New Zealand sharpens recruitment focus with regional trade strategies

Like many destination countries for international students, New Zealand relies heavily on major world markets, notably China and India, for its international enrolment base. But the New Zealand government has also signaled its intentions to target specific global regions for the development of closer trade and cultural ties. Two major strategy statements have been released over the past month under the “NZ Inc” banner, targeting the 10-nation ASEAN block and the six Middle Eastern states of the Gulf Cooperation Council (GCC). NZ Inc is an umbrella group representing a broad cross-section of New Zealand government ministries and agencies, including Education New Zealand, with an interest in international affairs and trade. The New Zealand Ministry of Foreign Affairs & Trade describes these NZ Inc initiatives as follows:

“The strategies are plans of action for strengthening New Zealand’s economic, political and security relationships with key international partners. They target countries and regions where New Zealand has existing or emerging relationships, and there is potential for significant growth. The strategies look at the future possibilities in these markets over the next 10-15 years, then set ambitious, five-year goals, as well as the steps the Government will take, often working with business, to achieve them.”

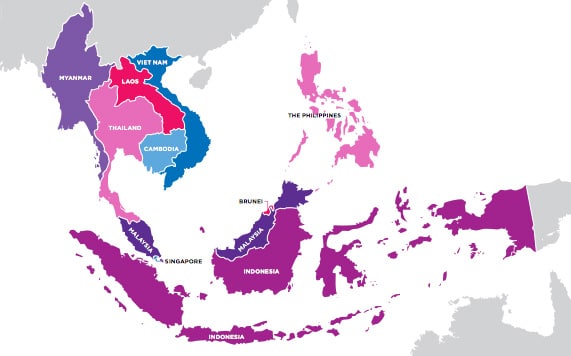

For example, the ASEAN strategy - New Zealand’s ASEAN Partnership: One Pathway to Ten Nations - sets out that:

“The Association of Southeast Asian Nations (ASEAN) is a grouping of ten economically diverse Southeast Asian nations… [that] have valued the quality and abundant goods and services we produce, such as food, education and engineering know-how. As a result, our exports to ASEAN have risen from 4% to 10% of our total exports. New Zealand now trades more in a week with ASEAN than we did in a year in the early 1970s.”

- Increase New Zealand’s exports to ASEAN by 40%;

- Double the education value from the region;

- Double two-way investment between New Zealand and ASEAN states;

- Increase annual visitor expenditure from the region by two-thirds, from NZD $289 million to NZD $470 million.

As these top-line goals suggest, education will figure prominently in the ASEAN strategy, which notes:

“[New Zealand] offers world-class education at a time when the increasingly affluent middle class across Asia wants their children learning safely in English language institutions as a passport to rewarding jobs and global citizenship.”

While New Zealand’s ASEAN strategy will no doubt further focus the efforts of the country’s educators, needless to say New Zealand is currently active and invested in the region. Among other activities, Education New Zealand maintains full-time Market Development Managers (MDMs) in Malaysia, Indonesia, Thailand, and Vietnam. MDMs work with local agent networks and support ongoing student recruitment and market development initiatives in their respective countries. Education also has a big role to play in NZ Inc's regional strategy for the Gulf which notes that, "Education is a cornerstone of the New Zealand/GCC relationship. From 2,143 students in 2006, this grew to a peak of 6,343 in 2011." The strategy statement sets out a key goal of making New Zealand a preferred destination for students from the region and calls for further action to attract more students from Gulf countries:

This includes working with New Zealand polytechnics to meet the demand for vocational and technical education as well as summer school programmes. There are also opportunities for receiving Gulf government scholarship students in areas such as tourism, police, health, defence, aviation, and public administration. As the education relationship matures, increased opportunities are likely to arise around academic exchange and science cooperation, and alumni communities in the Gulf will become important advocates for the relationship. As well as sending students off-shore, Gulf States are focused on improving education delivery in their own countries. New Zealand education services firms, as well as universities and institutes of technology, are well placed to partner with Gulf States.

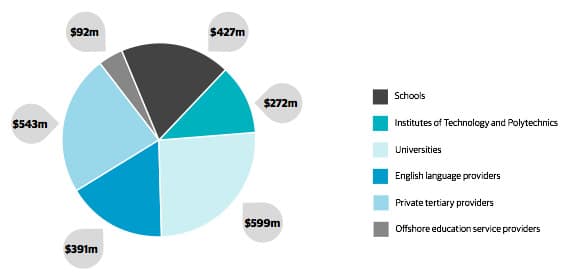

This renewed focus in ASEAN and the Gulf Region is taking shape as Education New Zealand has also released an updated Statement of Intent for 2013–2016. This follows earlier, but equally ambitious, goal statements for the expansion of the country’s share of the global education market. The new Statement of Intent provides a compact summary of the current position of New Zealand’s international education sector.

“International tuition revenue rose by 2% in 2012 compared to the previous year. This is the highest level of revenue recorded since 2004. However, the number of fee-paying international students in New Zealand fell by 6% in 2012. Excluding the Canterbury region, the number of students in the rest of the country decreased by 3% in 2012. This follows a 1% decrease in 2011, reflecting that we are operating in a challenging environment. The number of Chinese and Japanese student enrolments rose in 2012. China remains the single most important source country, providing 27% of New Zealand’s international students.”

. The updated statement establishes two “intermediate outcomes” - that is, specific near-term goals, for the period 2013–2016.

- Increased economic value from international students studying in New Zealand. More specifically, to increase the overall enrolment of international students by 1% in 2013, 4% in 2014, and 5% in 2015; and to increase international graduate student enrolment by 5% in 2013 and 6% in 2014.

- Increased economic value of education products and services that are delivered offshore. More specifically, to increase offshore enrolment by 9% in 2013 and 10% in 2014, and to expand the number of offshore agreements to include six new programmes in 2013/14, ten in 2014/15, and ten more in 2015/16.

Education New Zealand aims to achieve these goals by:

- Expanding the scale of its marketing efforts in top-priority markets.

- Differentiating marketing programmes for individual target markets by industry sub-sector. They explain, “Many of the current promotional activities are generic, rather than being targeted at specific sub-sectors. As the growth potential for each sub-sector within each market varies, we will also implement new activities that focus on growing specific sub-sectors.”

- Strengthening ties with education agents: “Education agents act as a key influence on the decision making process. We will strengthen our relationships with education agents to increase their preference for, and commitment to, New Zealand.”

- Investing in market research.

- Relaunching its student-facing website.

- Leveraging existing bilateral education agreements and encouraging the establishment of further agreements and programmes.

- Providing targeted funding to New Zealand institutions to build capacity or otherwise enhance business growth strategies.

It appears that many of these activities will be concentrated within Education New Zealand’s established Tier 1 and Tier 2 groupings of international markets. These include Indonesia (Tier 1), Malaysia (Tier 2), Thailand (Tier 2), and Vietnam (Tier 2) from the ASEAN block as well as a broad regional Tier 2 target - the Middle East region - that in turn aligns well with NZ Inc’s new Gulf region strategy.