Public sector providers an important driver of Canadian language programme growth for 2018

Newly released data reveals that enrolment in Canada’s language programmes grew by 6% from 2017 to 2018, with Canadian language schools booking a 2% increase in student weeks over the same period. This continues the upward trend, albeit at a slower pace, from 2017 when Canadian programmes reported double-digit enrolment growth (10.3%) and a 7% increase in student weeks.

These are some of the headline findings from the newly released 2018 Annual Report on Language Education in Canada, an annual survey commissioned by Languages Canada and produced for the first time this year by the independent market research firm Bonard.

This year’s survey factors responses from the entire Languages Canada membership of 214 public-sector and private language centres across the country. It also includes data from a further 30 non-member programmes, meaning that the survey reflects data for just under 70% of the 352 language centres operating in Canada in 2018. Bonard estimates that 88% of all foreign language students in Canada were enrolled with Languages Canada members last year.

The 244 respondents to this year’s survey reported a total enrolment of 166,847 students and 1.66 million student weeks for 2018. As this was the first year in which non-Languages Canada members were included in the survey, the 6% increase in enrolment and 2% growth in student weeks noted above relies on a members-only comparison between 2017 and 2018.

Drilling down into the numbers, the annual report observes contrasting trends for public and private-sector programmes (where the former refers largely to programmes based on university or college campuses). “Growth was driven by public sector providers,” says the report, “who experienced a 21% year-on-year increase in student numbers. Meanwhile, student weeks rose by 13%. Private sector programmes welcomed 2% more language students, yet the volume of student weeks dropped by 2%.”

“It is hard to identify any one particular factor at play,” adds Languages Canada Executive Director Gonzalo Peralta, in commenting on relative performance of campus-based language centres. “However, public-sector programmes have been working very hard at increasing capacity and, in some markets, such as China, it has been easier to obtain visas for students attending public-sector programmes. IRCC’s Student Direct Stream programme has also strongly benefited Canadian public-sector colleges.”

Key sending markets

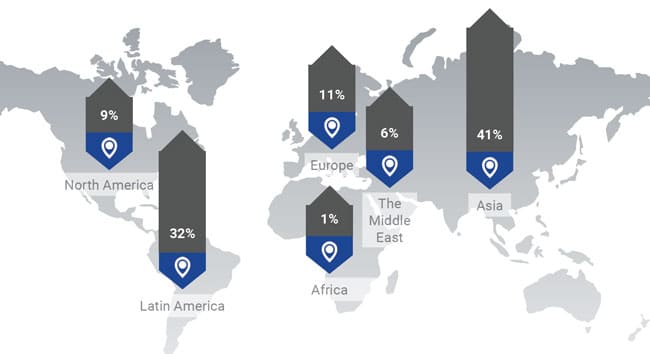

Asia remains the key sending region for Canadian providers, accounting for just over four in ten enrolments in 2018 (41%). However, Latin America registers strongly as the second-largest sending region with nearly a third (32%) of all language students in Canada last year.

As the following table illustrates, most of the top sending countries for Canadian language programmes grew between 2017 and 2018, with particularly notable growth from key Latin markets and also from Vietnam.

“It is hard to pinpoint one single reason,” says Mr Peralta in remarking on the continued growth from Brazil, Mexico, and Colombia. “But probably the strongest is the geopolitical factor. Changes to visa requirements for Mexico certainly help. And Languages Canada has a strong presence in all three markets that we have cultivated for years, especially Brazil and Mexico with Colombia being more recent.”

Mr Peralta adds that the June 2018 expansion of the Student Direct Stream in Vietnam was the major factor behind the dramatic increase in Vietnamese enrolments last year. “When you look at the further breakdown, a huge percentage of these students are in public college programmes, and are in the language course as a preparation for further post-secondary studies.”

Recruitment channels and pathways

Responding centres indicated that nearly six in ten bookings (58%) were made via education agents in 2018, with a further 21% of students booking directly.

Nearly half of all enrolments (46%) were for programmes of between 4 and 12 weeks, with an average stay of 10.5 weeks. Perhaps not surprisingly, most students enter Canada on a visitor visa to begin their language studies. Only one in four enter on a study permit (student visa), and those students were largely concentrated in public-sector programmes.

In a similar vein, nearly three in ten (29%) of all students were pursuing language courses in preparation for post-secondary studies in Canada.

In terms of global market position, Canada was the fourth most-popular English language travel destination in 2018 (after the UK, the USA, and Australia) and the second most-popular destination for French-language study (after France).

For additional background, please see: