US ELT enrolment down sharply in 2016

New enrolment data reveals a steep decline in both student numbers and student weeks for Intensive English Programmes (IEPs) in the US. Released during the NAFSA 2017 conference in Los Angeles this week, the latest Intensive English Programme Survey data from the Institute of International Education (IIE) counts just over 108,000 IEP students in America in 2016, and total bookings of about 1.5 million student weeks.

This represents a 19% drop in student numbers, and a 23% decline in student weeks, between 2015 and 2016.

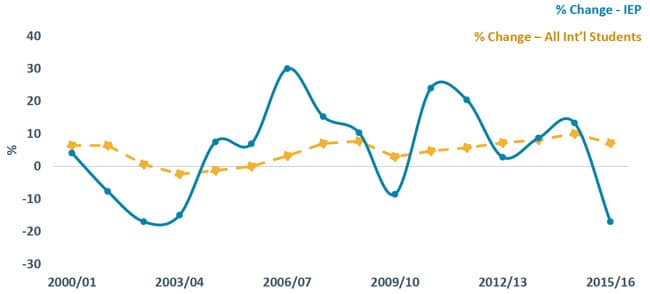

In introducing the latest trend data this week, IIE Research Specialist Julie Baer noted that IEP enrolment in the US, as a proportion of total international enrolment in the country, has remained relatively stable over the last 15 years, in the range of 3-4%. Average stay per student varies by region but has also been relatively stable in recent years at 14 weeks per student.

However, Ms Baer points out that historically IEP enrolment is also more sensitive to changing market conditions and tends to fluctuate more widely year-over-year. “This is likely due to the very nature of the differences between international students who are coming for multi-year stays to pursue degrees, and language programmes of shorter duration that are more subject to currency fluctuations or other factors,” she notes.

- China: 21,169 students, 345,137 weeks

- Saudi Arabia: 20,862 students, 354,102 weeks

- Japan: 13,511 students, 156,969 weeks

- South Korea: 6,433 students, 85,113 weeks

- Mexico: 4,963 students, 36,208 weeks

- Brazil: 4,732 students, 35,074 weeks

- Taiwan: 3,928 students, 47,368 weeks

- Kuwait: 3,086 students, 47,295 weeks

- Vietnam: 2,565 students, 51,481 weeks

- Turkey: 2,291 students, 30,702 weeks

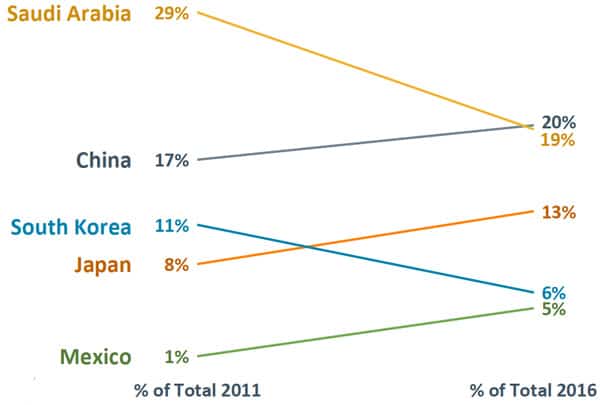

The notable changes within the top ten senders for 2016 include:

- Even as it assumed the top spot among leading sending markets, enrolment from China fell off by 16% in 2016, and Chinese students booked 11% fewer weeks during the year.

- Saudi Arabia recorded the biggest drop, with a 45% decline in students and 50% decrease in student weeks.

- Other notable declines included Brazil (-56%) and Vietnam (-35%).

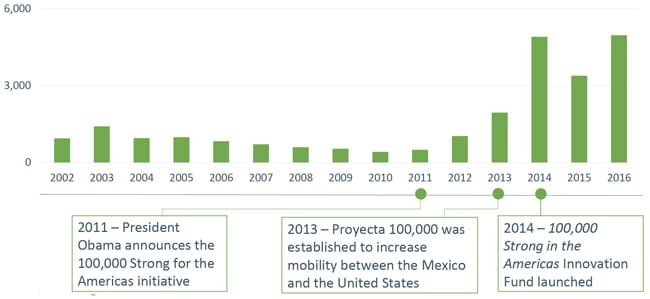

The following chart expands on these current-year highlights with an overview of the changing composition of IEP enrolment in the US over the last five years.

Looking ahead

The IIE findings for 2016 are echoed by a further survey of EnglishUSA members conducted in spring 2017. A majority of members for the peak IEP body are reporting enrolment declines through the first half of 2017, and most are also anticipating that numbers for summer and fall will drop off relative to 2016. The survey respondents attributed the decline to the political and policy environment in the US, the sharp decreases in government-sponsored students (particularly from Saudi Arabia and Brazil), currency exchange values, and increased competition. However, EnglishUSA President Patricia Szasz noted as well that member programmes are moving to counter some of these challenging trading conditions by opening new, innovative programmes. As indicated in the 2017 survey responses, EnglishUSA members are increasing their short-term study options, launching new specialised programmes, establishing new pathways and partnerships, expanding their engagement with international agents, and experimenting with price discounting. The current-year results set the stage for something of a reset in IEP programming and recruitment in the US. After a heavy reliance on government-sponsored students in recent years, it appears that US language programmes are now moving to establish a new competitive footing going forward. For additional background, please see: