MBA programmes report shifting international application volumes

The latest indication of shifting patterns of international student mobility has a very specific lens with a focus on the number of applications received by MBA programmes around the world this year.

The data comes from a global survey of 351 business schools in 40 countries, which in combination offer nearly 1,000 master’s and doctoral-level business programmes.

The survey was conducted over June and July 2017 by the Graduate Management Admission Council (GMAC) for its 18th annual Application Trends Survey. The GMAC is a global association of business schools and the administrator of the the Graduate Management Admission Test (GMAT) exam.

This year’s survey finds a market bias towards larger business programmes with nearly three in four (73%) of graduate programmes with 201 seats or more reporting increased application volumes this year. In contrast, only four in ten smaller programmes – that is, those with 50 seats or fewer – reported growth this year.

GMAC highlights as well that a majority of programmes in Europe, Canada, East and Southeast Asia, and India had larger application volumes in 2017, while fewer than half of graduate business programmes in the US registered growth this year.

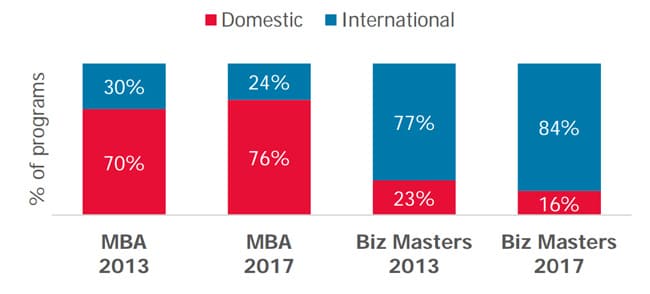

International students continue to play a significant role in graduate business studies. The proportion of foreign students applying for MBA programmes has declined slightly between 2013 and 2017, levelling off at nearly one in four (24%) of all MBA applicants this year. However, and as the following chart reflects, this demand appears to have largely shifted to non-MBA business master’s which continue to see a majority of their applications from international students (84% in 2017).

The US story

“Demand for graduate business education remains strong, especially among the largest programmes, which tend also to be the most well-known programmes with brand recognition,” said Sangeet Chowfla, GMAC president and CEO. “While non-US programmes are thriving, a strong economy and a disruptive political climate are likely contributing to the downward trend in application volumes among smaller US programmes this year.” Mr Chowfla’s observation points to an established historical pattern where application volumes to graduate business programmes in the US tend to negatively correlate to the American labour market. That is, when the economy strengthens and unemployment rates decline – as they have this year – so too do application volumes to US MBAs and other graduate business programmes. But GMAC points to another factor in this year’s numbers as well: the Trump effect. “Recent political events may provide additional clues to the declining demand for graduate business education in the United States,” says the survey report. “Only a third (32%) of US programs reported growth in the international pipeline this year, down from 49% in 2016.” The GMAC’s observations echo those from other recent research that finds that US government policy and rhetoric, notably in the form of a travel ban on seven Muslim-majority countries, has had a negative impact on the the attractiveness of the US for international students. However, the US remains the world’s leading study destination by far and its dominant market position is informed by factors beyond politics, including the strength of the US economy as well as the global reputation of US higher education. And, as one US respondent to the GMAC survey noted, political impacts of this sort can also be short-lived: “There was initial concern from international candidates immediately after the US presidential election that the United States was no longer welcoming of international students, regardless of country of origin. However, this seemed to abate around February 2017.”

Demand remains strong

Even as application growth slows this year, and particularly so in the US, the overall demand for graduate business education remains strong. This is reflected in part by the fact that business programmes continue to receive many more applications than they have available seats. “The largest programmes reported 10 applicants per available seat, compared with four applicants for programmes with 50 or fewer students. And, 92% of programmes reported their applicant pool being as or more academically qualified as [in 2016].” For additional background, please see: • “College admissions under pressure in the US: International numbers down for some” • “Survey finds travel ban influencing agents’ view of US” • “US: International graduate enrolment up in 2016 but applications slowing”