Changing affordability of markets adds to volatile global education landscape

Across publications reporting on the global higher education marketplace, including ICEF Monitor, one trend continues to arise: the increasingly complex and volatile student recruitment landscape, in which even established destination countries (e.g., Australia) can quickly decline in popularity, and newer competitors are gaining market share. In "A more complex marketplace taking shape for 2012" we pointed to two articles that looked at developments such as...

- Australia’s weakened market position

- the UK’s challenges due to tuition fee increases and stiffening visa requirements

- America’s uncertainty regarding the ethics of using agents in international recruitment

- the precarious global economy

Now, we point you to another must-read report from Higher Education Strategy Associates (HESA) 2011 Year in Review: Global Changes in Tuition Fee Policies and Student Assistance. One of the chief findings of the report is that, “In the face of continued increases in participation, demographic change and profound fiscal crises (in the west at least), higher education institutions are increasingly being required to raise funds from students as opposed to relying on transfers from governments.”

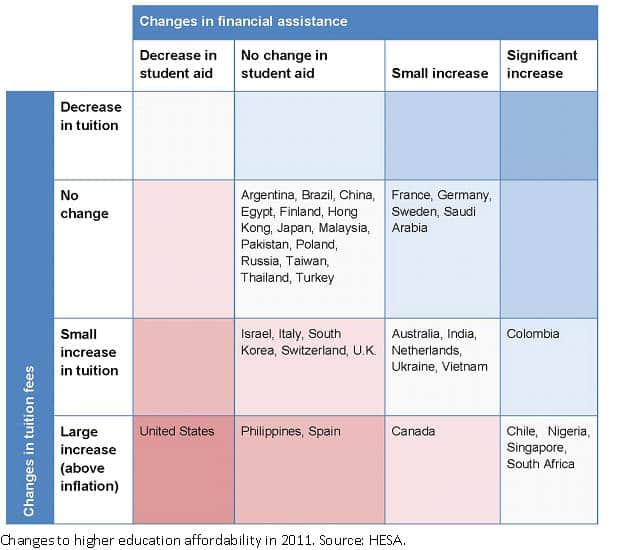

The report goes on to look at the various factors contributing to student affordability in 40 study abroad markets across the world - and of course, affordability is among the key criteria students look at when choosing a study destination. Overall, the report notes that tuition increased by 2.58 percent globally last year, or dropped by 1.76 percent when adjusted for local inflation.

Below is an excellent graphic featured in the HESA report that combines tuition fee changes with changes to financial assistance to students in order to arrive at the overall affordability of various markets. As you can see, the US emerges (in red) as the country in which affordability is decreasing the most dramatically. Other leading study abroad destinations (e.g., Canada and the UK) are also becoming more expensive, but not at the same rate as the US.

“Students today,” reports UNESCO, “are expanding their range of destinations. In 1999, one in four students chose to study in the United States while this was true for only one in five students in 2007…Meanwhile, Australia, Canada, France, Italy, Japan and South Africa not only remained popular destinations but saw their shares of mobile students grow. Countries that have emerged among the top host countries include China, the Republic of Korea and New Zealand.”

The global education landscape is indeed heating up … at the very same time it faces pressures like never before. Managing the opportunities and challenges inherent in this dynamic will no doubt be at the centre of both country-level and institutional educational policies and strategies in the next few years to come. See the full HESA report for further details.