FEDELE’s 2012 Spanish language school survey reveals overall growth

FEDELE (Spanish Federation of Schools of Spanish as a Foreign Language) has released its 2012 Informe Sectorial, or Sector Report, which was built from surveys conducted between January and April 2013 and contains some of freshest data available on Spain’s language sector. The survey does more than look at growth and demographic data for FEDELE’s schools - it also asks for opinions about Spain’s international education sector from the survey’s respondents (school directors) from across the country. Top-line results reveal an increase in student weeks and revenue in 2012, driven by growth from Russia and China as sending markets, which compensated for declines from other nations, namely Denmark. Small and medium-sized schools fared better than larger institutions. Below, ICEF Monitor translates, examines, and puts FEDELE’s data into context.

What is FEDELE?

Before getting into the survey, here’s some quick information about FEDELE that will help in interpreting the information: FEDELE’s main objective is to promote quality teaching of Spanish in Spain. It consists of six associations totaling 88 private Spanish schools. Five of the associations are named for five of Spain’s autonomous communities, and their schools are located in or near those communities. The sixth association is Asociación Escuelas de Español como Lengua Extranjera, or the Association of Spanish Schools as a Foreign Language, referred to as AELE. This association encompasses schools that are not members of the other five associations, and which are scattered from Málaga in the south of Spain to the Basque Country in the north. So as a whole, FEDELE looks like this:

- FEDELE Barcelona, which has 7 schools, all located in Barcelona.

- FEDELE Comunidad Valenciana, which has 13 schools, located in Alicante (3), Castellón (1), and Valencia (9).

- FEDELE Madrid, which has 13 schools, all located in Madrid.

- Asociación Español en Andulacía, or AEEA, which has 33 schools located in Cadiz (7) Granada (6), Málaga (13) and Seville (7).

- Asociación Español de Español de Castilla y León, or AEECYL, which has 14 schools in Avila (1), Salamanca (12), and Valladolid (1).

- AELE, which has 8 schools located in A Coruña (1), Guipúzcoa (1) the Balearic Islands (2), Marbella (1), Navarra (1), Santa Cruz de Tenerife (1), and Biscay (1).

Of the 88 schools, 50 took part in the survey, and FEDELE states that it is extrapolating data from this sample size to apply to the whole association. In a similar vein, FEDELE’s figures apply only to its collection of private schools, and may not perfectly correlate with data for other types of language schools in Spain.

Demographic trends in FEDELE schools

The FEDELE survey uses a measure based on enrolment weeks to show the size of its schools, the growth trends per region, and the demographic makeup of the students. The entire survey is of interest, but we’re going to jump to the middle and start with the demographic information that will be of greatest interest to recruiters.

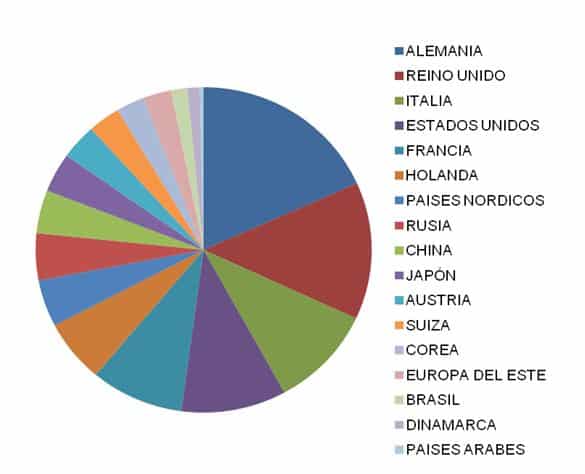

The graphic below reveals which countries or regions send students to FEDELE Spanish schools and in what proportions. Most of the Spanish country names are self-explanatory, but a few to note are Alemania (Germany), Reino Unido (UK), Corea (Korea), Europa del Este (Eastern Europe), Suiza (Switzerland), Paises Nordicos (Nordic countries), and Paises Arabes (Arabic countries).

