Agent and school survey projects recovery trends for language travel through 2021

- Most respondents to a new global survey anticipate a longer-term recovery for the language travel sector, with business volumes projected to reach roughly two-thirds of pre-COVID enrolments by the end of 2021

- Agents and schools also expect that recovery will hinge on related policy in major destinations, easing of travel restrictions, and availability of international flights

A new survey commissioned by the Association of Language Travel Organisations (ALTO) provides a snapshot of industry expectations as to how student mobility for language study may resume through the rest of 2020 and into 2021. The survey draws on a sample of 246 agents and 111 language schools across five global regions.

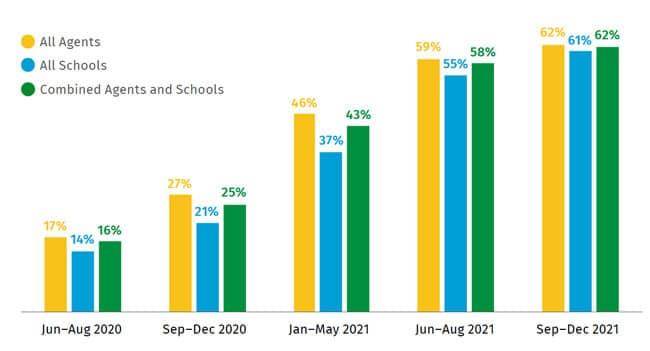

As the following chart reflects, responding agencies and schools expect that, on average, bookings in June through August 2020 will amount to 16% of 2019's enrolment. This forecast volume increases quarter by quarter through 2020 and 2021, with respondents expecting, on average, that business will reach 62% of 2019 levels by the end of 2021.

Commenting only on agent respondents, ALTO notes that, "Agents in all regions expect less than 1/3 of their 2019 bookings from September to December, around 50% from January to May, 60% for summer 2021, and between 50% and approximately 62% for September – December 2021. Of the regions, LATAM is the most optimistic, followed by Brasil, with Asia predicting the lowest percentage return of business." Indeed, there are marked differences in the expected pace of recovery among agents in different regions. Where Latin American agencies (the most optimistic respondents) expected business to recover to 50% of pre-COVID levels by January–May 2021, Asian agents (who offered the most pessimistic outlook) projected only a 38% recovery by that point. And where Latin American agents expected business volumes to reach 71% of pre-COVID enrolments for the period September–December 2021, their Asian counterparts forecast only a 53% recovery at end of year.

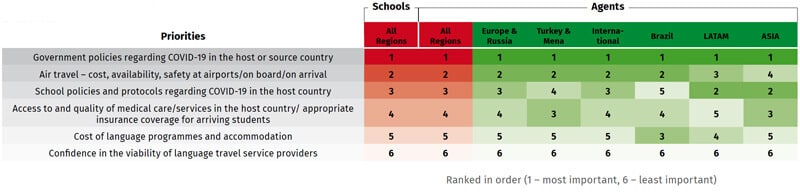

The survey also asked agents and schools to rank a number of issues in terms of their impact on student travel, and those results are summarised in the following graphic.

As the table reflects, there was a high degree of agreement between schools and agents in terms of which issues(s) would have the greatest impact on student mobility. As one agent with offices in Turkey and MENA put it, "Opening time for borders, visa processing times, and quarantine measures will have impact on country preference.”

Picking up on that sentiment, respondents were also asked to indicate which destinations would be the most popular for post-COVID travel. As ALTO puts it, "Participants commented that their decisions were affected foremost by the government policy of the host country, air travel and access to quality medical care and the host schools' COVID policy." While destination rankings varied somewhat by global region, "Canada, New Zealand and Australia are consistently in the top three globally."

There is also a suggestion in the findings of a need for new financial models and types of cooperation between agents and schools. Most respondents reported large amounts of outstanding receivables. For agents, this refers to either course fees owed by students or unpaid commissions from schools, and, for schools, unpaid course and accommodation fees.

"The financial systems currently in place would benefit from change," says ALTO, "starting with how payment timings are managed, refunds and credits, and how the industry as a whole deals with commission, market discounts, market contribution and general cost of sale."

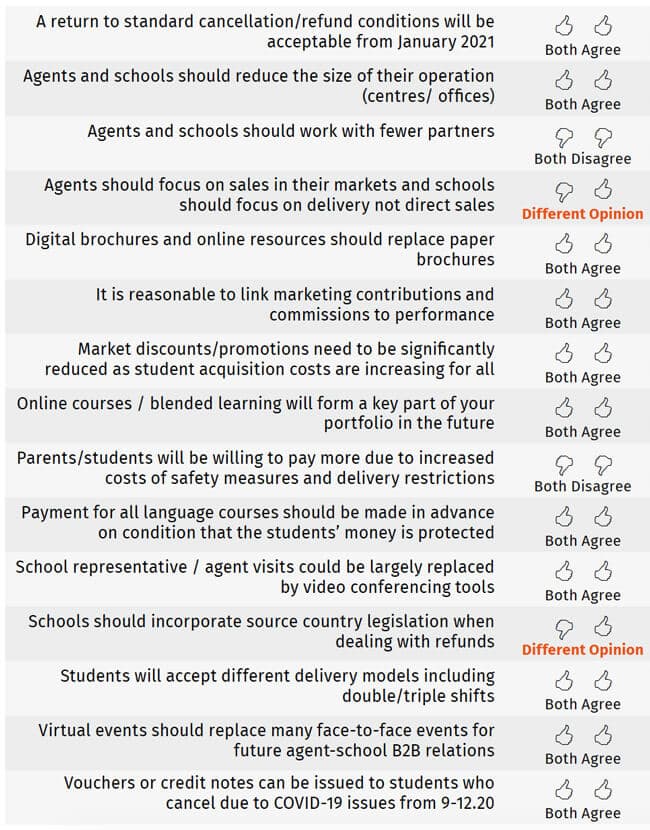

Finally, ALTO asked schools and agents to indicate their level of agreement with respect to "questions which commonly divide schools and agents and which have long been debated in our industry." The survey found that travel agents and schools were aligned on most questions. Both groups agreed, for example, that, "A return to standard cancellation/refund conditions will be acceptable from January 2021."

Other than that, responding schools and agencies also agreed that "It is reasonable to link marketing contributions and commissions to performance," and "Market discounts/promotions need to be significantly reduced as student acquisition costs are increasing for all." A summary of agent and school response across the range of "key statements" appears below, with the ALTO report offering much more detail by respondent category and region.

ALTO concludes its commentary on the survey by noting, "In spite of the current climate there was room for optimism and evidence of an industry-wide desire to improve our practices and collaborate. It was also clear from participant comments that there is still an appetite for language travel and a global student body with a strong desire to study abroad. The results show us the key concerns of students – affordability, government response and policy, quarantine restrictions, safety of travel, and medical care in host countries."

For additional background, please see:

- "Looking ahead: Scenario planning and recovery forecasts for international education”

- "ICEF Exchange podcast: Reopening visa services for the ELT sectors in the UK, Ireland and Malta”

- "Canadian language schools push for government support for 'Study Safe Corridor'”

- "FELCA continues to advocate for voucher system as an alternative to refunds”

Most Recent

-

The surging demand for skills training in a rapidly changing global economy Read More

-

US issues corrected student visa data showing growth for 2024 while current trends point to an enrolment decline for 2025/26 Read More

-

Survey finds US institutions expanding agency engagement and focusing on new student markets Read More