators above are the most significant, not only in the proportionate decline indicated here but also because that period corresponds to the peak summer season. Compared with the 301,631 weeks delivered in Q3 2019, responding member centres anticipate providing a total of just over 53,000 student weeks in 2020 (a collective decline of roughly 250,000 student weeks). Projected over the entire English UK membership, this would suggest a total drop for Q3 2020 alone of more than 500,000 student weeks.

“The impact of COVID-19 on the UK ELT industry has been unprecedented,” notes the study, “and the findings of this survey show a dramatic fall in business…Prior to the COVID-19 outbreak, the UK ELT sector was relatively well positioned for further growth – the 2019 Student Statistics Report showed that the market had increased by 1% on 2018 in terms of student numbers – a third consecutive increase since 2017.”

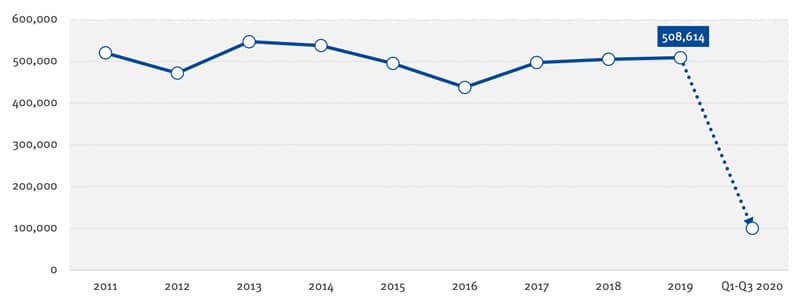

This pattern is reflected in the following summary of total student enrolments in British ELT centres from 2011 to 2019, and then for the first three quarters of this year.

The sharp decline in student numbers reflected here equates to a projected direct revenue loss of more than £510 million across the English UK membership.

Not surprisingly, most survey participants expect little recovery over the balance of this year. The outlook for 2021 and after is more optimistic with most respondents (43%) anticipating the market to regain up to 60% of its pre-pandemic volume during 2021. Another 31% expect recovery up to 40% of pre-COVID enrolments.

The outlook is stronger into 2022 with nearly half (47%) anticipating an 80% recovery, and another 31% a full recovery (to pre-COVID levels) by that point.

"These findings suggest that it might take years for the sector to fully recover," concludes the study, "depending on the COVID-19 metrics in the UK and source countries, the availability of travel connections and the confidence of parents and students in the measures taken by the sector to keep them safe. The under-18 segment, which comprises 54% of all international English language learners in the UK, is more prone to these external factors and thus expected to recover later than the adult segment."

The study highlights as well that government support will be critical to the sector's recovery as will close coordination and information sharing among all stakeholders.

For additional background, please see: