Non-EU applications to UK universities up this year

The UK application registry UCAS has released new data from its 15 January admissions deadline for the 2019/20 academic year, and so we now have an early view of what enrolment trends may look like for the coming year. “On time” applications received by January 15 are viewed as an important indicator of current demand for British higher education, though students continue to apply after the deadline as well.

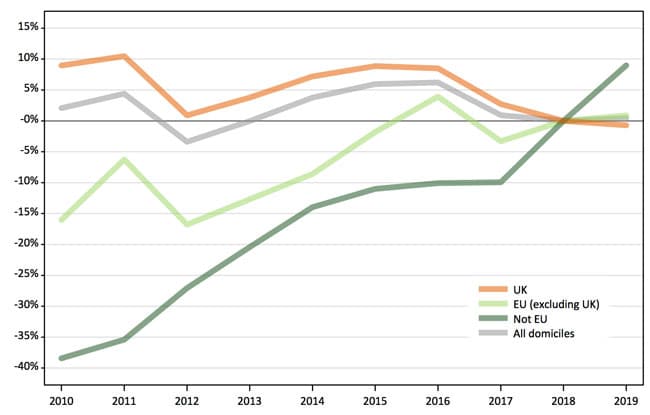

Applications to British universities for 2019/20 are up overall, and this marks the first overall increase in three years. More than 561,400 applications were received by UCAS, nearly 2,500 more than at the same time last year.

While the overall growth for this year is marginal, it is being led by a 9% increase in applications from students from outside the European Union. This was driven in large part by a surge from China (+33% over 2018). Looking at the broader pool of applications, there was a 1% decrease in the number of applications from students in the UK, and applications from countries in the EU were up slightly by 1%.

“It is a shame that we are so dependent on one country for our international students … as I would like to see similar growth from other territories too. But I welcome the growth and I also think it will provide the UK with some real soft power benefits in the future, when these people graduate and go back to China with experience here on their CV.”

Needless to say, the same concern could be raised of many leading study destinations, including the US, Australia, and Canada. But in one interesting indication of the significance of China in British higher education enrolments, UCAS observes that there were more applications from China and Hong Kong this year (20,980 combined) than there were from Wales (18,850) or Northern Ireland (17,910).

Comparing to 2018/19 data

At last year’s 15 January deadline, there were 11% more applications from non-EU students than the previous year, marking the first time in five years that applications had gone up from non-EU students. Non-EU applications numbered 58,450 in 2018/19, while this year, there were 63,690 from students from outside the EU, which amounts to 9% year-over-year growth. Where applications from EU students had dipped in 2017/18, they rose to 43,501 (3.4%) in 2018/19. The latest UCAS data reveals that the growth trend is holding, though modestly so: EU applications grew 1% to 43,890. UCAS registered 453,840 applications from the UK this year, which represents a decrease of just under 1% compared to the applications received in January 2018.

Country-level trends

While China is the big story in terms of the overall increase in applications volume this year, there were also notable gains from the following important sending markets:

- Canada: +3%

- France: +5%

- India: +5%

- Italy: +2%

- Malaysia: +4%

- Nigeria: +10%

- Spain: +7%

- US: +5%

There were also significant increases from countries sending smaller numbers of students to UK universities. While these are more modest numbers, the extent of the growth is notable given the push for greater diversification of the international student population in the UK. For additional background, please see: