Australia: ELICOS numbers holding stable into final quarter of 2019

The latest data from Australia’s Department of Education and Training (DET) reveals a consistently flat pattern for the country’s ELICOS sector (English Language Intensive Courses for Overseas Students) for year-to-date October 2019. Commencements grew by .9% compared to the same period for 2018, and overall enrolment edged up by 1.2% year-over-year.

There were some notable shifts among leading sending markets throughout the year with overall Chinese and Brazilian enrolments dropping off -11.1% and -8.1% respectively. Even so, China remains the leading sending market for Australia’s language schools, and Brazil continues as the third-largest sender.

In contrast, notable gains were recorded by India (+30.6% YTD October 2019), Colombia (+20.2%), Nepal (+38.3%), Mongolia (31.3%), and Saudi Arabia (+20.6%). Each of these source countries has a place among the top 15 sending markets for ELICOS providers, notably Colombia at #2 with nearly 16,000 students enrolled and India at #6 with just under 6,300 students.

A similar pattern plays out with respect to commencement figures through October 2019, where Colombia, India, and Mongolia each figure in boosting overall sector enrolment.

A related analysis from English Australia points out that, in terms of commencements, India is now the fifth-ranked source market (after only China, Colombia, Brazil, and Thailand), based in part on stronger growth performance from August 2019 onward. Conversely, Mongolia, whose year-over-year growth rate spiked above 40% in the first months of 2019 has cooled in the second half of the year. As English Australia notes, visa grants have played a big part in the slowdown. “Since July 2019, Mongolia has seen its offshore grant rate collapse, dropping nearly 30% to a low of 38% in October 2019. This includes a drop of 25% for onshore applications and a drop of 34% for offshore.”

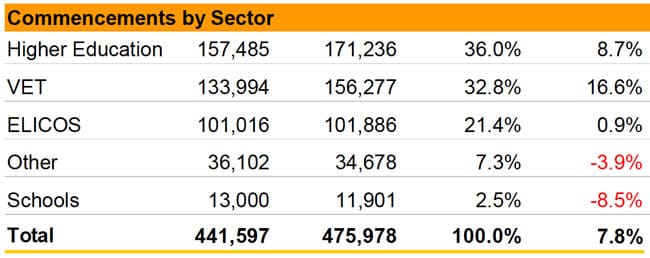

The marginal growth in ELICOS commencements can be compared to year-to-date performance for other education sectors as summarised in the following table.

As the table indicates, overall foreign enrolment growth continues to be driven by the higher education and VET sectors with all other areas either flat or declining compared to the same period in 2018.

The same DET update for October indicates that Australia’s continues to track to another year of double-digit growth overall with a total foreign enrolment of 738,107 through October 2019. This represents a 10% increase over the year before, and, if it holds for the rest of 2019, will lead to Australia’s third consecutive year of substantial growth.

This trend is likely to solidify Australia’s position as the second leading study destination globally, with only the United States welcoming more visiting students. Our analysis reveals that among the world’s largest host countries, only Canada (+73%) and Japan (62%) saw their respective foreign enrolments grow more quickly between 2014 and 2018. Australia’s enrolment grew +53% over that same period, but on a larger base as of 2014.

For additional background, please see: