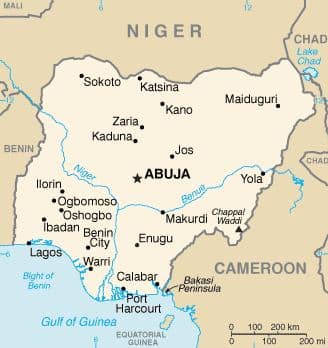

Nigeria: Rapid growth and a strategic gateway to Africa

The most populous nation in Africa, Nigeria is being touted by some as the next big education market. The combination of a rapidly growing population and burgeoning middle class has given rise to a huge demand for quality education in Nigeria, as well as significant opportunities for foreign education providers to meet that demand. Today’s ICEF Monitor post draws upon market updates and other insights we gathered at the recent International and Private Schools Education Forum (IPSEF) London Conference to take a closer look at education trends in Nigeria, and explore best practices for approaching this burgeoning market. Though working in Sub-Saharan Africa is not without its challenges, it can be – as those with experience will attest – definitely worth the effort.

Nigeria is on the rise

With approximately 169 million inhabitants and growing, Nigeria is leading Africa’s population rise. Its population is expected to exceed that of the US by 2050, and Nigeria could be the world’s third most populous country by the end of the 21st century, according to UN projections.

“In most sub-Saharan African countries, enrolment in higher education has grown faster than financial capabilities, reaching a critical stage where the lack of resources has led to a severe decline in the quality of instruction and in the capacity to reorient focus and to innovate.”

The entryway for foreign education providers

In Nigeria in particular, the demand for a quality education is prompting some families, especially those from the upper and middle classes, to look to the West. Perhaps not surprisingly, schooling in the UK is a popular choice, given the UK’s historical and cultural ties with Nigeria. Billboard in Nigeria. Source: Mark Brooks Education By some estimates Nigerians spend £300 million annually at British universities and elite secondary schools, and invest £250 million in British property, including student accommodation. According to the January 2013 Independent Schools Council (ISC) Census, approximately 1,600 African students are registered in an ISC school, around a third of which are Nigerian. And Iain Stewart, member of the British Parliament, estimates that 30,000 Nigerian students will be studying in various universities across the United Kingdom by 2015. British and other foreign education providers looking to make inroads in Africa may want to take note of such figures. Mark Brooks, an industry consultant experienced in the region, argues that the key to unlocking Africa is to have a foothold in Nigeria:

“Nigeria is a huge market. There’s never been a better time for schools to develop a relationship with parents over there.”

Importantly, Mr Brooks also notes that:

“The schools in Nigeria wish to develop working relationships rather than be seen as a captive recruitment market.”

In short, contacts are everything in well-connected Nigeria, and any education providers looking to explore the Nigerian market should conduct research to embark on the right approach from a relational and cultural perspective. While it is important to develop effective and successful relationships with recruitment agents, Mr Brooks also suggests not relying on agents alone, and proactively developing relationships with local partners and schools. Foreign education providers looking to foster links between top schools in Nigeria and the UK should get buy-in from the head and governors, and consider working with school leaders to develop exchanges, for example, to benefit schools and the nation. It is also important to set reasonable expectations: focus on a few schools and linkages, and set a realistic budget for any trips, on the ground work, or fairs, as living costs in Nigeria are high.

Private education providers play a major role in Nigeria

But for many Nigerians seeking a quality education at home, the choice is often private schooling. Consulting firm The Parthenon Group has reported that according to the International Finance Corporation (IFC) estimates:

“Private schooling accounts for between 10% and 40% of primary and secondary schooling in Africa, and is highest in Kenya, Nigeria and Ghana at the 40% mark. This is likely to increase as the middle class continues to expand, and parents increasingly view their children as their most important asset. For comparison, rates in other emerging markets vary from 13% in Mexico, to 30% in Ecuador. Around 14% of Brazilian students are in private education, while 20% and 26% of Colombian and Peruvian school goers are enrolled at a non-public institution.”

Indeed, private education providers play a major role in Nigeria. Let's consider these examples:

- It is a significant market for UK boarding schools with over 23,000 students enrolled at 72 British-oriented schools across the country.

- In urban areas, 43.6% of children attend private schools, and in Abuja alone, the number of pupils enrolled in independent schools has increased by 275% over the past three years from 800 to 3,000.

- In Lagos State, there are over 12,000 private schools, as compared to 1,700 public ones. Of note, the state has achieved the Millennium Development Goals (MDGs), and its Commissioner of Education, Olayinka Oladunjoye, estimates that only 1-2% of its children are not in school.

Low-cost private education is also expanding across Sub-Saharan Africa. James Tooley – a professor of education policy at Newcastle University and the Chairman of Omega Schools, a chain of 40 low-cost private schools across Ghana and Sierra Leone – has found that burgeoning numbers of low income families are willing and able to pay for education. Among the market solutions for education “at the bottom of the pyramid,” Mr Tooley has found that a “pay as you learn” model, which enables students to pay for school on a daily basis using a cash-free card system, effectively meets the needs of families who don’t have the ability or income stability to save and plan. But why, given that public schools are free, do Nigerian parents send their children to private schools? While the prestige and pedagogical style of some private institutions are factors, the overriding decision is often quality and accountability for ensuring pupils learn. For-profit schools typically outperform the public schools and operate at a lower cost. When the total cost of public schooling is factored in, including uniforms and books, private schooling is comparatively affordable – even for lower-income families. It is factors such as these – as well as the need to improve curriculum, enhance teacher knowledge, and drive vocational and technical education – that are driving private education investment in the region along with interest in public-private partnerships.

Practical tips for approaching the Nigerian market

So what can foreign education providers looking to approach the Nigerian market learn from others who have already made inroads in Africa? Iain Colledge, Owner and Director of World Academies, offers the following practical considerations for setting up and running schools in Africa:

- Africa is diverse and ever-changing: it is important to be open to change and have a structure which allows for flexibility.

- Plan for all eventualities that could constrain project planning, even extreme ones, such as terrorism and kidnapping or revolution (having £20,000 in cash in a school safe enabled them to get teachers onto departing flights during the Libyan revolution).

- It is important to be on the ground, get a feel for things, and work with local town planners, government and embassies.

- Have a well-structured approach to recruitment and succession planning.

- Things don’t always move quickly, so be patient.

Matthew Goldie-Scot, Director at Carfax Educational Projects, notes that some of the greatest challenges can be the tendering process; logistical challenges (such as power outages, roads, and transportation); compliance issues; and safety and security. However, to achieve quick wins, focus on:

- Local contacts: use existing contacts and government help at home. A letter from your government, for example, can go a long way to help achieve progress;

- Contingency planning;

- Decision-makers: go to the top.

As many in the field can attest, if it all goes too smoothly, something is probably wrong. However, there are many positives, and as Mr Colledge notes, at the end of the day, it is important to maintain humour, flexibility, and focus on the students throughout.

Most Recent

-

The surging demand for skills training in a rapidly changing global economy Read More

-

US issues corrected student visa data showing growth for 2024 while current trends point to an enrolment decline for 2025/26 Read More

-

Survey finds US institutions expanding agency engagement and focusing on new student markets Read More