- Germany - 94%

- United Kingdom - 70%

- Italy - 52%

- United States - 52%

- France - 46%

- Netherlands - 32%

- Nordic countries - 24%

- Russia - 24%

- China - 22%

- Japan - 20%

- Austria - 18%

- Switzerland - 16%

- Korea - 14%

- Brazil - 8%

- Denmark - 6%

- Arab countries - 2%

The ups and downs of international sending markets

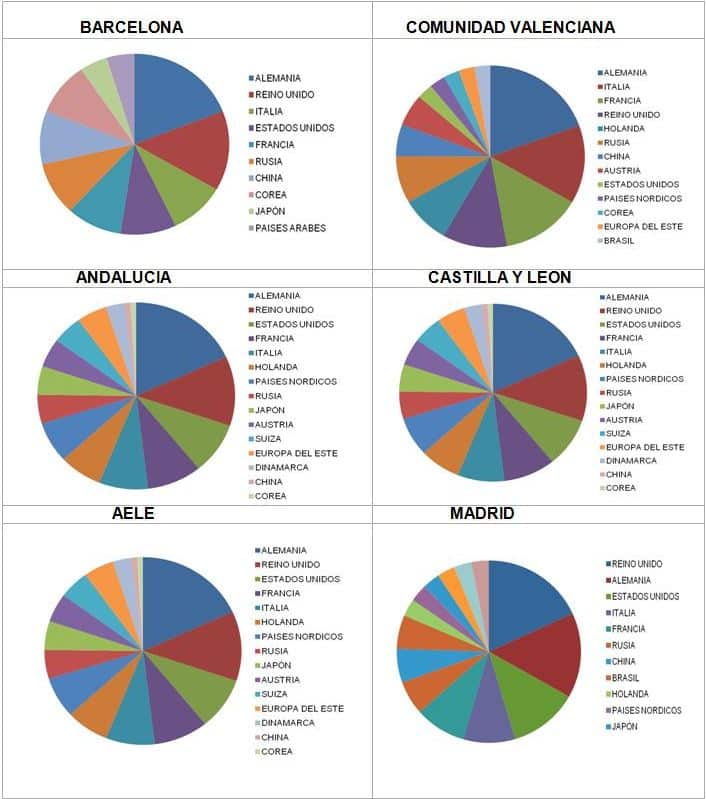

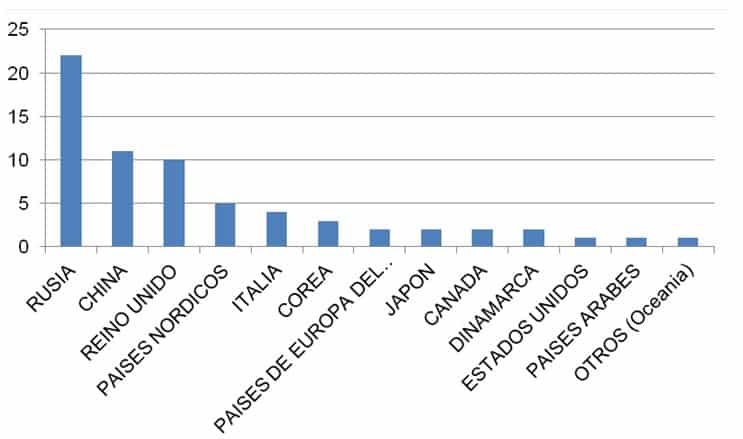

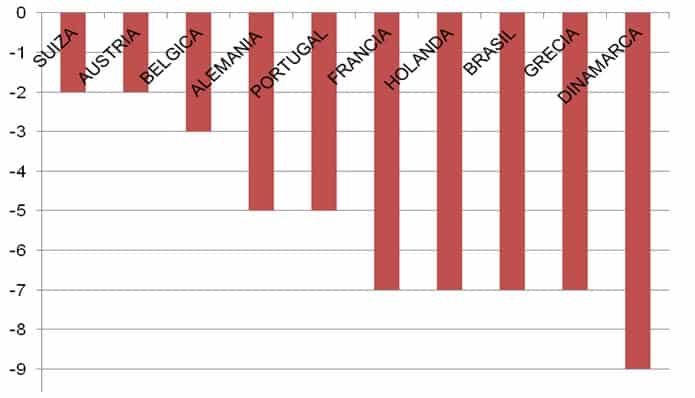

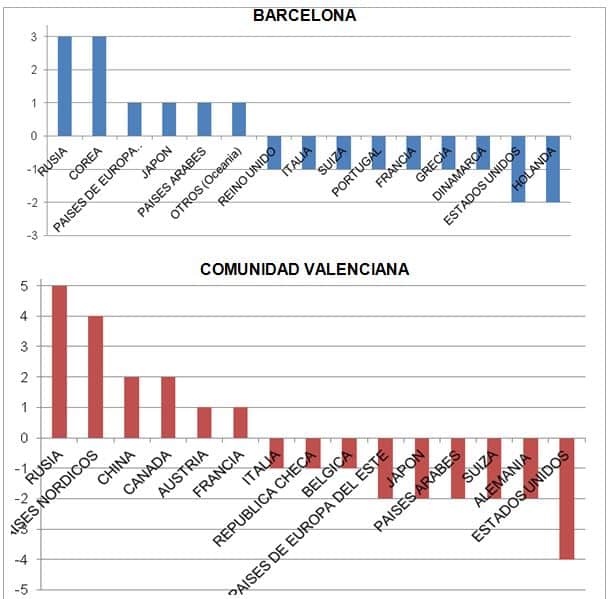

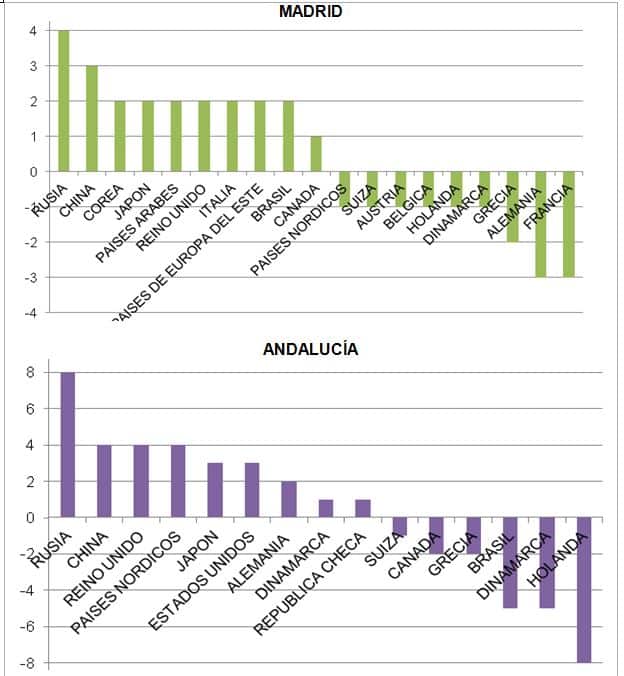

FEDELE also asked its schools which nationalities showed the fastest growth in 2012, and which showed the steepest decline. The methodology was the same - i.e., the results shown refer to the percentage of schools that included these nationalities in its response.

The results were broken into two charts. Thus FEDELE reveals which nationalities showed growth:

Notably, the Nordic Countries are up as senders, but Denmark shows a marked decline. Also Germany, while remaining the top sending market to FEDELE schools, did show a slight decline.

The differentiated charts appear below and reveal sharp variation between countries. For example, the US is down as a sender to the Valencian region located on Spain’s eastern coast, but up to Andalucia in the south. Similarly, the Nordic Countries (minus Denmark) are up to Andulacia but sharply down to Castille and León.

