Making sense of China’s social and mobile web

Without a doubt, China is the world’s number one source of international students. Asia has driven much of the dramatic growth in international student mobility over the past decade and more, and China accounts for a significant share of that growth and of overall mobility within and from the region.

The Internet is another major factor in international education of course, both as an enabling factor in the growth of markets around the world but also as a platform for new ways of connecting with, engaging, and recruiting international students.

But China’s Internet is different from the web as experienced in much of the rest of the world in some important ways. Many countries block or modify, with varying degrees of success, some types of content or major Internet services. But the scale of effort and technology employed in China to monitor and filter Internet traffic is virtually unparalleled and this introduces some very basic, practical considerations for international recruiters.

Have you invested heavily in building your Facebook audience? Or do you have a robust YouTube channel with lots of rich video content? Good for you if you have, as these are invaluable channels. But relatively few users in China are going to see them since both services are banned by the Chinese government.

Partly because of this virtual wall, China has developed a distinct Internet culture, complete with its own major platforms and services, the largest of which rival the global audiences of some of the world’s best-known Internet brands. For example, Youku and Tudou (the leading video-sharing sites in China, which merged in 2012) boast a combined audience of 400 million unique viewers each month - that's roughly 40% of YouTube’s global audience.

For many Chinese users, these homegrown social media platforms are the Internet – that is, they are both the primary activity for users as well as the main way in which they experience the web. The explosive growth of China’s social web in recent years coincided with the emergence of mobile technology, in particular the rapid adoption of smartphone devices. Many Chinese users first began to use the Internet on mobile devices, and mobile remains the predominant form of access in China today.

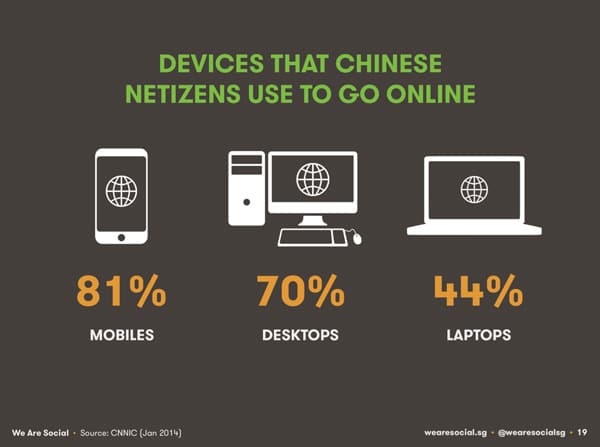

In 2014, 81% of Chinese users reach the Internet via a mobile device, and 58% of the videos viewed in 2013 were seen on mobile devices.

618,000,000 potential friends

The consulting firm We Are Social recently released a report – China Digital Landscape 2014 – that paints a vivid picture of Internet usage in China and of the country’s social web in particular.

The report estimates there are 618 million Internet users in China – representing nearly half of the country’s population (and twice the total population of the US) – and that the average Chinese user spends 25 hours online every week.

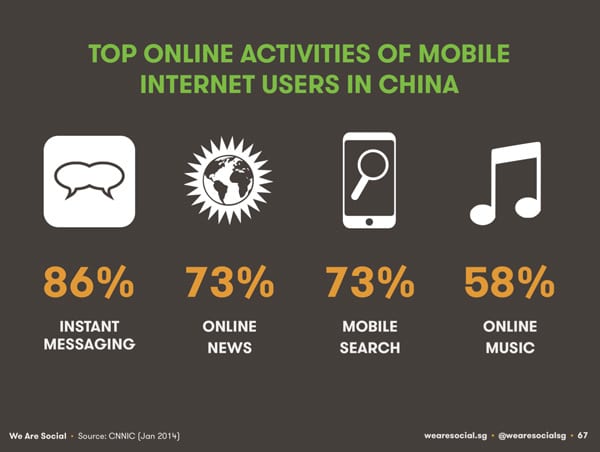

Instant messaging is reported as the leading online activity for Chinese users but this is a category of usage – more on which below – that goes much beyond simple messaging activity.

China’s social web

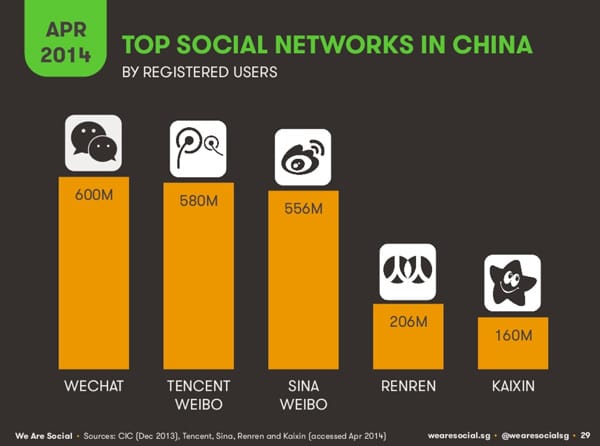

Many foreigners are familiar with China’s first major social networks, Weibo (similar to Twitter) and Renren (similar to Facebook). However, the landscape has shifted dramatically in the past few years with the emergence of new networks and services. There is now a larger field of social networks in China and some new leaders in the mix, too.

Qzone is China’s largest social network. Also known as QQ, the service has 625 million active users each month, representing more than half of Facebook’s total global population of active users.

The following charts show Qzone’s market position in relation to other leading networks in China, both in terms of total registered users and with respect to monthly active users.

WeChat rising

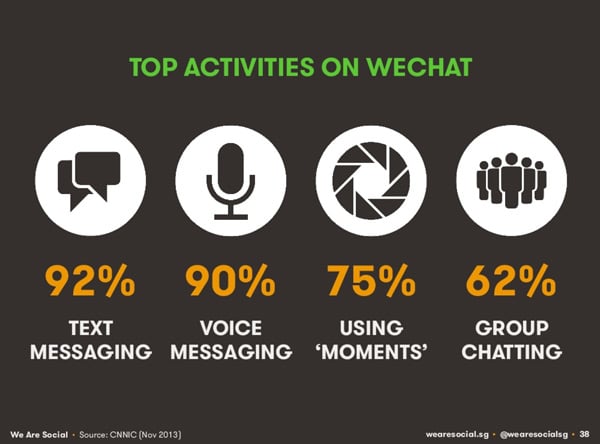

WeChat has been the big story in Chinese social media of late. First released by Tencent in 2011, the service has grown to become one of China’s largest social networks in the three years since. WeChat supports multiple languages and, along with its more than 350 million active users in China, the network has an estimated 70 million users overseas as well.

Building your profile on China’s social web

Chinese social media consultant Dana Chen has an excellent blog on how foreign institutions are using China’s social web to connect with and engage prospective students.

Ms Chen points to the University of Michigan’s use of Weibo as a particularly sophisticated and fortunate example. The university’s Director of Communications has extensive experience in Asia, and Michigan has set up a press room to provide content to a variety of channels and audiences across the world. On Weibo, its focus is on engaging with fans by providing support for students and fielding questions from prospects.

- offer great content;

- be consistent;

- create or adapt content for each platform or channel you are using;

- contribute to the conversation;

- be responsive;

- be prepared to experiment and to learn by doing;

- build your audience for the long-term.

In China, as elsewhere on the social web, these are durable ideas for success and for building real engagement with fans, prospects, students, parents, and alumni.