Part 2: Keyword research: Building your toolkit

If you have followed the brainstorming steps outlined in Part 1 of this series, you are now looking at a very full page (maybe pages) of keywords and search queries. But now what? The next step is to narrow that large field of keywords into a smaller, more focused set that you can use to guide your search optimisation efforts as well as your online advertising campaigns. As we noted in Part 1, the goal throughout is to find the keywords and search terms that are most relevant and most commonly used in searches that could apply to your institution or school. More to the point, the object of this exercise is to find the keyword terms that can help make your institution or brand more visible to the prospective students for whom your programmes, services, and location are most relevant and appealing. For the purposes of today’s article, we are going to assume that you already have a fairly clear picture of the prospective students you are trying to reach. Needless to say, understanding who that student is – their circumstances, motivations, and decision-making process – is a critical foundation for any aspect of your marketing and recruitment, including keyword research. For more on developing that deep understanding and profile of your prospective student, please see our recent post, “The art of listening: Better results start with understanding your customer.” We’re going to assume as well that you already have an equally clear picture of who your competition is. In the context of keyword research, this competitive set can include both direct and indirect competitors. It will particularly include those institutions that are ranking near or above you in search results for the keywords that are most relevant to your institution or brand. With those two assumptions regarding customers and competitors firmly in hand, let’s now take a look at a couple of strategies that you can employ to zero in on the keywords that will be most important to your online marketing efforts. The first thing we suggest is that you take a close look at what your competitors are doing: what keywords are they targeting and how are they performing in terms of search. Next, we will suggest a series of tools, most of which are freely available, that you can use to sharpen your keyword focus further.

Where do you rank?

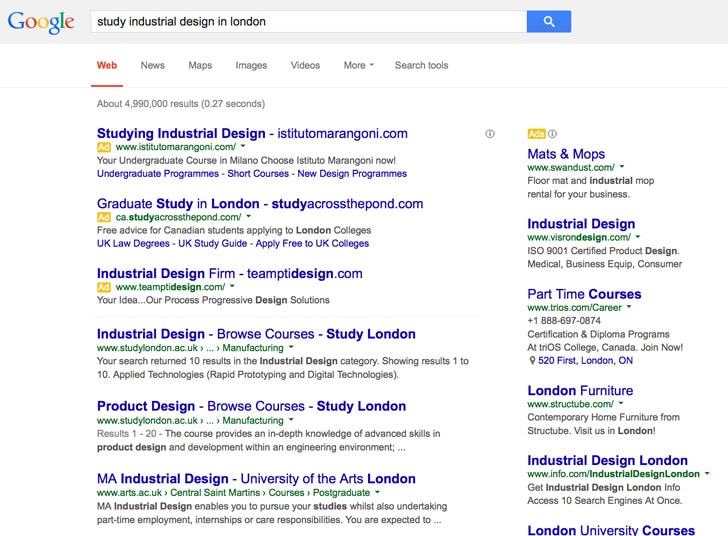

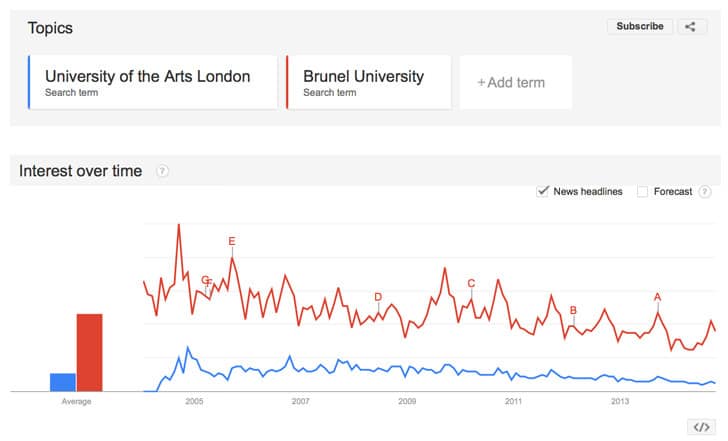

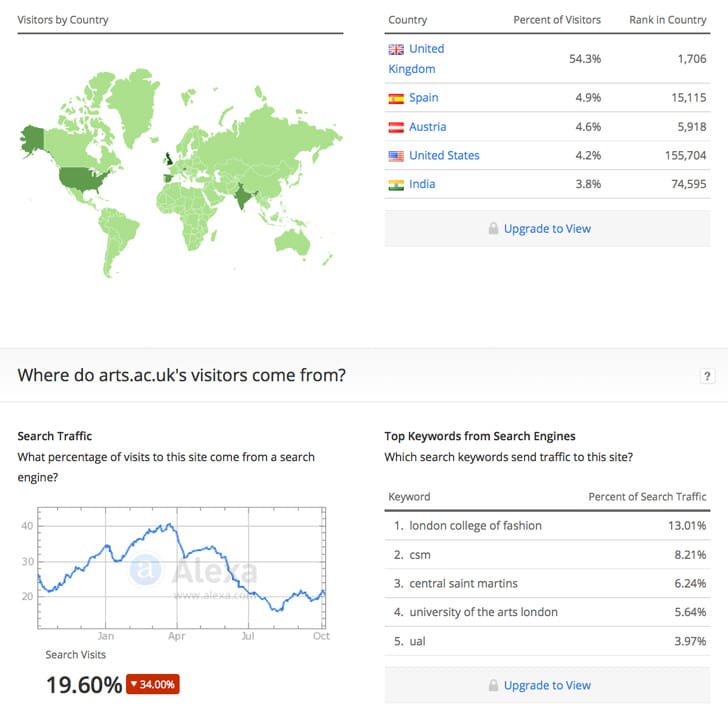

You can test your definition of your competitive set by running a number of sample search queries using the keywords from your brainstorming work. Where do you rank in the organic search results for those terms? What other institutions or schools currently rank higher than you?

Filling out the toolbox

Whereas the applications we’ve noted above are largely concerned with competitor research, there are a number of additional tools that you can use to further your keyword research. Here is a quick survey of some of the most commonly used and best-rated tools in this space, all of which are freely available.

Google Keyword Planner. This is the primary Google tool for keyword planning. Like a number of analytics and data tools from Google, it comes with a bit of a learning curve and will take some time (and trial and error) to learn to use properly. You will also need a Google AdWords account in order to use Keyword Planner. However, it remains one of the best-rated tools for keyword research and the following tutorial will help you get up to speed quickly.

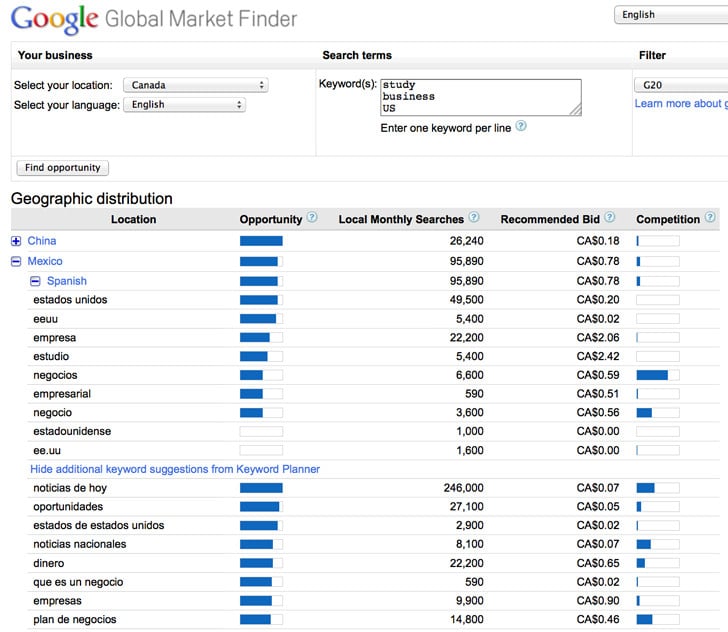

Google Global Market Finder. This is an interesting new spin on established Google keyword tools, and one of particular interest to international recruiters. It allows you to browse keyword trends by country, showing you the corresponding search terms used in the languages of each country, as well as search volumes and advertising costs for each.

What’s next?

By using the range of competitive research and keyword tools that we’ve outlined here, you will be better able to zero in on the most-relevant and best-performing keywords for your institution or brand. Even with all of the changes in search in recent years, keywords still play an important role and you will want to use them widely and well in the content and structure of your website as well as in your paid online advertising campaigns. As with any other aspect of online marketing, the key is to test, measure, and improve over time:

- If you revise your web content to incorporate new keywords that you have identified, track your search performance carefully so that you can observe the effects and adapt further as needed;

- If you run advertising campaigns with your new keywords, track those results carefully too and repeat or revise your advertising efforts based on the actual campaign data.

We will pursue both of these topics further in subsequent posts. For the moment, fire up those new keyword tools and zero in on the key terms for your international recruitment efforts!