Australia takes its double-digit growth into final quarter of 2017

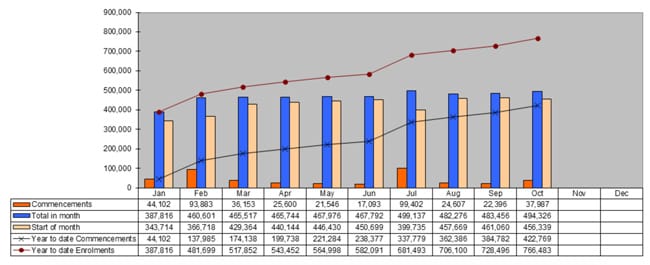

The latest data out of Australia shows continuing growth in international enrolment into the final quarter of the year. The Department of Education and Training (DET) numbers for year-to-date October 2017 show overall enrolment growth of 13%, with just over 11% growth in commencements.

This is slightly off the pace that Australia had established earlier this year, but still puts the country on track for another solid year of double-digit growth.

DET reports total foreign enrolment of 766,483 students YTD October 2017. This compares to just under 680,000 international students in Australia for the same period in 2016.

As the following chart reflects, total commencements, meanwhile, reached nearly 423,000 through October 2017, compared to just over 380,000 the year before.

The diversity question

In spite of this very positive growth picture, the composition of Australia’s foreign enrolment this year will again raise questions about the sustainability of current growth rates as well as the country’s reliance on a relatively small field of key sending markets. Needless to say, this is a challenge facing many leading study destinations. But in Australia we see that the top ten source markets account for roughly seven in ten foreign students in the country. The top five senders are responsible for more than half (53%) of all international enrolments, and the top two – China and India – account for 40% all by themselves. The same pattern plays out in terms of commencements, where China and India remain the leading source of new foreign students in Australia and where the two countries combined account for about half of all commencement growth through October. Australian providers are clearly working hard to diversify enrolments, particularly via important growth markets in Asia and Latin America, including Vietnam, Nepal, Brazil, and Colombia. But even so the country’s current heavy reliance on China and India will likely remain an element of risk in the overall enrolment picture for Australia for the foreseeable future. And as Australia’s international numbers continue to grow, the stakes are ever higher in this respect. As we noted recently, the Australian Bureau of Statistics has calculated the value of the country’s education exports to be AUS$28.6 billion (US$22 billion) for 2016/17. This places education as the third-largest export sector for Australia, and ABS calculates that international education now supports 130,000 jobs throughout the country. For additional background, please see:

Most Recent

-

British Council says student recruitment to UK higher education will get a boost this year from South Asia and the “Trump effect” Read More

-

New Zealand expands post-study work opportunities for international students Read More

-

As Iran retaliates across the Middle East, schools close, students worry, and institutions reassess transnational education Read More