South Africa’s language schools gaining students but struggling to clarify immigration policy

South Africa’s English language schools have attracted a growing number of international students over the past few years, thanks not only to the quality of courses available but also the amazing natural beauty of the country. The economic impact of the language sector was estimated at R2.6 billion (US$243 million) in 2009. However, as important as the sector is to the South African economy, language school providers are currently struggling with confusion around the implementation of new immigration legislation introduced earlier this year. This policy, if interpreted a certain way, would exclude prospective language school students around the world from receiving a South African student visa. Today’s ICEF Monitor article will look at the recent growth of the language school sector in South Africa, as well as the issues around the country’s new immigration policy and how it will be interpreted.

Enrolment on the rise

Education is a major export sector in leading destination markets around the world, and as far back as 2006, the Association of Language Travel Organisations (ALTO) estimated that the global economic impact of language schools on local economies was US$8 billion.

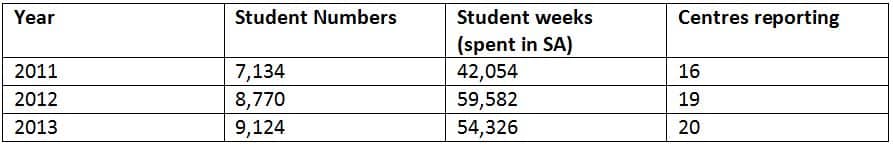

Education South Africa (EduSA), the national association of English language centres, frequently surveys its members to obtain data on the local market. In 2009, 20,825 international students studied at 50 language schools in South Africa. We can imagine this overall enrolment has increased substantially given the growth reported by the smaller group of leading providers that contributed data for the period 2011 through 2013. Surveyed members of EduSA reported an overall 27.9% jump in students from 2011 to 2013 - with particularly impressive growth from other markets in Africa - and a 29.2% increase in student weeks over the same period.

“Young people are increasingly travelling more often, to more destinations and spending more than any other group on international travel.”

Young students who have positive experiences in South Africa’s language schools are also apt to return to the country in the future as tourists and to spread the word about South Africa as an exciting destination.

The important link to tourism

For more than half of students attending the participating EduSA schools, South Africa was the first destination for their studies. The top reasons for choosing South Africa emerged as:

- English-speaking country;

- Reputation of South Africa as a tourist destination;

- Costs of studying in South Africa (including living costs);

- Types of courses offered.

An earlier article in Language Travel Magazine reported South Africa's reputation for “fantastic wildlife, awesome scenery, and welcoming people" to be a popular drawing card for the country’s language schools. EduSA notes in its more recent research that it is essential for South African language schools to leverage South Africa’s tourism appeal in their promotional activities, as well as to “improve links between tourism and language school marketing.” The Tourism Review International article we referenced above points out that South Africa’s coastal language schools are often differentiated from inland centres in terms of both programming and market focus, and that it is the coastal schools that tend to have a stronger connection to tourism.

"Inland schools around Pretoria and Johannesburg offer a range of 'diplomatic' and 'business English' courses that may not necessarily involve participation in tourism-related activities such as visits to local attractions, and largely are targeted at the market of learners from other countries in sub-Saharan Africa. By contrast, coastal schools emphasize the combination of language studies with added leisure components, which attracts students from a range of source markets in addition to African countries."

Visa confusion abounds

As much as international education, including language studies, are increasingly recognised for their potential to be key economic exports for a country, the South African government recently passed new immigration laws that may jeopardise South Africa’s prospects in this regard. The Immigration Amendment Act was officially passed into law on May 26, 2014. Draft regulations for the amended Act were published in February this year and some of the analysis and commentary arising raised the question as to whether the new regulations would limit study visa eligibility to certain types of institutions. A February 2014 commentary from IMCOSA Immigration Consulting, for example, asserted: “Study permits, short and long-term, will only be issued for studies at institutions of higher learning (universities), Further Education and Training colleges, and primary or secondary schools. There will be no more study permits for things like language courses.” Cape Town Magazine, meanwhile, reported in March that “study permits will only be issued for students at universities, colleges, and high schools.” It is not clear that this restriction is explicitly set out in either the draft regulations from February or the final version that was ratified in May. Needless to say, however, the suggestion that language schools might no longer be eligible has naturally caused alarm among the country’s language schools, and has sown confusion as to how to process study visa applications for language studies in South Africa. We asked Mr Fitzhenry for comment on whether any such restrictions regarding language schools made it into the final Immigration Act, and he said:

“What we have gleaned thus far, subject to confirmation, is that study visas will be issued only to schools/institutions accredited by the Department of Higher Education or an organisation mandated by the Department. We are accredited by one of the Sector Education and Training Authorities (SETA), which are mandated by the DoHE. Theoretically, therefore, we should be fine, but we are awaiting confirmation.”

Mr Fitzhenry told us that as language schools wait to see how the new Immigration Act will be interpreted, EduSA is hearing numerous complaints about bureaucratic red tape and unwelcoming messages being communicated by South African embassies around the world to students. He does note:

“There is one positive: it has been clearly stated that people studying for fewer than 90 days may now do so on a visitors visa. In the past this was always a bit of an issue.”

Mr Fitzhenry continues, though, to say:

“However, this is outweighed by the negatives: we tend to be a long-term destination, and the regulations state that anyone studying for more than 90 days requires a study visa. If some embassies, especially those in traditional source markets, decide that we don’t qualify, they will effectively be shutting down an industry. It has also become extremely difficult to extend a visitors visa.”

For now, EduSA members and other language schools are working through official channels to both represent the industry’s concerns to government and to clarify the new regulations. But eventually, they may have to take action to protect their industry. Mr Fitzhenry says:

“We are exploring different avenues; we have approached the Ministry of Tourism, as have many other sectors, we are trying to approach the Ministry of Home Affairs. If necessary, we will have to take legal action.”

Red tape aside, there is great potential for further growth

Mr Fitzhenry adds, “Language travel in [South Africa] is small, relative to other tourism and edu-tourism sectors. However, we contribute millions of dollars and euros of foreign exchange to our economy… As a group, we have worked tirelessly to ensure that our standing in the market grows, that our destination is recognised as a prime language learning destination, that we supply a quality learning and exploring experience, and that we remain legitimate, quality organisations. We have created a legitimate industry, and we contribute in so many ways to growth and development. Despite all this we are still struggling to get our government to see and understand the significant benefit to our country in our sector of tourism and education.” In the immediate future, South African educators and travel operators will continue to work to resolve the important questions arising from the new immigration regulations. In the long term, EduSA estimates that South Africa currently attracts 30,000 out of a total language student population of approximately 1.3 million students studying English globally, representing a “significant gap in the market” and an equally significant opportunity for further growth.