Global investment in student housing reaches new heights

- The availability of suitable student housing looms large for many study destinations

- The sector is now drawing significant private sector investment

- Large investors and/or multinational housing providers are moving quickly to address the opportunity of the undersupply in student housing

Most study destinations don’t have enough purpose-built student housing (PBSH) to go around, or at least not sufficient beds to keep pace with growing enrolments. Earlier this year, the Irish government announced a National Student Accommodation Strategy in a bid to create tens of thousands of new beds through 2024, and to address a long-standing shortage of student housing in the country in the process. PBSH beds have also historically been in short supply in Australia, a challenge that has helped push up housing costs in that leading destination. Within the past year, however, private providers have increased the stock of PSBH beds they offer by more than 50%. And in the US, new providers are introducing premium PBSH housing properties to a market that has traditionally relied on shared dormitory rooms.

This persistent supply-demand gap in purpose-built student housing is increasingly attracting large private investors that see an opportunity for above-market returns. And as we first observed a couple of years ago, it has also given rise to a growing field of multinational housing providers that are further helping to spur private investment in student housing on-campus and off, and both independently and in partnership with institutions.

A new report from global real estate services firm Savills highlights that global investment in student housing reached a record-high US$16 billion in 2016, up from less than US$8 billion only two years before. “Institutional investors, sovereign wealth and pension funds snapped up portfolios in a global search for scale and income producing investments,” says the report. “Activity was focused on the US and UK; the most mature global markets where the majority of investable stock is found. Viewed by investors as a residential asset, the sector is maturing fast in mainland Europe.”

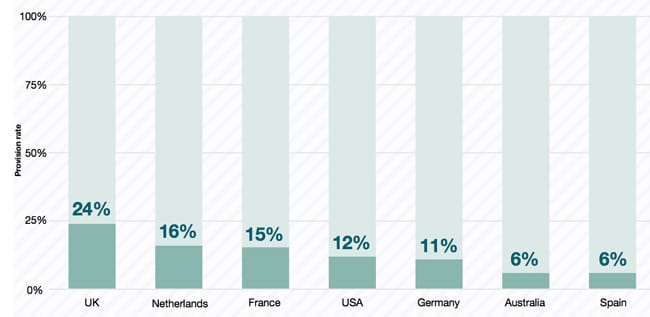

Even so, and as the following chart reflects, student housing stock is limited in many study destinations, particularly in relation to total tertiary enrolment.

Student wish list

Related data from Student.com indicates that students prefer private accommodations (as opposed to a shared room) with some communal spaces within the housing facility, including social spaces, gyms, and entertainment lounges. Students also prefer a suitable study space, separate from the bedroom, and to live as close to campus as possible. The Savills report finds generally that as the study abroad market continues to mature, students are more demanding in terms of housing, but are also increasingly prepared to pay for additional amenities and services within the student housing.

Of course, most institutions or schools provide their own campus or near-to-campus accommodations, but Savills argues that many lack the funds or expertise to bring this housing up to the standards that students expect today. And this, notes the report, “opens up opportunities for [joint ventures] and partnering arrangements with private sector operators.”

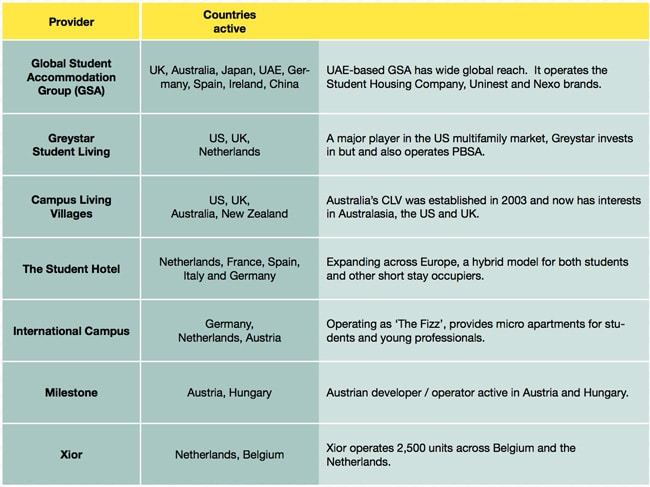

In addition to the US- and UK-focused investment activity referenced above, Savills also describes a new and growing class of multinational housing providers in this year’s report. The following table highlights some of the key players in this growing sector, and indicates that many are working across borders and, in some cases, with new and innovative models for student housing.

New approaches on the horizon

Looking ahead, Savills sees a number of important trends emerging in the student housing space. These include:

- More beds that target the middle ground between some of the premium priced PBSH now coming on to the market and the traditional (which is polite for “lower quality”) campus housing on offer directly from institutions.

- More mixed-use housing that sees students living side-by-side with non-students. There are some examples of this in-market now, such as growing number of The Fizz locations in Germany.

The report otherwise picks up on some of the important trends in international student mobility, including continued growth in student numbers overall as well as the growing importance of regional study destinations. As these underlying trends continue to play out, it becomes increasingly clear as well that student housing supply will follow those broader patterns of mobility and will continue to attract new investments in a bid to meet student demand. For additional background, please see: