US ELT numbers continue downward trend

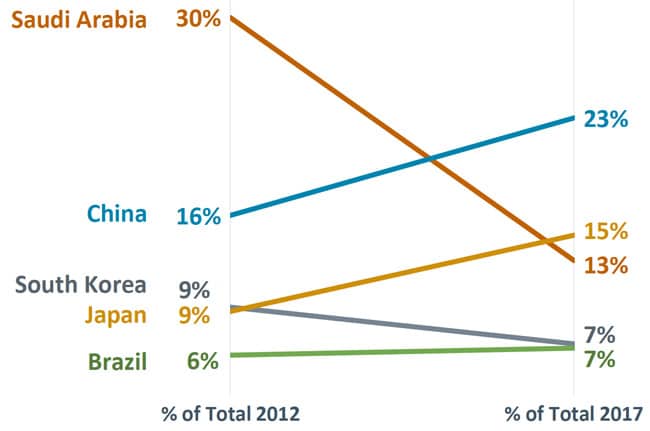

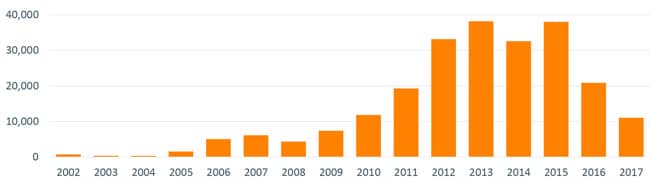

The effect of dramatic reductions in government-sponsored language students – notably those from Saudi Arabia and Brazil – continues to felt among Intensive English Programmes (IEP) in the US. The latest enrolment survey data highlights another year of sharp enrolment declines in 2017 with a majority of centres anticipating further reductions through 2018.

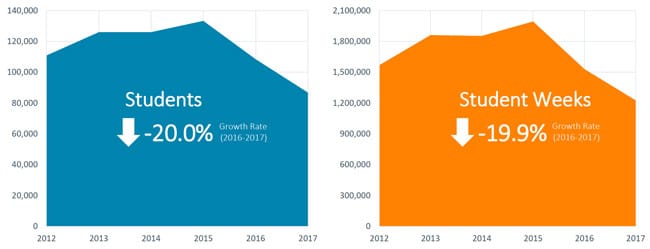

The Institute of International Education’s annual Intensive English Programme Survey was released last week. Drawing on reporting from 424 higher education institution-affiliated and independent IEPs throughout the US, it finds a 20% reduction in ELT enrolments from 2016 and 2017, and a corresponding 20% drop in student weeks over the same period.

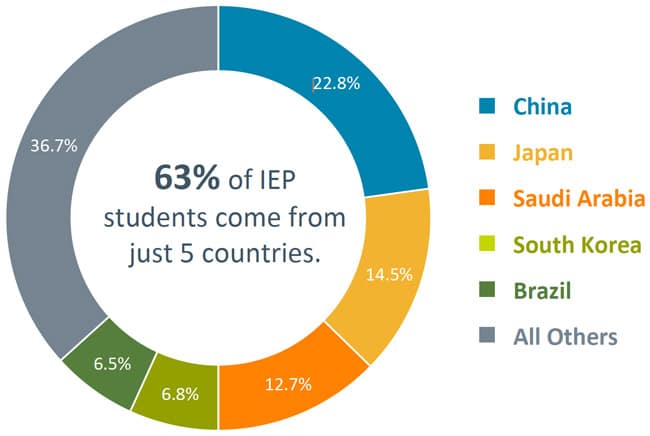

- China (19,756 students, 22.8% of total)

- Japan (12,607, 14.5%)

- Saudi Arabia (11,059, 12.7%)

- South Korea (5,903, 6.8%)

- Brazil (5,650, 6.5%)

- Taiwan (3,093, 3.6%)

- Kuwait (2,497, 2.9%)

- Vietnam (2,187, 2.5%)

- Colombia (1,917, 2.2%)

- Mexico (1,780, 2.1%)

As this summary indicates, nearly two-thirds of all IEP students in the US came from the top five sending markets.

Outlook for 2018

Also released last week, a new flash survey of English USA members finds that six in ten reporting IEP centres recorded further enrolment declines as of spring 2018. Nearly half expect to see some additional reduction in student numbers during the key summer season, and more than a third (35%) are projecting decreased enrolment for fall 2018 as well. When asked to indicate the primary factors for this downward trend, responding centres (representing roughly a third of the total English USA member base) cited the following:

- US political climate

- Decreasing numbers of government-sponsored students

- Erosion of enrolment at lower levels of English study

- Increased competition from language programmes overseas

- Increasing safety concerns

- Exchange rate for the US dollar

The English USA member survey also reinforces that IEPs across the US are taking a number of steps to counter these challenging enrolment trends, ranging from programme or staff restructuring to the introduction of new study options and increased investment in recruitment marketing. For additional background, please see: