Southeast Asia trading and mobility bloc continues to take shape

Southeast Asia is home to some of the world’s most important emerging economies. With the formal establishment of the ASEAN Economic Community on 31 December 2015, the ten member states of the Association of Southeast Asian Nations are moving toward greater economic and community integration on a number of fronts.

Those ten countries – Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Burma (Myanmar), Cambodia, Laos, and Vietnam – have a total population of more than 600 million people. Their combined economies would currently rank as the seventh-largest economy in the world, an economic footprint that is projected to grow to become the fourth-largest in the world by 2050.

A leading global economy

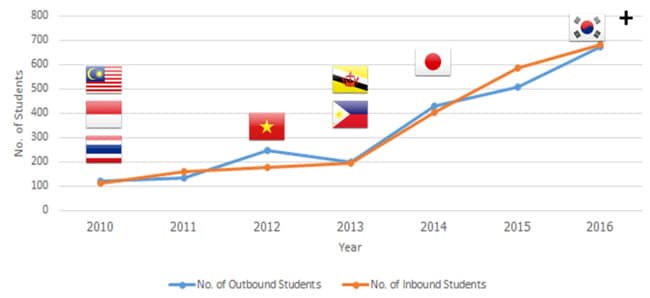

As we noted earlier, if ASEAN were a single country it would safely be counted among the world’s largest economies. Its combined (and youthful!) population of 600 million is larger than that of the European Union or North America, and surpassed only by China and India. Similarly, real GDP growth over much of the last 15 years has been clipping along at more than 5% per year. Of all world economies, only China and India grew faster during this period. A 2014 commentary from McKinsey & Company adds: “ASEAN has dramatically outpaced the rest of the world on growth in GDP per capita since the late 1970s. Income growth has remained strong since 2000, with average annual real gains of more than 5%. Some member nations have grown at a torrid pace: Vietnam, for example, took just 11 years (from 1995 to 2006) to double its per capita GDP from US$1,300 to US$2,600. Extreme poverty is rapidly receding. In 2000, 14% of the region’s population was below the international poverty line of US$1.25 a day (calculated in purchasing-power-parity terms), but by 2013, that share had fallen to just 3%. Already some 67 million households in ASEAN states are part of the ‘consuming class,’ with incomes exceeding the level at which they can begin to make significant discretionary purchases. That number could almost double to 125 million households by 2025, making ASEAN a pivotal consumer market of the future.” From a recruitment point of view, these are all powerful indicators of a regional bloc with considerable potential for outbound mobility. Indeed, skills development and access to advanced education will increasingly be a key determinant of continued economic growth and social development in the decades ahead. There are, however, considerable variations in market conditions across the region. Indonesia, for example, accounts for about 40% of total economic output among member states and is a G20 member. And Singapore’s highly developed economy is home to some of the top-ranked universities in the world. Myanmar, meanwhile, is really just emerging from a long period of political and economic isolation and so we can still observe significant gaps in educational attainment and income from country to country within the region. Even so, the ASEAN states are an increasingly integrated global market that includes some of the key emerging markets in the world for outbound mobility, notably Vietnam and Indonesia. There will be considerable momentum in the next decade and more to mobility within the region, and also towards study in neighbouring countries that have also stepped up their own recruitment activity of late, such as China and Japan. But as income levels continue to rise, the region’s very large college-aged populations also represent a significant opportunity for recruiters from further afield – one that also offers the added efficiency of recruiting in a series of diverse markets in close proximity to one another. For additional background, please see:

- “ASEAN poised to usher in new era of regional student mobility”

- “Indonesia’s growing middle class expected to drive outbound mobility”

- “Malaysian government cools on study abroad but outbound still growing”

- “Growing demand for vocational training in Vietnam”

- “Vietnam: Regulatory change expected to spur international school enrolment”

- “Singapore adopting a more cautious outlook on education hub ambitions”