Australia’s ELICOS sector flat in 2018

English Australia’s National ELICOS Market Report for 2018 shows that enrolments in Australia’s English Language Intensive Courses for Overseas Students sector grew by 1% last year to reach 179,340. There was no great change in the volume of student weeks either with a total of 2,334,336 for the year, amounting to a very slight (.1% decline) over the year previous. Students stayed in Australia for a slightly lower average duration in 2018 as well: 13 weeks versus 13.2 in 2017.

The greatest share of ELICOS students are found in independent language schools (39%), with the next largest proportions enrolled in VET institutes (27%) and universities (24%). Adults made up the vast majority of students (90%), with juniors accounting for the remaining 10%.

English Australia’s National ELICOS Market Report for 2018 is based on a national survey among English Australia members carried out by Bonard, a global market intelligence and strategic development company that specialises in the international education sector. English Australia members account for 77% of the ELICOS sector in Australia in terms of the number of students enrolled.

Where students come from

There were notable changes in 2018 compared with 2017 regarding source regions for ELICOS programmes. There was an 11% decline in student numbers from Europe, a 7% increase from the Americas, and a 1% increase from Asia-Pacific. It was the MENA (Middle East and North Africa) region that contributed the highest rate of growth in student numbers: 9%. The Asia-Pacific region still accounts for the great majority of ELICOS students (121,730), with the Americas region next in line (33,645). After that it’s Europe (18,410), MENA (4,935) and Sub-Saharan Africa (620).

The Americas and MENA are notable as well in that students from those regions tend to stay for longer durations. Students from the Americas stayed for an average of 17.1 weeks and MENA students stayed for virtually the same average duration: 17.2 weeks. In contrast, students from Asia stayed on average 12.1 weeks and European students stayed for 10.5 weeks in 2018.

Students from the Americas and MENA were responsible for great surges in revenues in the sector. Students from the Americas spent AUS$489 million in 2018 versus AUS$445 million in 2017 (a 10% increase), and MENA students spent 21% more (moving from AUS$86 million to AUS$103 million.

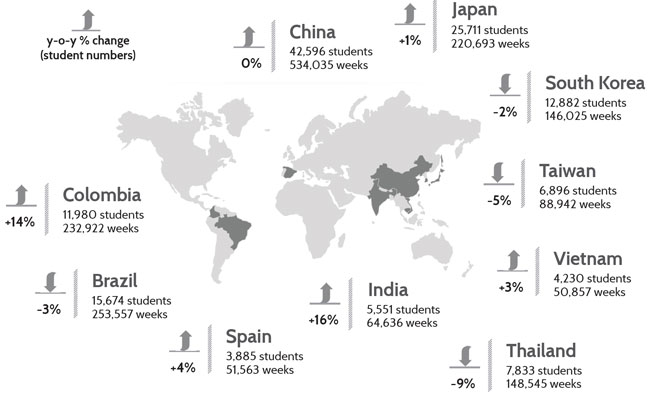

The report zeroes in on top source countries as well. China remains the top source country, but there was no growth in student numbers in 2018 (42,595 students were enrolled in 2018). The #2 market, Japan, contributed 25,710 students but there was only a small jump over 2017 of 1%. Brazil was the #3 market in 2018, and numbers from this country fell slightly by -3% to 15,675 students.

Negative growth of -9% occurred in the Thai market, which is significant given the high number of weeks that Thai students contribute (148,545 in 2018). Along with Thailand, the major contributors of student weeks in 2018 were China (534,035), Japan (220,695), Brazil (253,555), and Colombia (232,930).

In other Top 10 country news (2018), South Korea fell a bit (-3% to 12,880 students), and Colombia and India grew significantly, by 14% and 16% respectively. Taiwan declined by -5% to 6,895 students. Vietnam grew by 3% to 4,230 students and Spain grew by 4% to 3,885 students in 2018.

Economic impact

The ELICOS sector provided 1.4% more revenue to the Australian economy in 2018 than it did in 2017, with a contribution of AUS$2.35 billion. This figure represents an increase of AUS$31 million over 2017. Students from Asia are responsible for the majority of this economic impact, contributing AUS$1.6 billion in 2018.

Based on 2017 enrolment data for leading ELT destinations, Australia is the third most popular destination for English-language students in the world, after the UK (which hosted the the highest number of students) and the US (which accounts for the most student weeks). The report notes as well the continued attractiveness of Canada and Ireland, and the growing popularity of Malaysia and the Philippines for English-language studies.

Trending in 2019

Based on year-to-date (YTD) data through May 2019, ELICOS commencements were up by 1% versus May 2018. China accounts for the majority of commencements so far this year (24%), but the number of new Chinese students beginning ELICOS studies this year is so far down by nearly 12% compared to the same period in 2018. Another key market, Brazil, is also down so far in 2019, with 10.4% fewer commencements.

Notable growth markets through May 2019 include:

- India (up 22.2%, from 2,050 commencements in 2018 to 2,505 in 2019)

- Colombia (up 21.7%, from 4,850 commencements in 2018 to 5,890 in 2019)

- Vietnam (up 18.6%, from 1,255 commencements in 2018 to 1,485 in 2019)

- Spain (up 11.7%, from 1,350 commencements in 2018 to 1,500 in 2019)

With those gains in the first half of 2019, Colombia has now overtaken Brazil as Australia’s second-leading source country, in terms of commencements YTD May 2019.

New student enrolments from Nepal, meanwhile, leapt by 47.2% compared to the same period year-to-date in 2018, which now places Nepal among the top ten source markets for the ELICOS sector.

For additional background, please see: