New report argues that international students in France should pay full fees

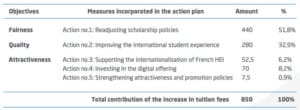

Foreign students enrolled with French higher education institutions currently receive a significant tuition subsidy from the French government. In fact, a recent economic impact study commissioned by Campus France pegged the value of the subsidy at roughly US$3.5 billion for 2013/14. There are increasing signs, however, that France may be moving towards a new fee policy, one that would see international students pay full fees for their studies. The idea has circulated in France for some time and was revived late last year by France’s then-Secretary of State for Higher Education and Research, Geneviève Fioraso (Ms Fioraso announced her resignation earlier this month, due to health reasons). Most recently, a report from France Stratégie outlines the country’s context in terms of the global marketplace for education and as a major destination for international students. It also makes a detailed case for a full-fee policy for non-European Union students that would in turn support greater investment in internationalisation of French higher education. The report - Investir dans l'internationalisation de l'enseignement supérieur (an English-language summary is also available) - is notable for its scope but also for the fact that France Stratégie is a consulting and research unit attached to the office of French Prime Minister Manuel Valls. A statement on the group’s blog explains further, “A place of exchanges and discussion, France Stratégie assists the government in determining the main directions for the future of the nation and the medium and long term objectives for its economic, social, cultural and environmental development. It contributes, moreover, to the preparation of governmental reforms.” The centrepiece of the France Stratégie report is a proposal that students from outside the European Union pay full fees for their studies in France. As University World News reported recently, “At present, all university students whether French, from the EU or from other countries, pay the same low registration fees in France. These are currently €184 (US$203) a year for the three-year licence (bachelor degree equivalent) course, €256 for a masters and €391 for a doctorate.” The authors estimate that a move to full-fee pricing for non-EU students would result in revenues of €850 million (US$900 million) per year and further propose that the entire sum be reinvested in French higher education in support of three goals: “ensuring fair access to a French higher education for all countries of origin through a readjustment of the current scholarship policies; improving services for the international students; and reinforcing the attractiveness of the French HE system.”

France’s starting point

The France Stratégie report adopts a broad view of internationalisation and its policy implications: “There are four, non-mutually exclusive, courses of action that might bring structure to a French strategy and which involve different public policy choices:

- internationalisation as a means of adjusting the labour market by attracting new talent, retaining international students and scientific immigration;

- internationalisation as a means of improving the quality of higher education;

- internationalisation as a source of export revenue for the economy and self-funding for HEI;

- internationalisation as a tool for strategic influence.”

The “self-funding” aspect of the report’s business case has certainly caught the attention of some observers but France Stratégie is quick to stress that extra revenues generated from international tuitions should not lead to a reduction in public funding for higher education. A full-fee pricing policy, the authors argue, should instead, serve a single purpose: “the development of an inclusive internationalisation to enhance the quality of French higher education.” In imagining such expanded internationalisation, the report also notes the country’s current significance as a leading global destination for foreign students. France is variously counted as the third (by UNESCO) or fourth (by the Institute of International Education) most-popular study destination in the world. It hosted 295,084 foreign students in 2013/14, and has established an ambitious goal to double its international student numbers by 2025. The France Stratégie report is an interesting counterpoint to this goal. Today, roughly three-quarters of France's foreign students come from outside of the EU and 43% come from Africa. Drawing partly on the experience of other destinations that removed or reduced subsidies for international students, the authors project a substantial decrease - on the order of 40% - in the number of foreign students in France in the years following the introduction of a full-fee policy. They also forecast, however, that the country would recover 75% of this “lost” enrolment in the following ten years, aided in part by expanded scholarship programmes and an increased recruitment effort.

The five-year plan

The report sets out a five-year action plan for reinvesting revenues arising from a full-fee policy for non-EU students.

The level of planned investment in each major area of the plan is reflected in the chart below.

- The creation of 30,000 additional scholarships per year, targeted to French-speaking markets and Africa in particular.

- An allocation of roughly €1,000 per student for new investments in improved services for foreign students, such as French-language classes, accommodation services, employment counseling, and student advising.

- Project-based funding for French institutions to support expanded internationalisation efforts, including the expansion of French programmes and services abroad.

- Project-based funding for expanded digital learning initiatives aimed at French-speaking populations abroad.

- Funding for an increased recruitment effort to attract and retain international students.

The action plan, in short, sets out a model whereby the entire revenue stream arising from a move to full-fee pricing for non-EU students is reinvested in the French higher education system. “Investing in the internationalisation of higher education is critical in the context of increased competition and diversification of the HE sector at the global level,” concludes the report. “But it is also crucial in order to improve sustainably the quality of the French HE system.” The next steps arising from the France Stratégie report are not entirely clear at this time but, at the least, it seems likely that these new proposals will help shape discussions around internationalisation policy in French institutions and among French policymakers in the months ahead.

Most Recent

-

The surging demand for skills training in a rapidly changing global economy Read More

-

US issues corrected student visa data showing growth for 2024 while current trends point to an enrolment decline for 2025/26 Read More

-

Survey finds US institutions expanding agency engagement and focusing on new student markets Read More