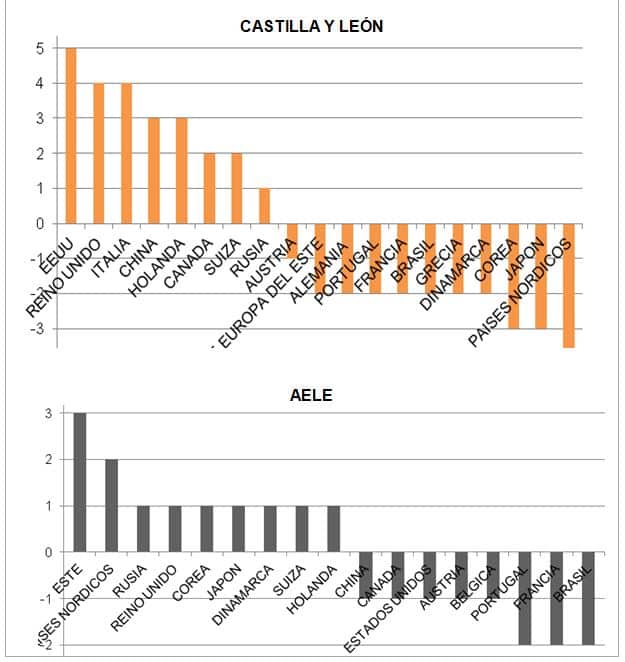

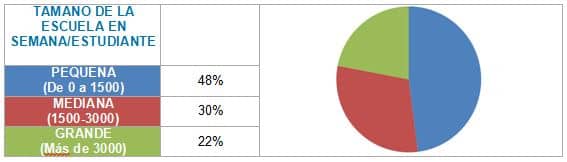

FEDELE growth figures

As stated earlier, the survey uses a measure of volume based on enrolment weeks to show the size of its schools. Thus we see that 48% of the schools are classified as small, 30% are medium, and 22% are large. Spanish schools in the Barcelona and Madrid regions tend to be large, while schools tended to be small in Andalucia in southern Spain, Castille y Leon in the northwest, and in the widely scattered AELE grouping.

Interestingly, the data also showed that while numbers were generally up, the schools showing growth were small and medium schools, while the large schools that responded to the survey showed a tendency to decrease.

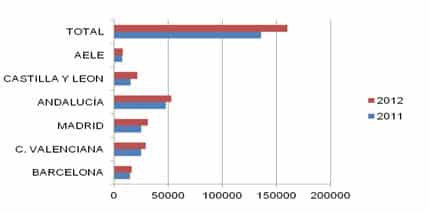

Next we see a comparison between 2012 and 2011 weeks/student to get a sense of the growth rate of the schools.

- AEEA: 53,250 weeks/student 2012; 48,100 weeks/student 2011

- AELE: 8,000 weeks/student 2012; 7,500 weeks/student 2011

- Barcelona: 16,500 weeks/student 2012; 14,700 weeks/student 2011

- Castile y Leon: 21,750 weeks/student 2012; 15,600 weeks/student 2011

- Comunidad Valenciana: 29,250 weeks/student 2012; 25,000 weeks/student 2011

- Madrid: 31,500 weeks/student 2012; 25,200 weeks/student 2011

Growth and decline drivers for FEDELE

FEDELE respondents were asked to cite the major factors affecting school enrolments. Again, the responses were subjective, but give an indication of the issues that are of concern to school administrators. The top responses were as follows:

- The exchange rate in Spain as compared to competing (international) markets: “The impact of this factor in both 2011 and 2012 remains as strong or very strong for most of the schools participating in the survey.”

- The economic climate: “The international economic crisis has affected major emitters of Spanish students and has caused the decline of Spanish students in our traditional markets.”

- Visa policies: “The immigration control measures established in Spain for some countries delay and often hinder penetration into emerging markets.”

- Unfair competition: “The growing number of Spanish students in the world and the consequent development of our sector in Spain has led to the emergence of multiple entities that compete in the market without compliance, with established quality standards even without complying with the law.”

- Marketing budget: “A limited budget to invest in marketing, both in the development of strategies and participation in action.”

- Spain’s image: “A new factor is … the image that Spain has been evolving in recent years [to people on] the outside: economic crisis, corruption, unemployment, eviction demonstrations. This image of instability and insecurity causes insecurity in parents and prescribers that ultimately decide not to send their children/students to our country.”

FEDELE and wider Spain

FEDELE’s data set confirms the increasing global demand for Spanish language instruction and the continued resiliency of Spain’s language sector. However, the concerns of FEDELE school directors paint a vivid picture. Even in the midst of growth, they feel that their strength with traditional sending markets is declining. Education providers may do well to focus on new sending markets and refine their marketing strategies, perhaps concentrating on untapped customer segments, as outlined in the British Council's Spain Country Brief.