Money talks: major private investments in education reflect expectations for further growth ahead

Private equity firms - private-sector companies that provide capital in exchange for equity ownership - have continued to make significant investments in education over the past year. In fact, 2013 was bookended by major investment transactions that drew headlines around the world and called attention to the fact that investors are taking a greater interest in key education sectors. This is partly a function of opportunity and reflects investor expectations for significant growth in education markets, especially where that growth is driven by rapidly expanding global economies or by new models for education. However, increased investment activity in education is also partly a response to the public-sector pulling back in some areas.

As public-sector budgets get tighter, educational administrators are under more and more pressure to find new ways to do more with less, and that opens the door to a wider field of public-private partnerships.A recent study

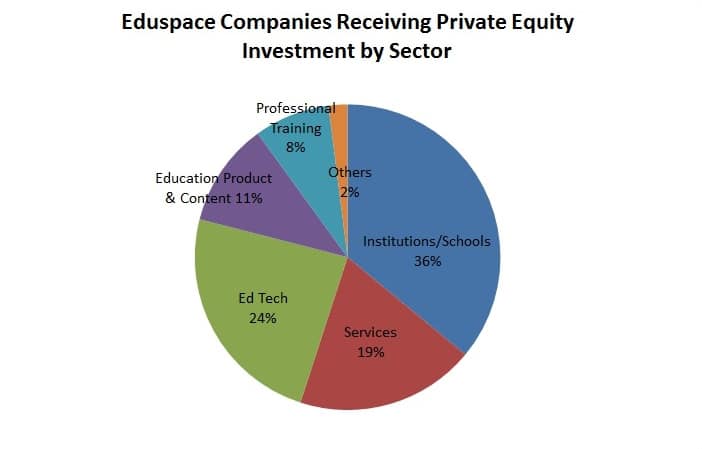

found 266 private equity firms in the US alone with investments in education. These firms have broad holdings in different aspects of K-12 or higher education ranging from direct investments in institutions or schools, education services (e.g., administrative services, marketing, recruitment), education technology, educational content, or professional training.

“A rapidly emerging middle class is becoming prominent in Africa. Due to this shift in social demographic, schools in countries such as Nigeria are preparing themselves for a new influx of students willing to pay their way towards attaining a quality education.”

Tech fever

The same rapid growth that characterises many emerging global markets is also true of the burgeoning field of education technology. The “ed tech” space has also seen considerable investment activity of late, including from major education providers and publishers that are investing heavily in new technology-enabled services and products. A recent Education Week report points to the role of education leaders, such as Kaplan, Pearson, and McGraw-Hill Education, in incubating new education technology firms. Each of these larger firms have been acquiring technology start-ups in recent years in a bid to keep pace with changing curriculum models, pedagogy, and market conditions in both K-12 and higher education. A related post on the PandoDaily blog notes that larger investors in education technology are taking the additional step of creating incubators for new start-ups as well: “Big for-profit education companies have noticed the baby startups creeping into their space. In response, instead of trying to squish them fee-fi-fo-fum style, these companies have introduced accelerators to work with them. This year, Kaplan introduced a TechStars-partnership accelerator; Pearson teamed up with Washington-based accelerator 1776; and McGraw-Hill announced an upcoming programme with an as-yet-unnamed university to mentor and fund education startups.” As these examples reflect, expansion and adaptation through acquisition - investing in either a new or established institution, technology, or service provider - is a tried a true strategy across education. The volume and variety of investment activity in education reflects as well the dramatic expansion of international markets, the emergence of new learning models, and the firm expectation among large investors of big returns in the future.