2017 Agent Barometer survey links student and agent perceptions with destination attractiveness

Now in its 11th year, the annual ICEF i-graduate Agent Barometer continues to be a landmark survey of the practices and perceptions of education agents around the world. The 2017 edition was released at the ICEF Berlin Workshop last week. It registered a dramatic increase in the response rate of recent-year surveys with 1,456 respondents from 107 countries (this compares to 1,111 responses last year) over the September–October 2017 survey period. As in previous years, the respondents were widely distributed by country with only India (16%), Nepal (7%), Brazil (7%), and Nigeria (5%) accounting for 5% or more of the total sample.

Programme mix and services offered

The 2017 respondents reported a very comparable programme mix as we have seen in recent-year surveys. Roughly eight in ten (79%) indicated that they recruit for undergraduate programmes, and 76% for post-graduate courses (this is up slightly over the 74% who reported recruiting for advanced degrees last year).

Nearly three quarters (74%) said that they also recruit for language programmes, and roughly half promote secondary schools and vocational training courses.

The areas of emphasis within the agents’ programme portfolios can be seen a different way when we consider the number of referrals to each type of course. Not surprisingly, language studies are the clear leader in this respect, accounting for just over one third of all reported placements in 2017. Post-graduate programmes account for the next largest share with nearly 14% of all referrals this year; undergraduate degrees follow close behind with 12%. Secondary schools and vocational courses each received about 4% of all placements from this year’s respondent field.

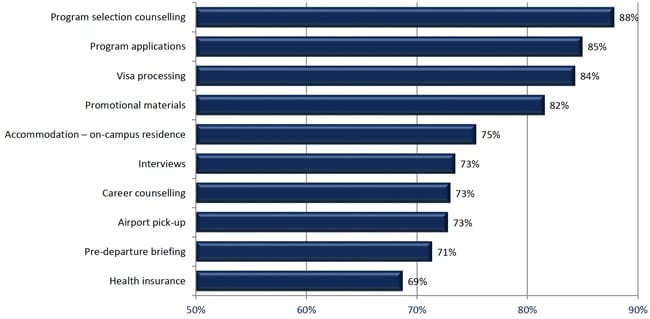

Responding agents also reported an impressive range of counselling and support services for students and families, underscoring again the importance of local agents in service delivery for outbound students. Nearly all provide counselling and advice for programme selection, and also assistance with admissions applications and visa processing.

As the following chart reflects, smaller (but still significant percentages) offer more extended support services, including career guidance, pre-departure briefings, and airport transfer and accommodation supports.

Mapping student concerns

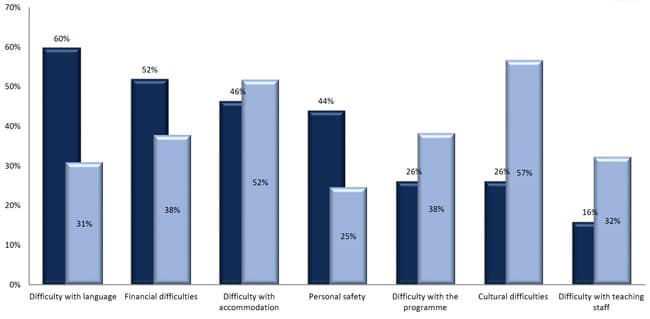

Those support services are thrown into sharp relief when we place them next to a summary of student concerns about study abroad, both before departure and after arrival at their study destination.

The following chart maps those concerns, with pre-departure ratings shown in dark blue and post-arrival in the lighter blue.

Mobility concerns and destination preferences

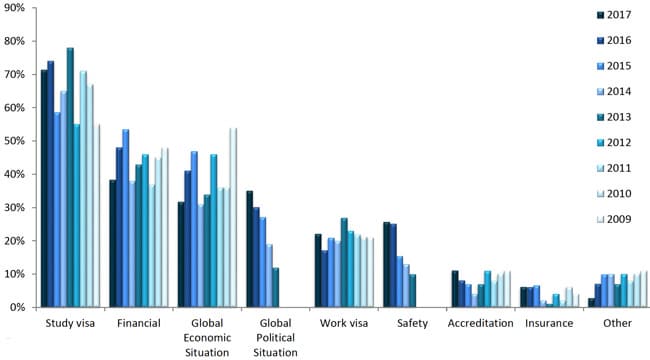

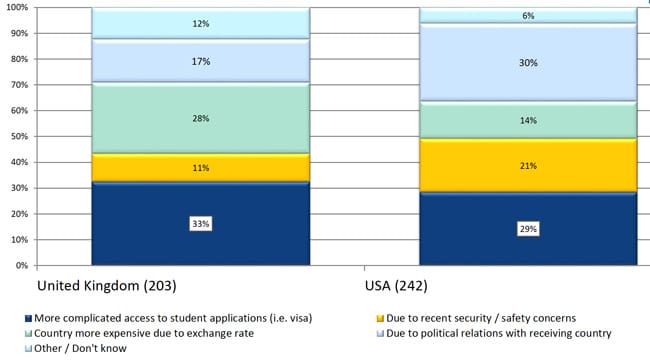

Another interesting perspective emerges when the survey drills down into more detail around student mobility concerns. This year’s Agent Barometer continues to track mobility concerns reported by agents across several key categories, and here again we see a distinct shift over time. Whereas financial issues and concerns about the global economy predominated in the early part of this decade, we now see a greater emphasis on concerns around safety and security.

As the following chart reflects, this encompasses both personal safety, which registers as an area of marginally greater concern this year, as well as the broader global political context, which shows a sharper increase as an area of student concern for 2017. We can imagine that this reflects major political currents in leading study destinations, such as the US and UK, along with regional disruptions in locations around the world, notably the current tensions on the Korean peninsula.

- “Summing up motivations for study abroad”

- “2016 Agent Barometer survey reveals important shifts in destination appeal and student perceptions”

- “2015 Agent Barometer survey yields new insights on student concerns and growing impact of online”

- “Survey finds high degree of student satisfaction with education agents”

- “South Asia: Measuring agent perceptions of Australia”

- “Survey finds travel ban influencing agents’ view of US”