ELT sector in the UK stable in summer 2019

From 2017 on, member centres of English UK have been invited to contribute their enrolment data to an optional student statistics scheme. Participating centres then become the “Quarterly Intelligence Cohort” (QUIC) and their data allows English UK to compare trends in the sector across quarters and from year to year.

According to the latest QUIC report, student weeks were up only marginally in Q3 2019 – (0.2%) compared with the same period in 2018 across the 132 centres that participated in both years of QUIC Q3 data gathering. This analysis is known as a “like-to-like” comparison.

But weeks were up by 5.7% in absolute terms, with student weeks rising from 396,783 in Q3 2018 to 419,368, as reported by the expanded number of centres participating in Q3 2019.

Those quarterly results are a significant indicator of sector performance for this year as the third quarter covers the key summer season from 1 July through 29 September.

Junior weeks increase, while adult weeks contract slightly

Juniors contributed the most growth in weeks, up by 1.3% over 2018 according to the “like-to-like” comparison. Around 75% of junior weeks were spent in summer camps, with another 17.5% spent in English for Academic Purposes programmes.

Adults booked -0.4% fewer weeks in Q3 2019, by contrast. Adults represent 60% of the total market for the QUIC centres and juniors 40%.

Top five markets now include Russia

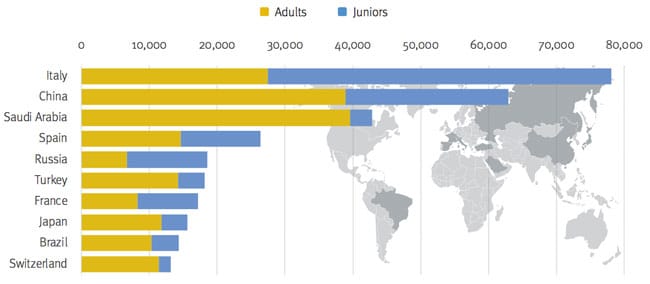

The top five markets for these centres remain Italy (responsible for almost one-fifth of all weeks reported), China, Saudi Arabia, Spain, and Russia; Russia replaced Turkey in this position in 2019.

Italy is particularly notable for the large proportion of junior students that it sends. China and Saudi Arabia, meanwhile, are the most important contributors in the adult market for UK English-language schools participating in QUIC.

Breaking it down according to market segments for UK ELT:

- Italy, China, Russia, Spain, and France are the top junior sending markets;

- Saudi Arabia, China, Italy, Spain, and Turkey are the top adult sending markets.

Student weeks were up in 58 source markets for the junior segment, and up in 51 for the adult segment.

Diversifying a must

Naturally, ELT providers in the UK are concerned about Brexit and how it will end up affecting their marketing and enrolments, especially given their heavy reliance on EU markets at the moment. Diversifying outside of these markets is crucial – both because of Brexit and for other reasons. Patrik Pavlacic, research director at Bonard, the market research firm that works with English UK on the QUIC data, said, “If was a school I would not diversify because of Brexit but because of the numbers. EU markets are in decline.” He offered this advice to English UK centres:

“Looking into the future, what are the countries that will help you offset those numbers, particularly in student weeks? It's very important to make sure the messaging is right and I also want to encourage you to leverage the market information you have at your hands – it's really critical to reassess multiple times in the year if you have right market and the right pricing and are always looking out for new opportunities. The world is a very dynamic place and doing it once a year is really dangerous."

Students from within the EU accounted for 57% of enrolments in the ELT sector in Britain last year – which amounts to nearly 290,000 students – and 37% of all student weeks booked.

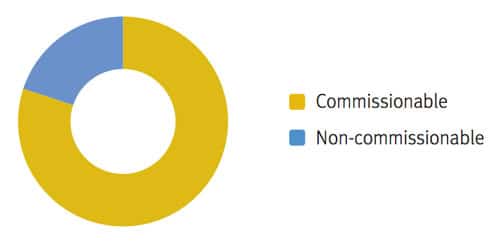

Agents responsible for most bookings

Four in five student weeks were booked through an education agent. Agents are widely used across the international education industry in the UK, and recent research has found that in another major English-language destination, 86% of enrolments in the English-language training sector come through agents.

For additional background, please see: