Mapping the geography of international students in the US

A new study by the Brookings Institute, The geography of foreign students in US higher education, goes beyond collecting data on international students in America to offer fascinating insights on:

- The metropolitan centres international students are choosing to study in – and often, to stay in to work after graduation;

- The international cities sending the most students to the US.

In this article we’ll explore some of the most important findings from this interesting new take on US student data.

Steady growth in international student numbers

A quick note on the methodology of the report: the primary data source was US Immigration and Customs Enforcement I-20 forms from 2001–2012, in particular the Student and Exchange Visitor Information System (SEVIS) data submitted by US schools with foreign students enrolled under F-1 visas. The Brookings Institute then filtered the sample to include only:

- F-1 international students in bachelor’s, master’s, or doctoral programmes;

- F-1 international students in metropolitan and global cities with “at least 1,500 F-1 visa approvals over the 2008 to 2012 period”, which yielded “a final list of 118 US high F-1 visa metropolitan areas and 94 global high F-1 source cities and hometowns.”

Given these restrictions, the Brookings report counts 524,000 international students in the US in 2012, versus SEVIS’s 2012 total of 858,180 F-1 and M-1 students in the US for that year. (SEVIS is now reporting 966,333 F-1 and M-1 students studying in the US as of July 2014.) The main point for the purposes of this article is that the Brookings report and the overall SEVIS data show notable growth in international student numbers in the US. According to the Brookings methodology:

“The number of foreign students on F-1 visas in US colleges and universities grew dramatically from 110,000 in 2001 to 524,000 in 2012.”

The report notes that the biggest increases come from sending countries considered “emerging markets,” such as China and Saudi Arabia.

Why the focus on metropolitan centres and sending cities is interesting

As much as has been written about the cultural and economic benefits of international students for host universities and local communities, there is much room for discussion on the wider implications of hosting international students. In short, international students can provide long-term links to the key global regions from which they originate, whether these links are research-oriented, diplomatic, or economic. The Brookings Institute notes the following areas of potential impact:

- International students can be “valuable assets to local business communities that are seeking to expand globally.” They cite the IT sector, where “immigrant entrepreneur networks play a critical role in technology industries’ international expansion, linking Silicon Valley to new technology hubs in Bangalore (India), Hsinchu Science Park (Taiwan), and Shanghai (China).

- “Migrants can increase the availability of valuable market information for exporters from origin-and destination-countries, find buyers, learn about regulatory requirements and overcome market imperfections.”

- International students, if successfully attracted and retained post-graduation, can allow the US to “tap powerful diaspora networks around the globe.”

Those American cities with significant numbers of international students are the best placed to enjoy such benefits – particularly when the cities also contain exciting work opportunities for foreign graduates. A key consideration here is the limited extent (currently) to which US immigration laws allow talented international students to remain in the country to work post-graduation.

Where students go

The Brookings Institute found that from 2008 to 2012, “85% of foreign students pursuing a bachelor’s degree or above attended colleges and universities in 118 metro areas that collectively accounted for 73% of US higher education students.” Some metropolitan areas command very significant proportions of that 85%:

“The New York metropolitan area had by far the highest number of F-1 visa approvals: more than 100,000 over the 2008-2012 period, accounting for more than 8% of national F-1 approvals. Los Angeles, Boston, San Francisco, and Washington made up the remaining top five metro areas, each with between 35,000 and 70,000 F-1 visa approvals. The 10 metro areas with the most F-1 visa approvals together accounted for 36% of all approvals; these metro areas also represent some of the largest by population.”

As large as the leading metropolitan areas for international students on F-1 visas are, the report notes that relatively small metro areas can attract large numbers of international students if they have a prestigious institution operating within them. The report provides these examples:

“Champaign-Urbana, Ill. ranks 191st among metro areas for total population (just over 234,000 in 2012), but the presence of the University of Illinois ranks the metro area 17th for incoming foreign students. Likewise, Lafayette, Ind., home of Purdue University, ranks 209th for total population but 20th for incoming F-1 visa holders.”

The report lists the metropolitan areas experiencing the fastest increases in international students between 2008 and 2012, all of which are “small to mid-sized” in terms of population, and all of which boast a public university. None of them are in California or New York – visit the report’s summary page to find out what they are.

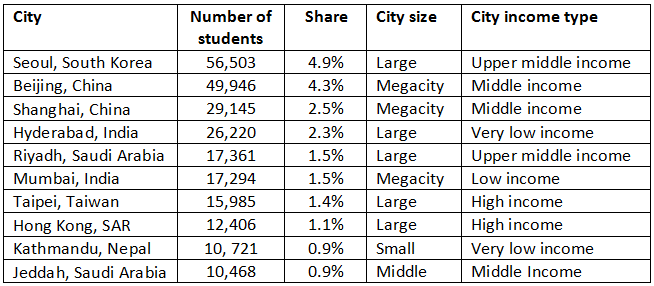

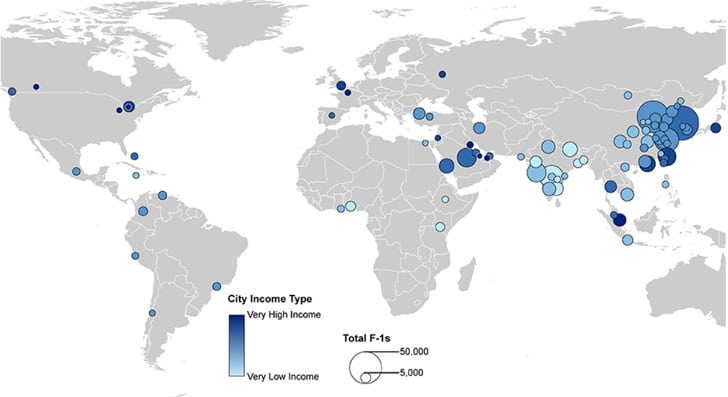

The cities sending the most students to the US

The top ten cities from which F-1 students studying bachelor’s, master’s, or doctoral degrees in the 118 metro areas in the Brookings sample are:

- The top global sending countries in terms of international student educational spending;

- The top metro destinations for different types of degrees (e.g., STEM, business, marketing);

- The top global source countries for different types of degrees.

Staying to work after graduation

The Optional Practical Training (OPT) programme, which allows international students on F-1 visas to apply to work between 12 to 29 months post-graduation, is well used: Brookings estimates that about one in three F-1 graduates ends up working in the US under the OPT programme. From the report:

“As metropolitan leaders consider the potential role of foreign students in their regional economies, the extent to which these students remain in the area for OPT is an important consideration. Across the 118 high foreign student metros, fully 45% of foreign students using the OPT programme stayed in their school’s metropolitan area to work after graduating with a BMD degree for the 2008–2012 period.”

The bigger the metro area and the more relevant industry work there is for an international graduate, the more likely the international student will make use of OPT in that area.

So much to build on

The report goes on to discuss the limitations of current US immigration policy in encouraging the retention of talented international students (i.e., allowing them to achieve permanent residency). It also provides valuable advice regarding the best ways for metropolitan areas to leverage international students while they are here – in other words, to consider them properly as key players and innovators in global knowledge and economic markets. For example:

“Metropolitan leaders wanting to retain US-trained foreigners should help educate local employers on how to obtain the necessary visas through the current US immigration system. As already proposed by Congress, the federal government can also make changes in the F-1 visa programme to allow foreign students from high-quality schools to apply directly for permanent residency if an employer is hiring them. State and metropolitan leaders should engage with their local higher educational institutions to utilize foreign students’ knowledge and connections with markets abroad to benefit local businesses. These reforms can help metropolitan economies grow in more productive, inclusive and sustainable ways.”

All in all, it is a fascinating and in-depth report and we highly recommend reading it in its entirety.